-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

INTC with just god awful earnings...yikes

Earnings haven't mattered for over a decade.

severestorm

Member

severestorm

Member

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Powell is not going down as Arthur Burns. He believes that if they hit a crisis because they have raised rates too much they can respond as they did with Covid. There is no "pivot" in this man.

severestorm

Member

Yup, market thinks they are going to pivot and that's not the case. He's going the Volcker route. Insane consumer inflation expectations are so low already. And people are buying homes again. clown world lolPowell is not going down as Arthur Burns. He believes that if they hit a crisis because they have raised rates too much they can respond as they did with Covid. There is no "pivot" in this man.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

LCID was rumored to be taken private by he Saudis. Sound familiar?

I know MVIS gets clowned but these guys are on point and about to make some big announcements. Feel very confident with my investment in them

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

welp tech

severestorm

Member

?

severestorm

Member

Good Advice

Storm5

Member

AMD puts only have 3 72s it's all about guidance

David Lowery

Member

Storm5

Member

AMD meh . Flat double beat with shrinking margins . Will be interesting to see if this small move AH holds

AMD meh . Flat double beat with shrinking margins . Will be interesting to see if this small move AH holds

Data Center was great, but pc was very bad as expected. Lisa said she expects a recovery 2nd half in that space. 16% yoy growth with a very tough comp is solid. It's still my biggest individual holding from now low $60's avg.

Storm5

Member

Data Center was great, but pc was very bad as expected. Lisa said she expects a recovery 2nd half in that space. 16% yoy growth with a very tough comp is solid. It's still my biggest individual holding from now low $60's avg.

View attachment 131970

Yeah my puts are toast . Expire next Friday but still wrecked . My only hope is a Hawkish Powell today to send the market to hell

Sent from my iPhone using Tapatalk

severestorm

Member

No way Powell is Dovish today. Especially after the jolts report.

Yeah my puts are toast . Expire next Friday but still wrecked . My only hope is a Hawkish Powell today to send the market to hell

Sent from my iPhone using Tapatalk

Powell doesn’t want the stock market up so I expect fairly hawkish Q/A. But, they are going to be nearing 5% ffr and they need to pause.No way Powell is Dovish today. Especially after the jolts report.

severestorm

Member

Didn't expect Powell to be this hawkish. wow...

Problem is market knows they are close to the end of hikes and market will take off once it's confirmed. But Jay doesn't want market higher.Didn't expect Powell to be this hawkish. wow...

David Lowery

Member

As long as inflation cools he has no reason to hike in the future or am I wrong?

Storm5

Member

How has it cooled ? CPI report will be HOt next month . Gas and oil up 15 percent last month

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Must not be too hawkish. Stocks are green on the day.Didn't expect Powell to be this hawkish. wow...

David Lowery

Member

Sorry was just asking a question. I believe it has not cooled either. I agree with you about the cpi report. Gas prices have jumped, I did noticeHow has it cooled ? CPI report will be HOt next month . Gas and oil up 15 percent last month

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

It's below 2% if you annualize it from June/JulyHow has it cooled ? CPI report will be HOt next month . Gas and oil up 15 percent last month

Sent from my iPhone using Tapatalk

Oil still down 11% yoy though. I think we continue to see softer CPI next few months. Wages/jobs are I think going to be the problem. Jay wants balance and it hasn’t come yet.How has it cooled ? CPI report will be HOt next month . Gas and oil up 15 percent last month

Sent from my iPhone using Tapatalk

Any thoughts on TMF? 5 year isn’t great but bought in on the 31st and have had decent return so far.

severestorm

Member

Companies are buying back probably from the money saved from layoffs. There's no external liquidity, markets are trying to go back to fundamentals. There was a rally before the fall in 2008 I believe.This is getting just slightly absurd... there was many positioned short tech to start the year thinking this was going to be a multi-year blood bath like 2000-2002 so shorts are unwinding now. And maybe this is just a short term rally but we shall see.

