GeorgiaGirl

Member

Really wasn’t looking for an up day yesterday but that was disappointing. That move into 4320 or so in premarket looks like a liquidity grab (and understandable because it really did look as if there was not much selling juice on Thursday).

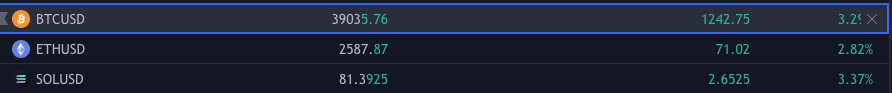

I can't imagine that we see a big gap down on Sunday for the third week in a row, but considering that the war hasn't stopped, it probably happens. Probably down Monday and Tuesday and then I wouldn't be surprised if Wednesday opened higher for the 3rd week in a row because shorts probably front run the "unwind hedges" effect and are currently in full control. It likely takes a surprise like late January to throw things off again.

(coming from a library instead of at home as I still don’t have very functional internet, outside of a couple hours at night recently where I got lucky, AT&T is a few days away from possibly losing a customer for their internet)

I can't imagine that we see a big gap down on Sunday for the third week in a row, but considering that the war hasn't stopped, it probably happens. Probably down Monday and Tuesday and then I wouldn't be surprised if Wednesday opened higher for the 3rd week in a row because shorts probably front run the "unwind hedges" effect and are currently in full control. It likely takes a surprise like late January to throw things off again.

(coming from a library instead of at home as I still don’t have very functional internet, outside of a couple hours at night recently where I got lucky, AT&T is a few days away from possibly losing a customer for their internet)