-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Storm5

Member

Ukraine says it's ready for diplomacy. We fly today

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

?????????

Spend about 5 minutes on Twitter and you will see peace, war, WWIII, market rocket, market crash, we're sending planes we're not sending plane, NATO threatened, NATO not threatened..... and these are the news outlets or blue checkers with "inside" info, fun to read.

No wonder the markets don't know what to do.

No wonder the markets don't know what to do.

$UCO getting hammered this morning. ?

Down 3.7% this morning for me. It’s over for me. ?

VegasEagle

Member

Bitcoin up around 10%

Check out 's stock price (BTC.CM=) in real time

Get Bitcoin/USD Coin Metrics (BTC.CM=:Exchange) real-time stock quotes, news, price and financial information from CNBC.

www.cnbc.com

Down 3.7% this morning for me. It’s over for me. ?

Are you long oil?

Yeah, among some other commodities.Are you long oil?

VegasEagle

Member

Bitcoin up around 10%

Check out 's stock price (BTC.CM=) in real time

Get Bitcoin/USD Coin Metrics (BTC.CM=:Exchange) real-time stock quotes, news, price and financial information from CNBC.www.cnbc.com

Storm5

Member

I loathe these pre-market pumps...have this huge gap in all the indexes. Tough to chase here...

Pump this crap . Let's fill those gaps tomorrow after CPI

Sent from my iPhone using Tapatalk

Expecting us to head down from here, retail will FOMO in this morning, then their EOW calls will get crushed by EOD. But then I’m long oil down 11% on that, so I’m an idiot.I loathe these pre-market pumps...have this huge gap in all the indexes. Tough to chase here...

Storm5

Member

So we are really gonna sell off

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

Shrek dongs !!!!

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

My favorite kind of dongsShrek dongs !!!!

Sent from my iPhone using Tapatalk

Storm5

Member

SPY is all about $427...was a great support...now can we push through as resistance.

View attachment 115085

Jesus lol that gap below

Sent from my iPhone using Tapatalk

? market.Jesus lol that gap below

Sent from my iPhone using Tapatalk

Just kissed that resistance area followed by a big candle to the sell side

Bulls ate that candle up. Wow this looks strong. Hard to imagine a 3% up day though....

severestorm

Member

SPY would rip above 427...can’t see that happening today because then we would close +4%. Is that even possible?

SPY would rip above 427...can’t see that happening today because then we would close +4%. Is that even possible?

Can it just be nice...break above $427...pullback, retest multiple times and than go.

Going to be up 4% today. Peace deal by the end of the weekend is my guess.

Storm5

Member

Market wants to melt face

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

DadOfJax

Member

Russian peace deal? ?.....No sir, there will be peace when Putin is dead, maybe.Going to be up 4% today. Peace deal by the end of the weekend is my guess.

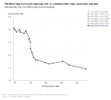

Started position on PYPL...it's down over 70% from highs and multi-year support. ?

I do have a fairly wide stop as I will add if it dips down to low $90's.

They generate cash, solid rev growth. I really don't understand why it's down this much, this isn't some cash burning high multiple name.

View attachment 115091

PYPL is trading at 4x sales...with 15% growth. I don't get it...yeah spending will come down but that affect pretty much every tech company too. 7-8x sales would be a very reasonable valuation.