Yeah 2% seems imminent lmaoInflation up 6.4% from last year, rising for the first time in months, Labor Department says

Inflation up 6.4% from last year, rising for the first time in months, Labor Department

Prices for all times increased 0.5% from December to January, the agency also said.justthenews.com

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

severestorm

Member

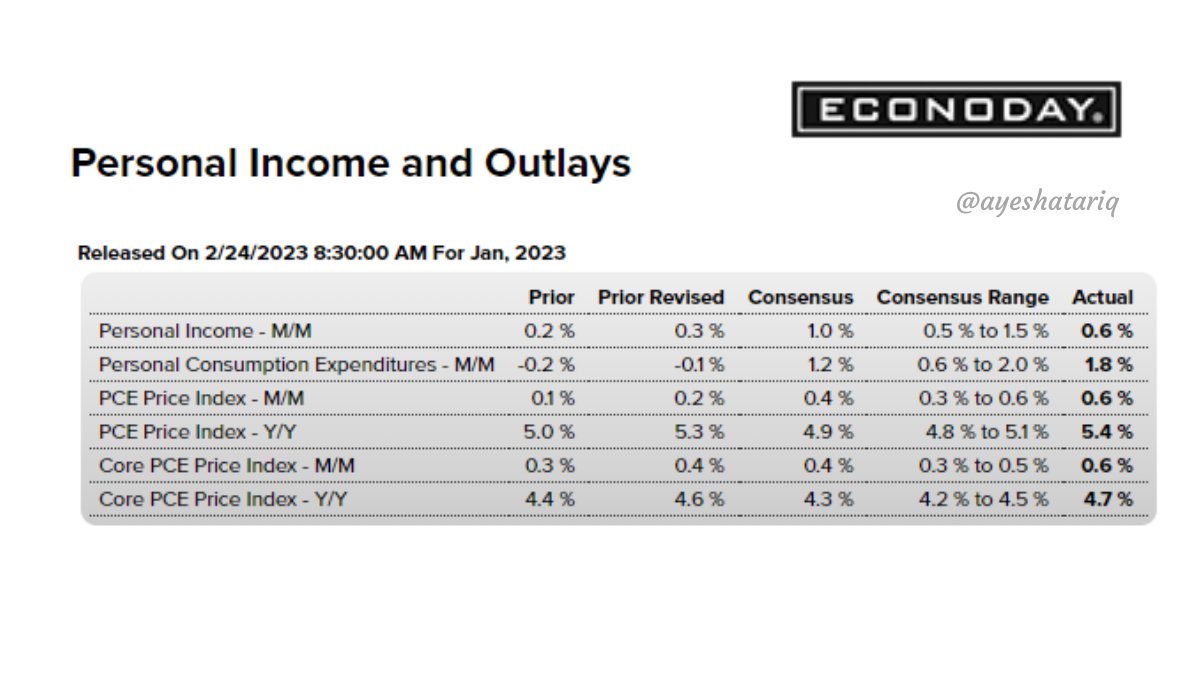

Market hasn't rolled over because of unfounded claims Fed will cut rates in September which will not happen because they will not reach 2% in 6 months.I did buy the dip at the open as the pain trade for the market is higher. Everyone expects market to rollover and it hasn't. From a TA perspective this is a very bullish chart.

View attachment 133199

Market hasn't rolled over because of unfounded claims Fed will cut rates in September which will not happen because they will not reach 2% in 6 months.

Inflation report was as expected but it's going to take a long long time. They ain't cutting rates with employment this strong, market this strong.

severestorm

Member

It looks like it came in hotter than expected. What you are seeing in the cuve is a what we call concave up in statistics, which is not the direction you want to go.Inflation report was as expected but it's going to take a long long time. They ain't cutting rates with employment this strong, market this strong.

D

Deleted member 609

Guest

I think there is a decent shot at 2-3% by summer. Total inflation over the last 8 months is at about 1%. As long as MoM numbers don't go crazy over next few months you will see that YoY number drop to under 3%.Yeah 2% seems imminent lmao

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

welp

severestorm

Member

I wonder what the correlation is between peak inverted to market bottom is....was market bottom back in the fall.

Not feeling it. Feels like they’re just treading water killing early shorts. We’ll seeQ's look great. Breakout after 2 week consolidation would mean higher highs coming. But, it's almost 20% since late December.

View attachment 133254

severestorm

Member

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Fed floating 50 bps more and more

D

Deleted member 609

Guest

Might jump in on some puts a month out here. I'm up like 15% so far this year. Don't think the upward trend can continue much longer

D

Deleted member 609

Guest

In for a few March 17 IWM $185/$175 put spreads for $138 each.

You guys should buy calls

You guys should buy calls

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

old Carl Icahn going to cash in today. those Puts look to pay off if S&P closes below 4050. He put 50 million in total on that bet the last 2 weeks. Billionaires don't take L's

Time for the typical Friday afternoon reversal.

oop

severestorm

Member

drfranklin

Member

- Joined

- Dec 1, 2016

- Messages

- 507

- Reaction score

- 749

not a financial analyst, but if rates were to go (well) above 5% in 2023 what does that translate for cost of Fed interest debt payments?

severestorm

Member

Oy vey…Fed has rapid hiked to almost 5% and economy can’t be slowed. ?

Ouchy. Compounding bulls torched yet again

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

welp

Straight up into the close. Typical Friday afternoon burn