Better save some for the tax man.Out. Quick $100. Covered my Walmart groceries. ?

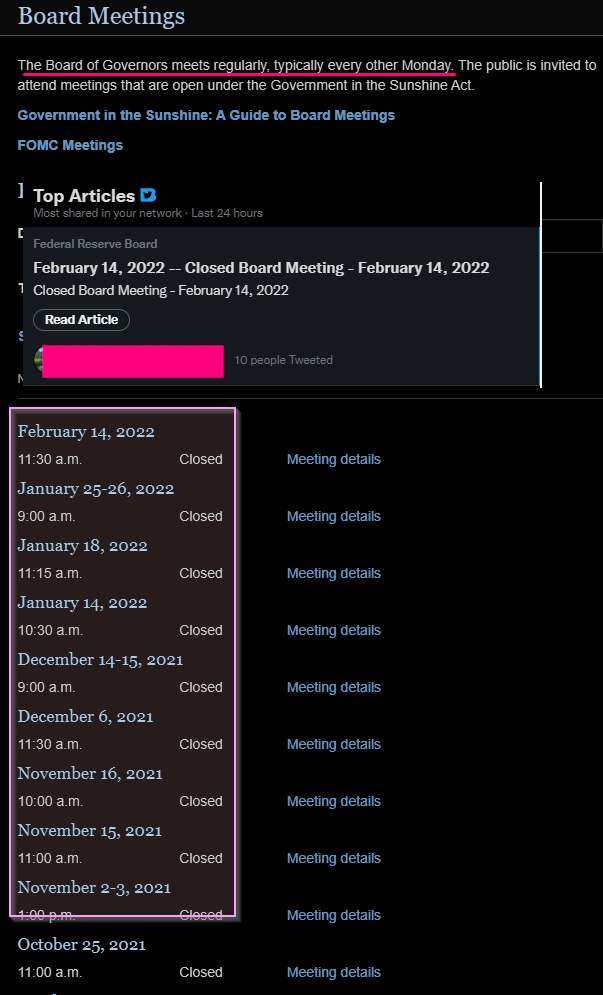

Market apparently rattled by Russia News but also by the unscheduled Monday Fed meeting now on the books.

Better save some for the tax man.Out. Quick $100. Covered my Walmart groceries. ?

It will someday. If the Fed moves to slow it's purchases and begins tightening rates, why would it continue to rise unabated?In 2016 and the end of 2018 S&P dropped all the way to the 200wema. Currently, it's at $351 which is another 20% down from here. Tough to imagine the market dropping that much...

View attachment 113408

If Putin doesn't invade, then I think vol gives this back on Monday, which would mean a snapback in stocks.

I've quoted Crimea before, but in reality, I don't want anything with Ukraine because oil is already too high. And if that escalated, that would get worse even if we tighten.

This is apparently not even certain (saw that some in Russia don't buy it, because they don't think Putin wants the sanctions), but merely mentioning it has caused a huge bond market rally and oil is mooning off it.

Retail has changed everything in the stock market. That’s one thing that could keep this from that type of decline. The retail mob buys every dip…?It will someday. If the Fed moves to slow it's purchases and begins tightening rates, why would it continue to rise unabated?

Retail money will run out one day, Feds can't prop the market forever, everything that goes up eventually comes back down, I don't have a clue when but one day the fall is gonna be brutalRetail has changed everything in the stock market. That’s one thing that could keep this from that type of decline. The retail mob buys every dip…?

They are always the last leg before the crash. Always.Retail has changed everything in the stock market. That’s one thing that could keep this from that type of decline. The retail mob buys every dip…?

They are always the last leg before the crash. Always.

Agree 100%I agree and not just because I'm holding a ---- load of puts . This market is a bloated pig and needs a major pullback before it rips again before midterms . Can't print damn money forever a war while horrible for Ukraine would be healthy for the market in encouraging a huge dump

Sent from my iPhone using Tapatalk

So when are gas prices gonna come down , with crude that low??Going to be a wild week. Futures limit down, crude near $31, gold near $1700, and the 10 yr yield is at 0.5%! How long until the Fed steps in? Tomorrow or Tuesday is my guess. I bet some big funds and some companies are going to blow up soon. Would hate to be holding junky debt right now.

Gonna be a long long time.So when are gas prices gonna come down , with crude that low??

Yes, when the common man is talking about stocks it’s a sign the top is near. It was as true in 1929 as it is today.They are always the last leg before the crash. Always.

Yes, when the common man is talking about stocks it’s a sign the top is near. It was as true in 1929 as it is today.

SPY touched 435 in pre market trading

It's going to 430 this week . PPI tomorrow , fed minutes Wednesday and whatever Putin does . I'm literally short on 15/18 of my positions . Not holding any weeklies though . Too risky for me

Sent from my iPhone using Tapatalk

aren't you?Indecisive spinning top daily dojis accross the board. Market is scared.

Yeah but I’ve been scared for a year and look where that got me ?aren't you?

Not one tiny bitaren't you?

Seasonality this period is weak until end of March but it just feels like people want to buy right now.

This doesn't look bullish that's for sure. Rejected the 200dsma today.

I don't have much on right now, it's tough to get any kind of read.

View attachment 113562

Could we get a rejection of the daily MA200? This is SPY View attachment 113586

Prominent H&S: Negative

Prominent Double Top: Negative

S&P Rejection at 200 DMA: Negative

CPI Surprise Upside: Negative

PPI Surprise Upside: Negative

Fed Speakers Bearish: Negative

Fed to hike by 50 bps in March: Negative

GG/Reddit Index: Bearish

Outlooks for stocks: Bullish