-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

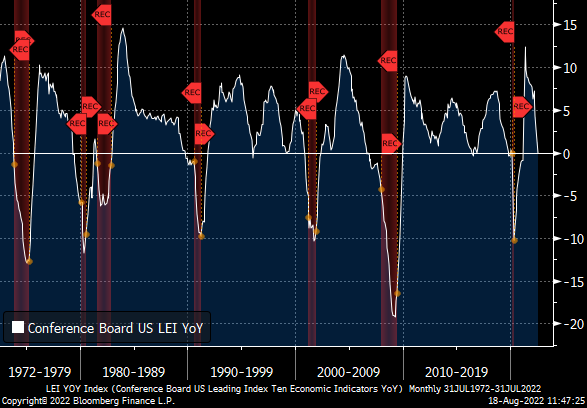

FOMO is real. Money managers are more afraid of missing the upside rather than going down more.

severestorm

Member

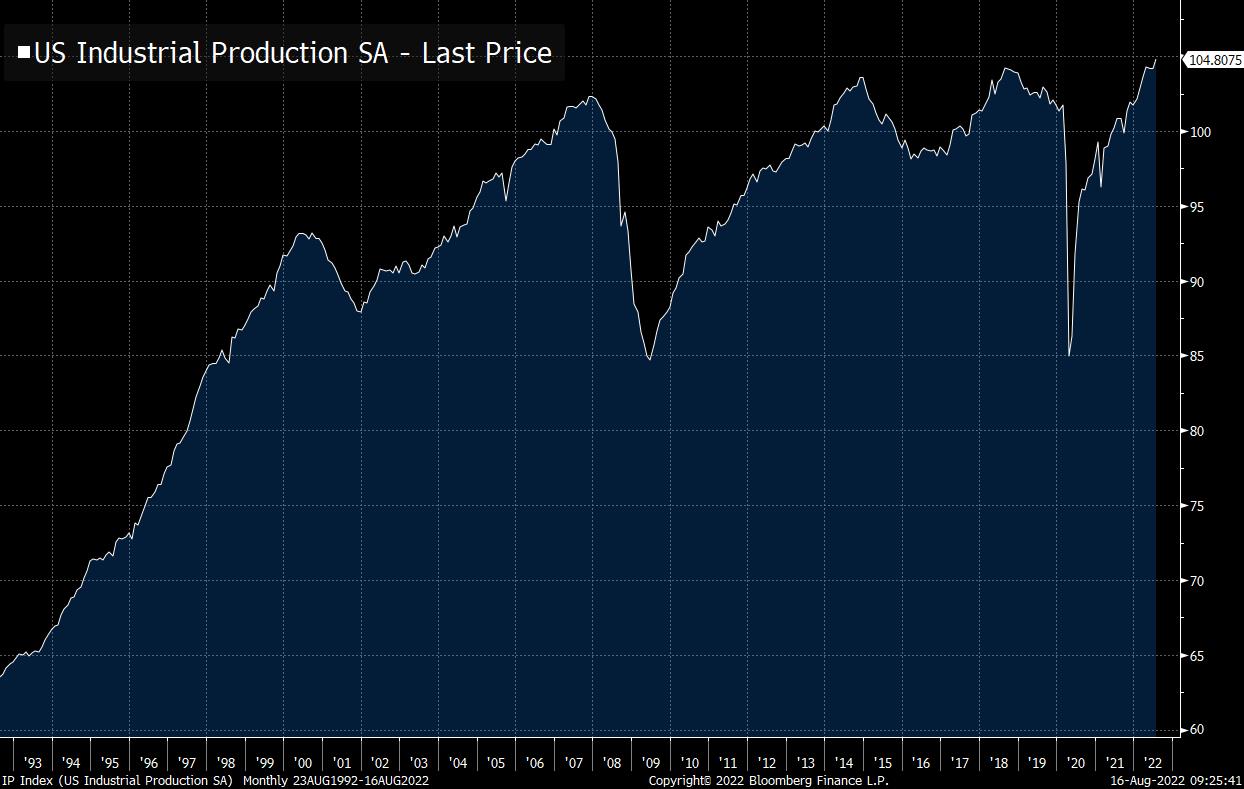

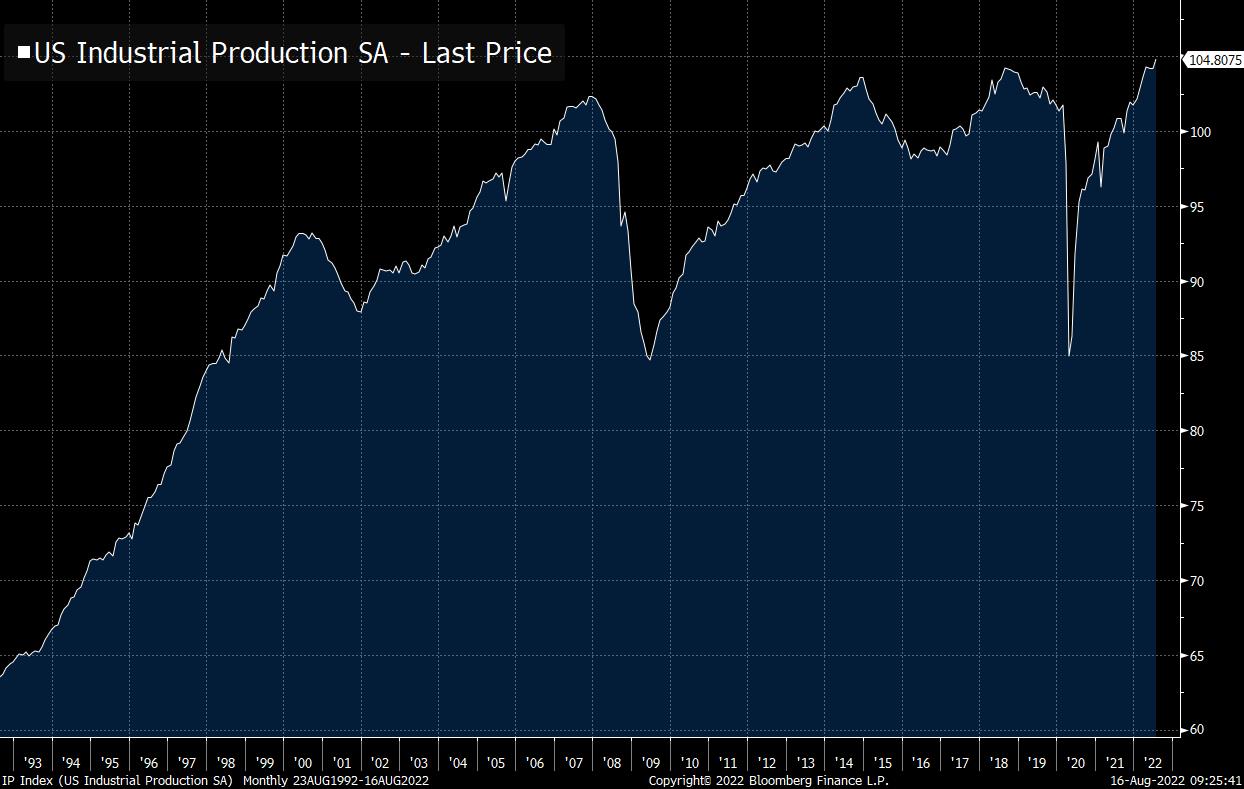

Onshoring is propelling manufacturing

D

Deleted member 609

Guest

Apes at it again

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Citadel wins againApes at it again

Bitcoin not confirming the rally. Proceed with caution

DOW and SPY up 5 days in a row....no more red days for 2022.

I don't like it when the SPY/Q's get this far extended from it's 20dema, its not healthy. But, it can run a long time like this...still think Sept is when a real pullback could occur. Opex this week and things are typically bullish after opex so...

I don't like it when the SPY/Q's get this far extended from it's 20dema, its not healthy. But, it can run a long time like this...still think Sept is when a real pullback could occur. Opex this week and things are typically bullish after opex so...

Last time the SPY/Q's got this extended from it's 20dmea was last Oct/Nov. That was a 10% move in the SPY...this rally is almost 20% in SPY and it's 23% in the Q's.

I did close out my swing longs today when it gave up $333.50 on the Q's this afternoon. Something doesn't feel right but I don't think it's going to fall apart either. Very tricky.

I did close out my swing longs today when it gave up $333.50 on the Q's this afternoon. Something doesn't feel right but I don't think it's going to fall apart either. Very tricky.

Inflation Reduction Act? Do they think we are stupid. ?

$7500 EV credit...meanwhile every auto mfg just jacked up the prices of the EV's by more than that. Makes sense.

$7500 EV credit...meanwhile every auto mfg just jacked up the prices of the EV's by more than that. Makes sense.

