D

Deleted member 609

Guest

Market is going to be redder than a baboons ass tomorrow.

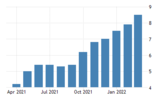

The energy index rose 32.0 percent over the last year, and the food index increased 8.8 percent, the largest 12-month increase since the period ending May 1981.

Psaki screwed the bears…what a trap.8.5 percent and the market is pumping lol

Sent from my iPhone using Tapatalk

Plus your gas mileage is going down to use E15 along with the maintenance issues. Just like the government to recommend a way to save $.10 per gallon only to use more fuel.Anyone for E15 Gas. I go out of my way,pay extra to not use E10 in my power equiptment espeacilly.

Joe Biden Announces a Mind-Numbingly Stupid Move on Gas Prices

As has become typical during most Democrat administrations in the modern era, gas prices have explodredstate.com

May have spoke too soonTurnaround Tuesday, right?

Surprised the print wasn't worse.

For all the hullabaloo about "rigging", I would think it'd be tough to hide energy inflation.

What's more interesting is that CPI stripped of food and inflation actually missed to the downside. That possibly sets up this interesting theory to actually come true potentially (read the thread):

April CPI was just so darn bad last year that unless things get worse overall, this morning's print was "probably" the peak. Finally.

Chipotle burrito still under $10 ??I notice inflation every time I go to the grocery store or to restaurants. It’s getting hard to get fast food under $10, which is insane to me.

Even Cookout has gotten absurd.I notice inflation every time I go to the grocery store or to restaurants. It’s getting hard to get fast food under $10, which is insane to me.

Barely! They just stepped their prices up a couple weeks ago! ?Chipotle burrito still under $10 ??

At least I can still get the Cajun Filet Biscuit combo from Bojangle’s for under $7. For now. ?Even Cookout has gotten absurd.

Don’t get cocky…tomorrow is a long ways off. ?At least I can still get the Cajun Filet Biacuit combo from Bojangle’s for under $7. For now. ?

Was this morning a total bull trap or is this a bear trap. ?Pump head fake ?

Sent from my iPhone using Tapatalk

We talk food an gas. Rent is the macdaddy for those caught up in that cycle. Up to as much as 40% past 15 months.I notice inflation every time I go to the grocery store or to restaurants. It’s getting hard to get fast food under $10, which is insane to me.

Probably an idiot…added NVDA at $219. Market either holds these gains or completely rolls over.Semis are so weak…going to be very difficult for tech to go up with semis this weak.

If NVDA pushes down through $217 it’s going to get ugly for a lot of tech.

View attachment 117151