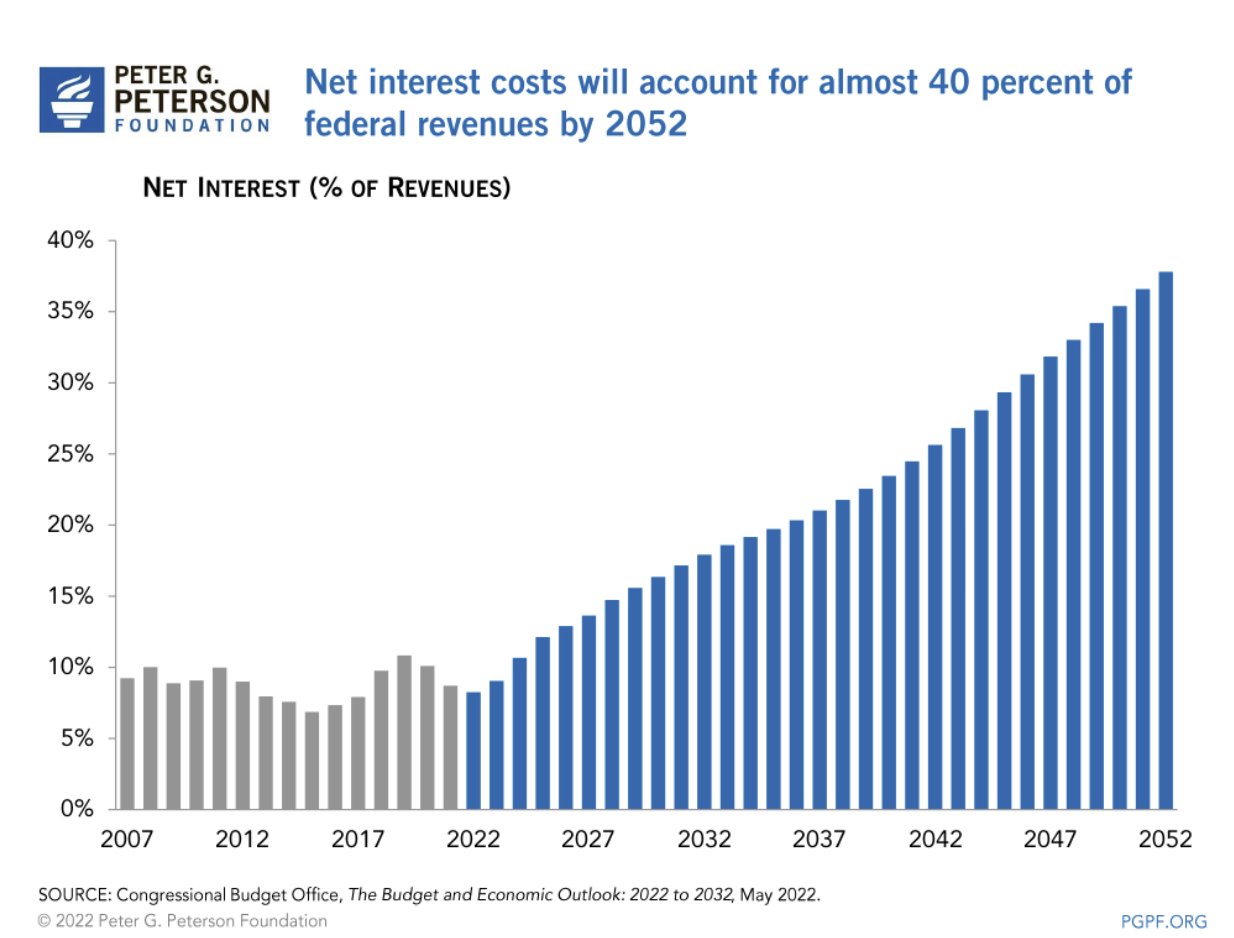

View attachment 132023

Zuckerberg and Intel are shipping the proceeds from their layoffs straight to Wall Street

Wall Street long groused about cash-generating tech companies refusing to pay dividends and buy back stock. That is no longer a problem, in multiple respects.

Companies are buying back probably from the money saved from layoffs. There's no external liquidity, markets are trying to go back to fundamentals. There was a rally before the fall in 2008 I believe.

Zuckerberg and Intel are shipping the proceeds from their layoffs straight to Wall Street

Wall Street long groused about cash-generating tech companies refusing to pay dividends and buy back stock. That is no longer a problem, in multiple respects.www.marketwatch.com

Problem is we saw the unemploy rate rate spike and you had big financial institutions failing in 2008. We have nothing like that.

Storm5

Member

Baba puts only thing saving me for the week . Up 1300 on those to balance losses . Down $50 for the week . Just added 7 414 SPY puts for next week . Still no pullback yet

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

severestorm

Member

It's coming though. It's slower than 2008. Reason you are not seeing it in the weekly unemployment is because most of the layoffs in tech have severance packages so not many are claiming government benefits. JOLTS job openings for information actually got cut in half from the highs. I also remember it was Lehman Bro's that was the catalyst for the rapid decline in 2008 too. Your seeing companies cut costs and have more slim margins along with US consumer savings rate depressed still. Layoffs will not slow down.Problem is we saw the unemploy rate rate spike and you had big financial institutions failing in 2008. We have nothing like that.

Over 100K job cuts announced in January: analysis

U.S. companies announced roughly 103,000 job cuts in January, the highest monthly total since September 2020, a Thursday analysis found. Last month was the worst January for job cuts since the Great Recession in 2009, according to a report from employment firm Challenger, Gray & Christmas...

Last month was the worst January for job cuts since the Great Recession in 2009, according to a report from employment firm Challenger, Gray & Christmas.