-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

D

Deleted member 609

Guest

This has been crazy. I might buy some SQQQ today... mainly because I hate money.Q's with a 20% move from it's June lows. $330 on the Q's is going to be very very tough to get through. I sold some Q's I had in my long term account today, I was 100% in Q's in my long IRA with roughly a $285 avg.

View attachment 120392

severestorm

Member

FED MESTER: I AIM TO REDUCE BALANCE SHEET TO $6.5-$7 TRILLION. Currently 8.9 Trillion

GeorgiaGirl

Member

severestorm

Member

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

so much for that Fed pivot

severestorm

Member

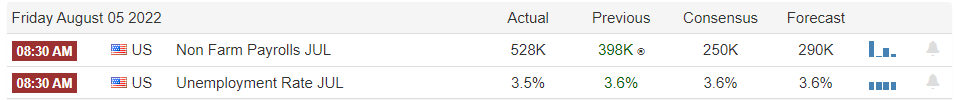

I'm thinking 50bp hike next. Elon Musk confirmed we are past the peak of inflation in his shareholders meeting. Expecting the next CPI number to be lower. Lower inflation trend and continued job growth is ideal.so much for that Fed pivot

What about that 30% unemployment rate you called for?I'm thinking 50bp hike next. Elon Musk confirmed we are past the peak of inflation in his shareholders meeting. Expecting the next CPI number to be lower. Lower inflation trend and continued job growth is ideal.

severestorm

Member

I was wrong. Ill gladly take the L on that!What about that 30% unemployment rate you called for?

Yep, 10yr treasury up, interest rates up, inflation will most likely continue to rise..... strong job market with solid wages, demand not decreasing. As long as they don't address the supply issue, inflation will not improve.so much for that Fed pivot

GeorgiaGirl

Member

I'm thinking 50bp hike next. Elon Musk confirmed we are past the peak of inflation in his shareholders meeting. Expecting the next CPI number to be lower. Lower inflation trend and continued job growth is ideal.

Been my thought but we'll have to just wait and see because September is a long ways away.

I hope the commodities selloff holds, but even if it does, past July, inflation has some very easy comps until spring next year. That's going to make things tricky...do you have fed folks at the September meeting stick their neck out and suggest 5%+ next year in dots, or will it be mostly the same as June.

Just feels like we’ve overpropped here just waiting on more inevitably bad data

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

We are looking at 50 BPS next meeting as my models show inflation running 8.6% in July and 8.3% for august which would be a +.1% MoM in July and -.1% MoM in August. The Fed is actually making the supply issues worse with raising interest rates as it is causing the cost of capital to increase, thus making it more expensive to build out the need infrastructure to fix the supple lines long term.Yep, 10yr treasury up, interest rates up, inflation will most likely continue to rise..... strong job market with solid wages, demand not decreasing. As long as they don't address the supply issue, inflation will not improve.

And just like that I am down big this week. I carried some NVDA over the weekend as it showed relative strength on Friday and they pre-released just god awful earnings. I would never carry shares into earnings, hate when mega caps release earnings early.

Last edited:

GeorgiaGirl

Member

Well, this certainly is only going to heighten my concern with CPI day.

- The Nasdaq doesn't toss what it was doing up to 11 AM without there being issues.

- Google reversed at the last stand area for bears.

- The Dow and S&P both hit the minimum targets you'd look for here.

Really sucks because I was thinking for a lot of the 10 AM hour while I was at the gym that the Nasdaq had to have folks screaming at the wall with how it opened. There's no way it should've opened the way it did with the awful news we heard from NVDA.

But that now looks like an exit pump to me...one that may have happened even if NVDA said nothing.

- The Nasdaq doesn't toss what it was doing up to 11 AM without there being issues.

- Google reversed at the last stand area for bears.

- The Dow and S&P both hit the minimum targets you'd look for here.

Really sucks because I was thinking for a lot of the 10 AM hour while I was at the gym that the Nasdaq had to have folks screaming at the wall with how it opened. There's no way it should've opened the way it did with the awful news we heard from NVDA.

But that now looks like an exit pump to me...one that may have happened even if NVDA said nothing.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Gamma starts rolling off the dealers books starting around 11 and ends about 2:30. So if a lot of options expire on the Friday before the dealers then sell the hedges on those stocks unless there is a lot of call buying before 11.Well, this certainly is only going to heighten my concern with CPI day.

- The Nasdaq doesn't toss what it was doing up to 11 AM without there being issues.

- Google reversed at the last stand area for bears.

- The Dow and S&P both hit the minimum targets you'd look for here.

Really sucks because I was thinking for a lot of the 10 AM hour while I was at the gym that the Nasdaq had to have folks screaming at the wall with how it opened. There's no way it should've opened the way it did with the awful news we heard from NVDA.

