-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Round Oak Weather

Member

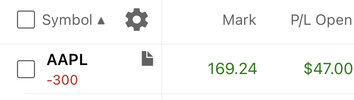

I’ve been buying some stocks for the long term but I’m probably gonna slow down for awhile. Think things are bouncing a little to crazy when the overall economy isn’t much better outside of the job marketApple getting a little ridiculous. Market setting up for a rough September…IMO. Still think rest of Aug try’s to push higher, maybe higher than some expect.

View attachment 120590

Sept is notorious for being weak but mid term years are known to be strong in Q4. That’s what I am expecting. But, other mega caps have to pick up the slack, we can’t run Apple to ATH’s.I’ve been buying some stocks for the long term but I’m probably gonna slow down for awhile. Think things are bouncing a little to crazy when the overall economy isn’t much better outside of the job market

I expect Q’s to get back to the $348 level by end of year to end the year down 15%…which is a big down year.

severestorm

Member

GeorgiaGirl

Member

It actually isn't quite there on the May highs. It needs 430ish.

It's probably going to happen soon to be honest (granted, I'm talking about something that isn't a stretch anymore). The Nasdaq Comp just filled its violent gap down post-May 4th and it's been ahead on moves (was first to get above the late May/early June highs).

It probably happens after OPEX I think as long as the S&P holds 4130/4140 (yea, I'm looking for things to cool off some).

D

Deleted member 609

Guest

Think top is in for a while?Closed out my longs when Q’s tagged $330 and just have a Q’s short on here, stop $331.

I sold 1/3 of my Q’s in my long term IRA and now just over 30% cash. Happy to stay with that if market keeps pushing higher or will add back in low $300’s if that happens

View attachment 120609

$330 probably top until Q4. Just my guess. I dont think things fall apart though. Monthly opex (Aug 19th) tend to be lows +- a couple of days. I would love a pull back to $320-$322 in Q’s.Think top is in for a while?

Apple could issue a statement and say they will never sell another product again and that they were shutting their doors forever and the stock would go up.

severestorm

Member

Round Oak Weather

Member

They love to pump it. It doesn’t seem to matter what happens Apple won’t go down much and when it goes up it doesn’t do it slowly.Sept is notorious for being weak but mid term years are known to be strong in Q4. That’s what I am expecting. But, other mega caps have to pick up the slack, we can’t run Apple to ATH’s.

I expect Q’s to get back to the $348 level by end of year to end the year down 15%…which is a big down year.

View attachment 120600

They have a gazillion dollars in buy backs authorized and window is open. Apple is its own market.Apple could issue a statement and say they will never sell another product again and that they were shutting their doors forever and the stock would go up.

buckinbronco

Member

Bought a good chunk of HUMA at 3.50. Has had a nice run up today going into their earnings tomorrow. This biotech company is actually based in Durham for you NC peeps.

severestorm

Member

GeorgiaGirl

Member

Welp, I should've kept my thought to myself this morning. Bonds look ready to sweep the leg of tech. That 4300 gap will continue to act as a runaway gap down like it should.

Suppose I shouldn't be surprised. The technicals there were really weakening, and I was talking a bit too much. Like I didn't say I was looking for it, but I was saying there's a world where TNX breaks down and SPX sees 4600 again sooner rather than later.

Tbh I'm surprised this didn't occur yesterday because I can remember in April on CPI day, there was a big gap up to start that got wiped (well, it kinda did happen in treasury bonds, high yield/stocks ignored it).

Suppose I shouldn't be surprised. The technicals there were really weakening, and I was talking a bit too much. Like I didn't say I was looking for it, but I was saying there's a world where TNX breaks down and SPX sees 4600 again sooner rather than later.

Tbh I'm surprised this didn't occur yesterday because I can remember in April on CPI day, there was a big gap up to start that got wiped (well, it kinda did happen in treasury bonds, high yield/stocks ignored it).

severestorm

Member

Good article

fedguy.com

fedguy.com

One Armed Fed

An aging demographic implies a decreasing supply of labor, which boosts wages and reduces the employment costs of tight monetary policy.

fedguy.com

fedguy.com

severestorm

Member

GeorgiaGirl

Member

As much as I'd love for it to, oil was never going to go down in a straight line. All it's done to this point is bounce off a trendline it needed to bounce off of or else it truly was death for it.

This does expose two issues though. The reason it really came off in July was recession fears, not any real change in policy, and the reason why it was able to perk back up might have been a Fed pause being sniffed out.

WTI probably shouldn't be below $100 and the US10Y probably shouldn't be below 3. Heck, WTI probably shouldn't even be below what the line in the sand is (as long as it's below $105, it's on a one-way trip to nowhere for now at least, that's your line in the sand).

This does expose two issues though. The reason it really came off in July was recession fears, not any real change in policy, and the reason why it was able to perk back up might have been a Fed pause being sniffed out.

WTI probably shouldn't be below $100 and the US10Y probably shouldn't be below 3. Heck, WTI probably shouldn't even be below what the line in the sand is (as long as it's below $105, it's on a one-way trip to nowhere for now at least, that's your line in the sand).

severestorm

Member

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Right now both the bond and stock market are saying no recession/ soft landing. Commodities are saying we are heading for a depression. If that is the case you better back the truck up on commodities. If we are going into a recession and it blind sides the market watch out below for stocks. This is what makes a market.

Also most commodities storages are getting to record lows. Sometime after the midterms those chickens will come home to roost.

Also most commodities storages are getting to record lows. Sometime after the midterms those chickens will come home to roost.

severestorm

Member

hmmm

severestorm

Member

Debt based economy will come crashing down like Biden's bicycle rides. Watch the 10 year yield. It starts spiking....see ya.

severestorm

Member

What is reddit saying? @NoSnowATL

severestorm

Member

Only have about 10 shares but starting to get antsy. 7 weeks in a row or so? Weekly RSI getting around 70 but doesn't look crazy yet, so yeah it could hit ATH in my opinion as well.Is Apple ever going to stop going up....ATH's ($183) look likely in the next 2-3 weeks.

View attachment 120689

severestorm

Member

They are buying back stocks before the buyback tax takes effect.Is Apple ever going to stop going up....ATH's ($183) look likely in the next 2-3 weeks.

View attachment 120689

severestorm

Member