Last time the SPY/Q's got this extended from it's 20dmea was last Oct/Nov. That was a 10% move in the SPY...this rally is almost 20% in SPY and it's 23% in the Q's.

I did close out my swing longs today when it gave up $333.50 on the Q's this afternoon. Something doesn't feel right but I don't think it's going to fall apart either. Very tricky.

View attachment 120732

Glad I went flat on all my longs yesterday. So extended...but I do think last two weeks of Aug could rally. Going to sit and watch next couple of days, no FOMO to short here either.

Oscillator very extended. So far this year when the osc rolled over from this spot the bottom fell out of the market. I don't think that's going to happen here.

Inflation Reduction Act? Do they think we are stupid. ?

$7500 EV credit...meanwhile every auto mfg just jacked up the prices of the EV's by more than that. Makes sense.

Yes, yes they do. For the real impact to you, your family, and your wallet, always go with the opposite of the title of most of these bills that get passed. Patriot Act, Affordable Healthcare Act, I could go on and on.

severestorm

Member

Anecdotally, I'm passively looking for a new home and the amount of price drops, back on market or new listings these past few weeks have been staggering compared to earlier months.

severestorm

Member

It will be interesting...when we lower inflation and come out of this recession, whenever that is, what will happen to home prices. Builders are not building and developers are not developing. Prices are going to go through the roof, again.Anecdotally, I'm passively looking for a new home and the amount of price drops, back on market or new listings these past few weeks have been staggering compared to earlier months.

$NVDA looking like an ominous double top...it pre-released earnings last week, had a huge gap down and the market does what it always does,....it bid it back up. The earnings were so bad. I don't like tech when semi's are weak. If Apple wasn't acting like a meme stock tech would be down over 2% today.

Stocks at ATHs with no recession, no inflation, and rates at 0.FOMC meetings could have literally said we are all going to die and market was going to rip higher. Apple even more parabolic...80 rsi coming fast.

Not chasing anything nor am I shorting anything. I don't like when the market gets like this, I usually get chopped up.

View attachment 120769

Stocks at ATHs with recession, inflation over 8%, and rates over 4% when all is said and done.

Lol

GeorgiaGirl

Member

I wonder if the post-OPEX up week is going to happen here. While it's not something that I fully understand...the May/June post-OPEX up weeks at least (and possibly all three of them including July) had to have at least some roots in dealers unwinding their hedges from the put buying, no?

With us not going into the week after OPEX being down for the month, that should have less of an impact...but then maybe we pull a 2021 and sell a bit...then bounce back next week.

As an aside, FOMC minutes seemed vague to me, so it's going to come down to what's said at Jackson Hole and the September Fed meeting. Will the dot plot go "bold" and suggest 5-6% next year?

I think it'd be a mistake, but I suppose it's very possible.

With us not going into the week after OPEX being down for the month, that should have less of an impact...but then maybe we pull a 2021 and sell a bit...then bounce back next week.

As an aside, FOMC minutes seemed vague to me, so it's going to come down to what's said at Jackson Hole and the September Fed meeting. Will the dot plot go "bold" and suggest 5-6% next year?

I think it'd be a mistake, but I suppose it's very possible.

severestorm

Member

I think it's all up from here oil wise. Goldman called it correctly. 5 dollars gas coming soon again.

I don't know if his accurate but if it is then it's going to tough to get people to sell. Personally, I have a 3% interest rate with a payment so cheap that I can't imagine moving until I retire. But, never say never.

severestorm

Member

Germany is collapsing

severestorm

Member

severestorm

Member

I’m still new to investing and still trying to learn! Read a lot on how the bear market is over and stock will start rebounding soon. I made some gains recently and sold yesterday as I’m not sure. To much volatility in the economy for me. Cryptos seem good outside of Sun/Mon when sell offs seem to occur. Looking somewhere to park my money long term and I’m just so indecisive on it!

Not a bad idea to watch for a while and get an idea of a company you believe in's trading channel. When it goes below that channel its a good time to make a small buy in with the thought that if it continues to drop you can buy more. Keep short term capital gains and long term in mind as well. There were some deals to be had this year, a lot less of them now in my opinion.I’m still new to investing and still trying to learn! Read a lot on how the bear market is over and stock will start rebounding soon. I made some gains recently and sold yesterday as I’m not sure. To much volatility in the economy for me. Cryptos seem good outside of Sun/Mon when sell offs seem to occur. Looking somewhere to park my money long term and I’m just so indecisive on it!