-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

That gap and the NFLX gap is going to remain unfilled for a long time most likely. They were breakaway gaps, and you have a lot of funds stuck in there that likely want out and are willing to do so at a loss.

That doesn't mean that it can't go higher now...I'm hoping that it does so I can dump my bags for less of a loss. -.-

Maybe it can get to $270 within the next couple weeks. If it does, I'm bailing for sure as I can easily envision a BABA like deal this year.

In other news, the Fed might have no choice but to do 50 bps next month and they were trying to walk that back as recently as 24 hours ago through Bostic and Mester. The 2 year looks like it did not respond yesterday, and I don't think it's going to respond anymore to them trying to jawbone.

Fed should hike 50bps in March but they won't. They are still buying assets and still have rates at 0%. Completely useless...

And the Fed is still buying assets with rates at 0%. What an epic disaster the Fed has created.

I am thinking of buying a house in the next year or two, and I looked at housing prices yesterday around my area and just shook my head. As bad as CPI inflation is, the asset price bubble the Fed has largely contributed to has been even worse. It is screwing over the middle class really bad, too, further increasing economic inequity. Great stuff…

MVIS showing more strength today

I bought my house for $500k in Jan 2016....I could sell it in a day now for $800k. Of course....no where to buy since everything has skyrocketed in Wake Co. I have a 3% interest rate so payment is very cheap. I am really stuck here...in a good way.I am thinking of buying a house in the next year or two, and I looked at housing prices yesterday around my area and just shook my head. As bad as CPI inflation is, the asset price bubble the Fed has largely contributed to has been even worse. It is screwing over the middle class really bad, too, further increasing economic inequity. Great stuff…

Textbook bearish wedgeIWM with what looks like a rising wedge but looks strong...if it gets through $209

View attachment 113270

A buying opportunityWhat even is this?View attachment 113297

VIX is ripping

Rumor is JPOW is going to raise the Fed rate tomorrow

They look like complete idiots. And that is an understatement.Rumor is JPOW is going to raise the Fed rate tomorrow

5yr +20% ?

Storm5

Member

GeorgiaGirl

Member

Closed Board Meeting - February 14, 2022

The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

I don't know about a surprise rate hike in a few days, but a hard stop to QE may happen. They were going to release a final QE schedule tomorrow. I'd say that does not happen.

Having said that, the interesting thing is, the only time that you've seen a surprise rate hike:

ETA: That meeting apparently isn't actually important.

Last edited:

S&P futs has rejected $4585 3 times but has also rejected $4460 5 times now. That's about a 3% channel that will get resolved one way or another soon.

Ideally, we get a retest of $4260-$4280 area. That's my hope. But, everyone sees these pivots so it's going to be violent bounce as it approaches...if it approaches.

Ideally, we get a retest of $4260-$4280 area. That's my hope. But, everyone sees these pivots so it's going to be violent bounce as it approaches...if it approaches.

GeorgiaGirl

Member

By the way, I'd say what I had mapped out in my head before the Bullard bomb was more neutral then actually bearish.

I had a 4600-4650 high into options expiration next week and then a move lower after that to perhaps search for a higher low before the live meeting in March. Was thinking that you'd see that suck in some more put buying (there are already a LOT of puts for March), and then after a hike is announced, we'd see a move higher instead of lower to make the puts die.

Now I'm not certain. It feels like the risk is high that we full on "December 2018" it into that meeting. My question if that were to happen would be if whether hiking would help with certainty, unless credit markets get into an uncomfortable place...

I had a 4600-4650 high into options expiration next week and then a move lower after that to perhaps search for a higher low before the live meeting in March. Was thinking that you'd see that suck in some more put buying (there are already a LOT of puts for March), and then after a hike is announced, we'd see a move higher instead of lower to make the puts die.

Now I'm not certain. It feels like the risk is high that we full on "December 2018" it into that meeting. My question if that were to happen would be if whether hiking would help with certainty, unless credit markets get into an uncomfortable place...

GeorgiaGirl

Member

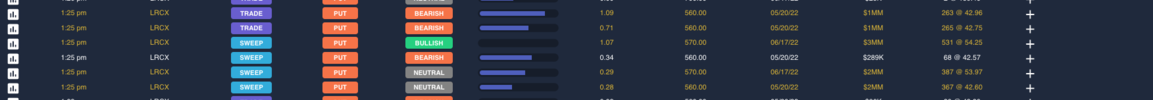

Interesting option flow just came in for LRCX....always interesting watching this unfold.

View attachment 113390

Russian related.

I like semis, but we're likely going to get a better opportunity to buy the dip, as apparently Russian stuff would affect semis in a negative way.

In related news...crude to a million it seems now. Freak my freaking life.

Shellacking accross the board. Gravestone doji hit ?

Time for the Friday afternoon vertical rally. Here we go.

D

Deleted member 609

Guest

You're rally is going the wrong wayTime for the Friday afternoon vertical rally. Here we go.

Dojis mean nothing in this marketShellacking accross the board. Gravestone doji hit ?

GeorgiaGirl

Member

If Putin doesn't invade, then I think vol gives this back on Monday, which would mean a snapback in stocks.

I've quoted Crimea before, but in reality, I don't want anything with Ukraine because oil is already too high. And if that escalated, that would get worse even if we tighten.

This is apparently not even certain (saw that some in Russia don't buy it, because they don't think Putin wants the sanctions), but merely mentioning it has caused a huge bond market rally and oil is mooning off it.

I've quoted Crimea before, but in reality, I don't want anything with Ukraine because oil is already too high. And if that escalated, that would get worse even if we tighten.

This is apparently not even certain (saw that some in Russia don't buy it, because they don't think Putin wants the sanctions), but merely mentioning it has caused a huge bond market rally and oil is mooning off it.

But it did today. Textbook dump after yesterday’s stoneDojis mean nothing in this market

When shrek dildo?

Q’s dumping here

Bought some TQQQQQQ 52’s for an EOD scalp

Out. Quick $100. Covered my Walmart groceries. ?