-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

I’ll be buying TSLA calls into earnings if I can get sub 162

Are we finally going to see a multi week correction. We’ve thought this before but haven’t been able to get follow thru. Let’s see if tomorrow sees follow thru.

And we got no follow through down today. That's happened over and over the past 5-6 months. Market just unstoppable.

Windergawx

Member

Might try to gap’n go it again tomorrowprice action gross...2 big rug pulls today only to violently bounce them higher...still just watching

I don't know how anyone can be short this market

View attachment 147325

I’ve been trading a lot of Tesla lately. I like to watch that one move and I’m starting to get a pretty good feel for itprice action gross...2 big rug pulls today only to violently bounce them higher...still just watching

I don't know how anyone can be short this market

View attachment 147325

Brutal price action...they rug pulled things hard late in the day...in fact SPX was a round trip and then they gap it up hard overnight.Might try to gap’n go it again tomorrow

I'm still not doing a whole lot...I guess if it closes at new ATH's I have to put money to work. It seems like this market will never see another correction ever in our lifetimes.

Anyone who signed up to be a GOLD digger (invest) past couple years is loving life.

Sidenote: Gas up 26 cents over past month.

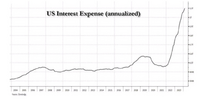

Gross US Debt now accounts for 245,000 per us household. Imagine if every household represented on here and all throughout Harlem, ten buck two usa would just hand the feds$ 245,000. We would wipe the ole debt out. Amazing watching US economy that was over 70% driven by consumer spending , now getting replaced by govt spending as the main driver.

Sidenote: Gas up 26 cents over past month.

Gross US Debt now accounts for 245,000 per us household. Imagine if every household represented on here and all throughout Harlem, ten buck two usa would just hand the feds$ 245,000. We would wipe the ole debt out. Amazing watching US economy that was over 70% driven by consumer spending , now getting replaced by govt spending as the main driver.

Last edited:

Big afternoon pullback

Epic selloff

This market has become a clown show. I almost relented and put money to work but didn’t. I should buy here…we probably see another huge gap up tonight.Epic selloff

Israel has put all of it's embassies on alert, with Iran threatening retaliation.Are we at war…what is going on. I can’t find anything that is causing this.

I've been 80% cash for a couple weeks now but now 100% cash when 5180 got taken out. Brutal past couple of days....rug pull late yesterday and then they gap it up almost 1% today and then another rug pull and market is in in free fall. I don't know whether to buy or run and hide. If this doesn't start a multi-week correction then I give up.

Windergawx

Member

And that's why I short inter day

Windergawx

Member

GeorgiaGirl

Member

Nice rally today, but in this case, the jury is going to be out for longer than today, since the uptrend was broken, and volatility is a bit jumpy.

It'd be a different story had we closed on session lows on Tuesday instead and had the +1% day the next day, or what was pulled in early March with a two-day rally.

If nothing special occurs in geopolitics land this weekend and core inflation isn't surprising, then vol probably gets crushed a bit.

It'd be a different story had we closed on session lows on Tuesday instead and had the +1% day the next day, or what was pulled in early March with a two-day rally.

If nothing special occurs in geopolitics land this weekend and core inflation isn't surprising, then vol probably gets crushed a bit.

TSLA down sharply on the news it's not going to come out with a "cheap" EV instead focus on developing robo taxis.

It's going to take a lot for me to get into a car without a human driver.

View attachment 147344

Agreed. I’m not gonna ride in something that can get hacked and hold me inside until I pay a ransom.

@KyloG are we ready to long China? Which tickers?View attachment 147354

It's been on my to do list for a while...but it's so volatile. Would hate to lose money in China while our markets are non stop going up.

packfan98

Moderator

Gold is at an all time high! If you have any old jewelry lying around that might be gold, now is the time to sell it. I sold an old gold chain I wore in high school today for $600. I was shocked!

I put some cash to work this morning. This market has had plenty of opportunities to break down and hasn’t. I may regret not being more patient but Qs was about 3% off highs so maybe that’s all we get.

Needless to say I went back to all cash real quickly, lost a few $ but not a biggie. Should have been more patient. This market desperately needs a prolonged correction but the dip buyers are relentless so we will see.I put some cash to work this morning. This market has had plenty of opportunities to break down and hasn’t. I may regret not being more patient but Qs was about 3% off highs so maybe that’s all we get.

Bad numbers? Big dipper PM. Looking for another TSLA entry

I bought a bunch of 4/19 Tesla 175 calls on that dip under 171

Windergawx

Member

And sold. If we open under 169 tomorrow morning I’m back inI bought a bunch of 4/19 Tesla 175 calls on that dip under 171

snowlover91

Member

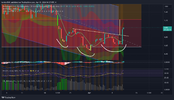

Qs 8dema crossing below the 20dema...that has been typically bearish for obvious reasons...but these dip buyers are relentless.

View attachment 147383

Earnings season coming up in a couple weeks for a lot of chip/AI themed stocks. I imagine the dip this week and maybe into next week is to load up on stuff before earnings start rolling in again.

One of my favorite AI/chip type plays is CLS, I’ve had it since $34 and started watching it around $23. Still undervalued imo with a forward PE of 16. Also ASPI is a speculative uranium play of mine that’s done really well recently. APP and VRT are two others I really like that I have in my portfolio.