Storm5

Member

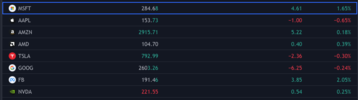

Man apple getting closer and closer to a 150 break

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Knocking on that floor way too much for comfort. Maybe the Fed will have a stick save on Wednesday.NQ turned red. The macro news couldn't be any worse right now...over the weekend we had China go on lockdown, more supply chain issues probably. Prediction of double digit inflation this summer.

What's really amazing is SPY is only down 12% from it's ATH's with all that has gone on the past few months. It's so difficult to take the S&P down.

View attachment 115601

Apple and Tesla getting smoked PM . Amazon hanging by a thread. Does big tech finally sell off this week ?

Sent from my iPhone using Tapatalk

Yeah that's going to be a problem.This is gonna drive food up big time late Summer to Fall. Fact im betting we dont plant qty we normally would, because of fertilizer prices up 500%.

Farmers hit hard by price increases as food price spike looms

(The Center Square) – Goods and services around the country are becoming increasingly more expensive, but farmers may be among the hardest hit as inflation, supply chain issues, and Russia'swww.thecentersquare.com

“Because of the seasonal aspects of … this agriculture industry, it takes about six to nine months for the impacts felt in the impact market to really work its way through the supply chain and reach the consumer,” said Nathon Carson, head of supply chain operations for Chemical Dynamics, a multi-million dollar fertilizer supplier based in Florida servicing 12 states. “The crazy thing is, fertilizer prices for NPK, especially nitrogen, the most important nutrient, went up by about … doubled essentially in Q4 of 2021, which means we are not really going to see those impacts until this coming summer.”

Back in office for first time in 2 years. Have to pretend to be working instead of wasting my money on stonks. ------- lame.

Nice backhanded way to put sanctions on the west.17 million .

'China's Silicon Valley' Locked Down, Could Affect Supply Chains

Another Covid-19 lockdown poised to hammer tech supply chains.www.tomshardware.com

Dreading that...we are mid/end April.Back in office for first time in 2 years. Have to pretend to be working instead of wasting my money on stonks. ------- lame.

Oil prices continue to drop rather quickly, might even get under $100 a barrel today....of course those prices that went up by 20-40 cent a day will somehow not come back down at the same rate....the local station by my house was down a whole .02 cent this morning

News like this will hopefully continue this trend

AMZN rejected the 20dema...theme across most stocks/indexes. Big gap to fill.

View attachment 115613

Damn, I should’ve bought puts this morning. NASDAQ went from neutral to 2% down already. ?Bulls about to get taken to the woodshed when they buy in to the gap up at open tomorrow morning, then get crushed when we end the day 2%.

Or not, I don’t know anything. ?

I’d think a 25 basis point hike is priced in and could even lead to a bit of a rally given there’s some fear of a bigger hike still, but who knows with this ? market.Thoughts for Wednesday ? Let's say the fed moves forward with a .25 hike. What does that mean ? Market rally ?

Sent from my iPhone using Tapatalk

I’d think a 25 basis point hike is priced in and could even less to a bit of a rally given there’s some fear of a bigger hike still, but who knows with this ? market.

Thoughts for Wednesday ? Let's say the fed moves forward with a .25 hike. What does that mean ? Market rally ?

Sent from my iPhone using Tapatalk