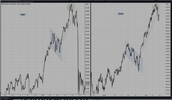

Corrective sequences usually hold the 20-30-40w ma's and bear markets reject. We aren't far off the 30w-40w ma's...only 2-3% more. Things will get really interesting if we get a close below the 40wma. I will flip to heavy long around there...so roughly Qs $400.

We are 6 days down in SPX...I don't remember the last time we had 7 days down in a row. So we might get a 1-2 week bounce before really testing the 30-40w ma's.

We are 6 days down in SPX...I don't remember the last time we had 7 days down in a row. So we might get a 1-2 week bounce before really testing the 30-40w ma's.