But that now looks like an exit pump to me...one that may have happened even if NVDA said nothing.

severestorm

Member

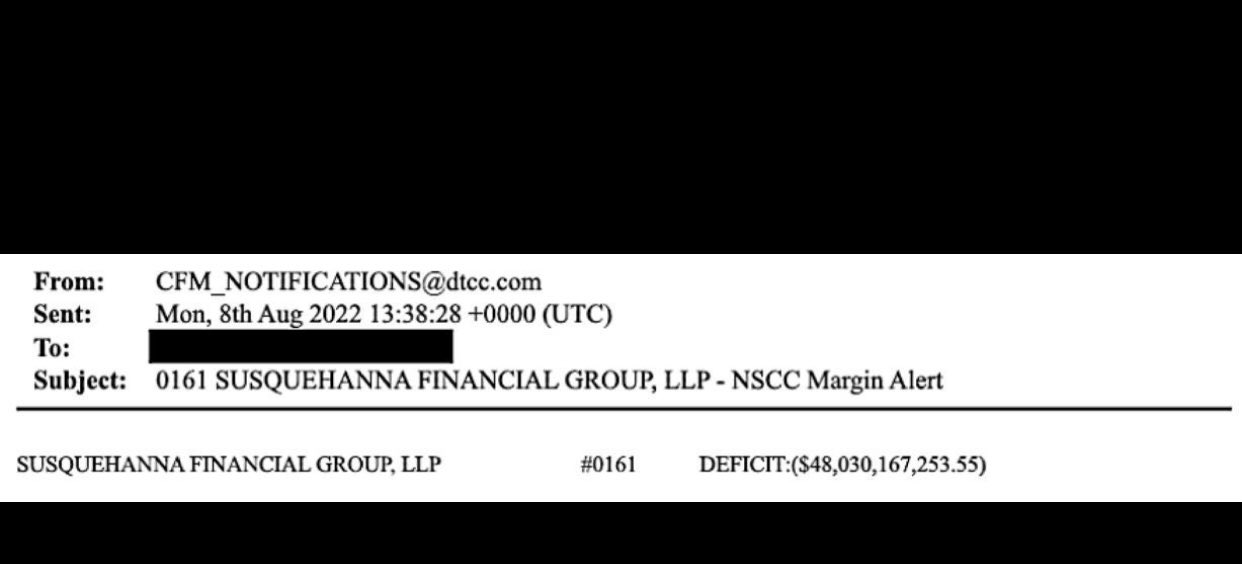

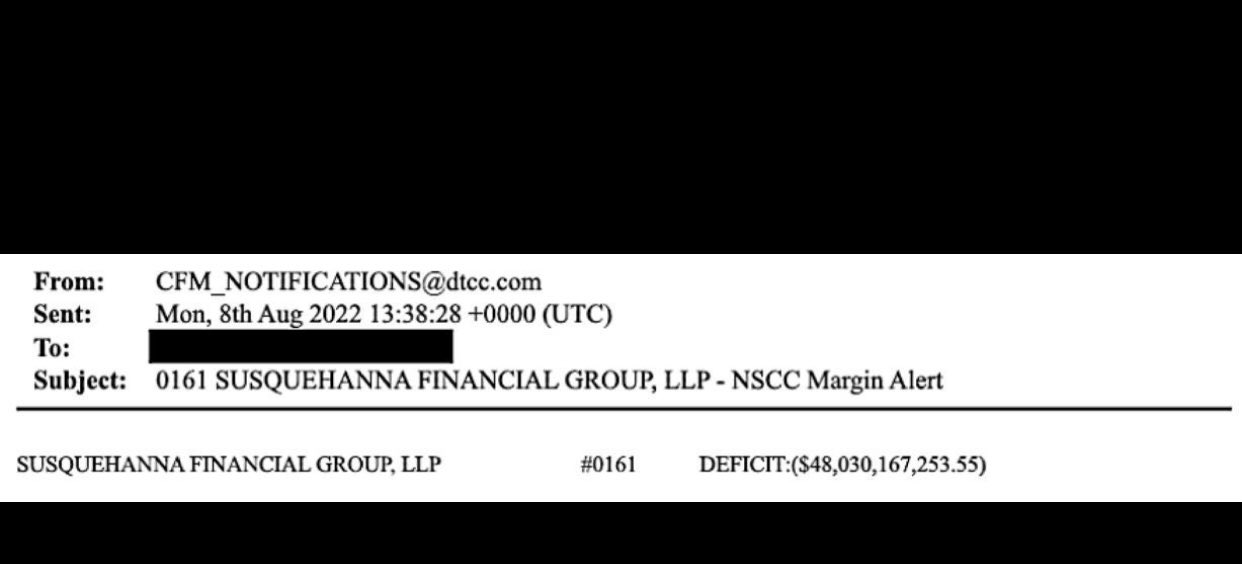

Wow this might be big news in the Financial Markets....

severestorm

Member

Rockets engaged ladies and germs

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

So close. 8.5% and 0.0% MoMWe are looking at 50 BPS next meeting as my models show inflation running 8.6% in July and 8.3% for august which would be a +.1% MoM in July and -.1% MoM in August. The Fed is actually making the supply issues worse with raising interest rates as it is causing the cost of capital to increase, thus making it more expensive to build out the need infrastructure to fix the supple lines long term.

