No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Damn itWhere we going

Sent from my iPhone using Tapatalk

Damn itWhere we going

Sent from my iPhone using Tapatalk

Boom. Idk if I call myself a winner today thoughOver!!!

Shorted some $QQQ at $290.6...stop just above $291. Probably means you should buy calls...

What a line! NSFY magic!Boom. Idk if I call myself a winner today though

Bought YOLO SPY 405’s at the close. EXP Monday. Ask me if I even care anymore

If we rip Monday, bottom’s inI bought 6 Amazon 112 calls . Praying for no bad news on the weekend and for a Monday morning pump

Sent from my iPhone using Tapatalk

If we rip Monday, bottom’s in

Hard to believe we have seen the lows for the year...today was a complete embarrassment for our Fed/govt. FOMC meeting next week...JPowell will have to unleash shock and awe.

I just donate money any time I trade lately

Yeah...true...we are so screwed.We say that but will he ? He doesn't have a set ....

Sent from my iPhone using Tapatalk

Another .25% hike should do the trick. SPY 500 by July 1st ??Yeah...true...we are so screwed.

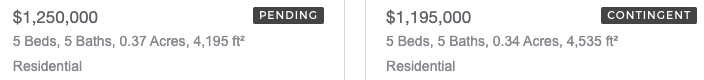

Nobody told the people buying houses in my neighborhood...they still going for crazy high prices and selling within a day or two.@KyloG time to sell?View attachment 119104

It will come to a screeching halt soon and when it does, oh boyNobody told the people buying houses in my neighborhood...they still going for crazy high prices and selling within a day or two.

View attachment 119105View attachment 119106

With Apple and Meta coming I think our area will hold up better than most. Just depends if we see unemployment jump.It will come to a screeching halt soon and when it does, oh boy

405 first? ?Spy is definitely going to at least 350 by end of year

Yep...

Watch bitcoin over the weekend. If it turns up, expect a rally to start the day on Monday. If it remains/continues down, stocks are going lower.

Bitcoin on the struggle bus. Market open on Monday would be pretty painful.