I'm at Subway right now.. All I'm eating is a wrap and chips and it was over $11.I notice inflation every time I go to the grocery store or to restaurants. It’s getting hard to get fast food under $10, which is insane to me.

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

D

Deleted member 609

Guest

Dude just go harris teeter. They have a meal deal on there whole subs for 7.99. Tastes better than subway too.I'm at Subway right now.. All I'm eating is a wrap and chips and it was over $11.

I'm in Lenoir... I don't think there's many options here..Dude just go harris teeter. They have a meal deal on there whole subs for 7.99. Tastes better than subway too.

D

Deleted member 609

Guest

Oh. Yea probably not.I'm in Lenoir... I don't think there's many options here..

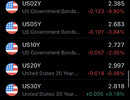

Lacking a catalyst. Haven’t seen a Green Day look this bearish in a long time

severestorm

Member

What a joke!

Jefferey Herbst who was VP of Business Development for 20 years with NVDA just appointed to BOD of MVIS couple weeks ago, need this price to sky rocket so NVDA has the financial clout to seal a deal with MVIS. I'm tired of holding lolSemis are so weak…going to be very difficult for tech to go up with semis this weak.

If NVDA pushes down through $217 it’s going to get ugly for a lot of tech.

View attachment 117151

Storm5

Member

Let the sell off begin !!

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

And we’re red. What a move

D

Deleted member 609

Guest

I knew puts were the move this morning.

Storm5

Member

Tech looks dead…a break of $340 and that’s an engulfing daily. Will be $330 in a hurry.

View attachment 117160

You've made me a lot of money over the last 6 months . Your knowledge and daily insight is greatly appreciated

Lots of knowledgeable people in this thread

Sent from my iPhone using Tapatalk

Thanks! Lot of value on this board, it’s been great for me tooYou've made me a lot of money over the last 6 months . Your knowledge and daily insight is greatly appreciated

Lots of knowledgeable people in this thread

Sent from my iPhone using Tapatalk

If we lose SPY 436.75’ish it’s going back under 430

Storm5

Member

Tesla . Amazon and apple holding up the market

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

Why you looking at my tradesFB…someone bought $17m in options. 200 and 220 strikes. The $9.7m expires this week and $220’s expire in May. They bought these on the big Q’s dip 30 mins ago.

View attachment 117165

Storm5

Member

Shanghai factory closed till mid May . Just bought Tesla 800 puts

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

Sent from my iPhone using Tapatalk

severestorm

Member

Looks like this isn't going to end well

Sent from my iPhone using Tapatalk

Haven’t seen a green to red move like this in years

Lol wutHaven’t seen a green to red move like this in years

severestorm

Member

Haven’t seen a green to red move like this in years

We were +1.5% this morning. Now -0.75%. When’s the last time that happened?Lol wut

@GeorgiaGirlWe were +1.5% this morning. Now -0.75%. When’s the last time that happened?

Little help!

Nearly a 100 point swing at one point from the intraday high for the S&P. Really impressive

We've seen that kind of move in both directions several times over the last couple of years. You usually get a few bouts of Volatility each year.Nearly a 100 point swing at one point from the intraday high for the S&P. Really impressive

Guess the market remembered that we shouldn’t be spiking on 8.5% inflation prints.

This guy is a Tesla bull but estimate of 270k would be a disaster. But, most who buy Tesla is buying because Elon tweets. No fundamental reason it should be this high.Shanghai factory closed till mid May . Just bought Tesla 800 puts

Sent from my iPhone using Tapatalk

It's time for regular folks to come to terms with the fact that markets are no longer controlled by the natural ebbs and flows of securities. It is all based on algorithms. Who controls the algorithms? That is where you'll really open your eyes......

We've seen that kind of move in both directions several times over the last couple of years. You usually get a few bouts of Volatility each year.

Looking at Wiki. Most of the biggest intraday moves of all times came in March 2020. View attachment 117166

We’ve had these both ways before but this one felt like a nail in the coffin. I haven’t felt this bearish in so long I don’t even remember.

Feel like the Falcons gagging away the Super Bowl.