You think this gives them enough cover to slow the hikes down?So close. 8.5% and 0.0% MoM

severestorm

Member

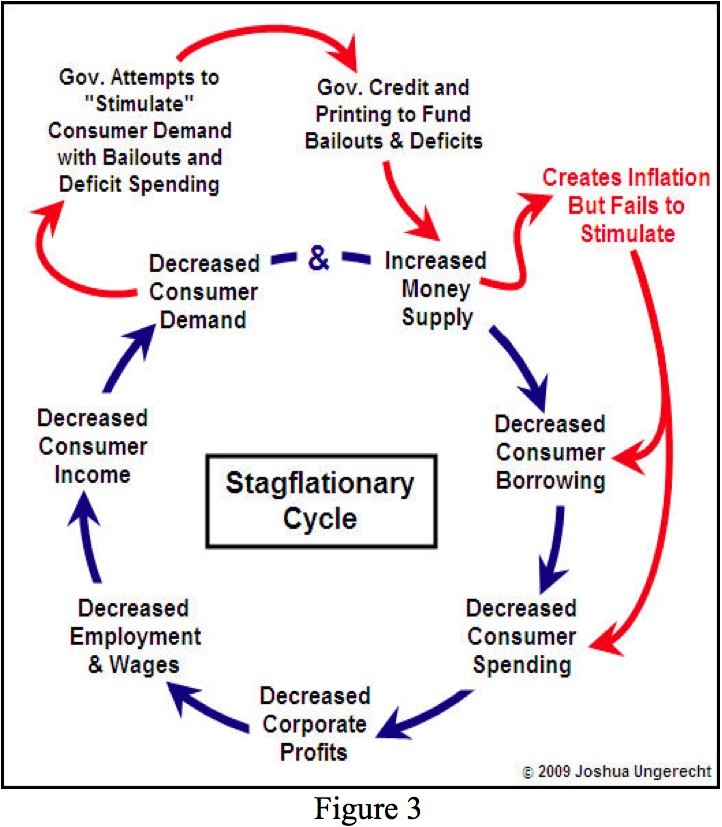

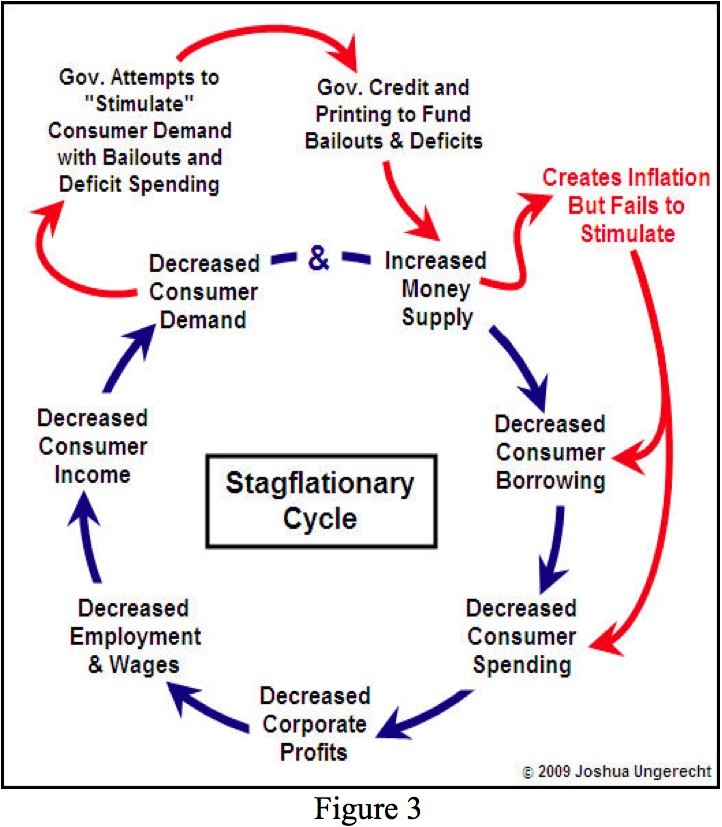

I'm still very cautious right now with the markets. People/Governments are going to buy/print and the cycle will repeat.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

They will get a lot more data between now and the september meeting but I still think they raise by 50 bps instead of the 75 the market was thinking.You think this gives them enough cover to slow the hikes down?

Still hard to believe hiking and reducing the balance sheet is good for stocks. Like we're at 4700 with the FFR at zero and back to 4700 with the FFR at 3. That's a head-scratcher.They will get a lot more data between now and the september meeting but I still think they raise by 50 bps instead of the 75 the market was thinking.

Google with a multi month channel breakout.Google with a big channel….that’s a $12 channel. Can it close over $120 today.

View attachment 120527

severestorm

Member