No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Somebody or something just hammered the vix higher with call options about 30 mins ago. They were big boy trades

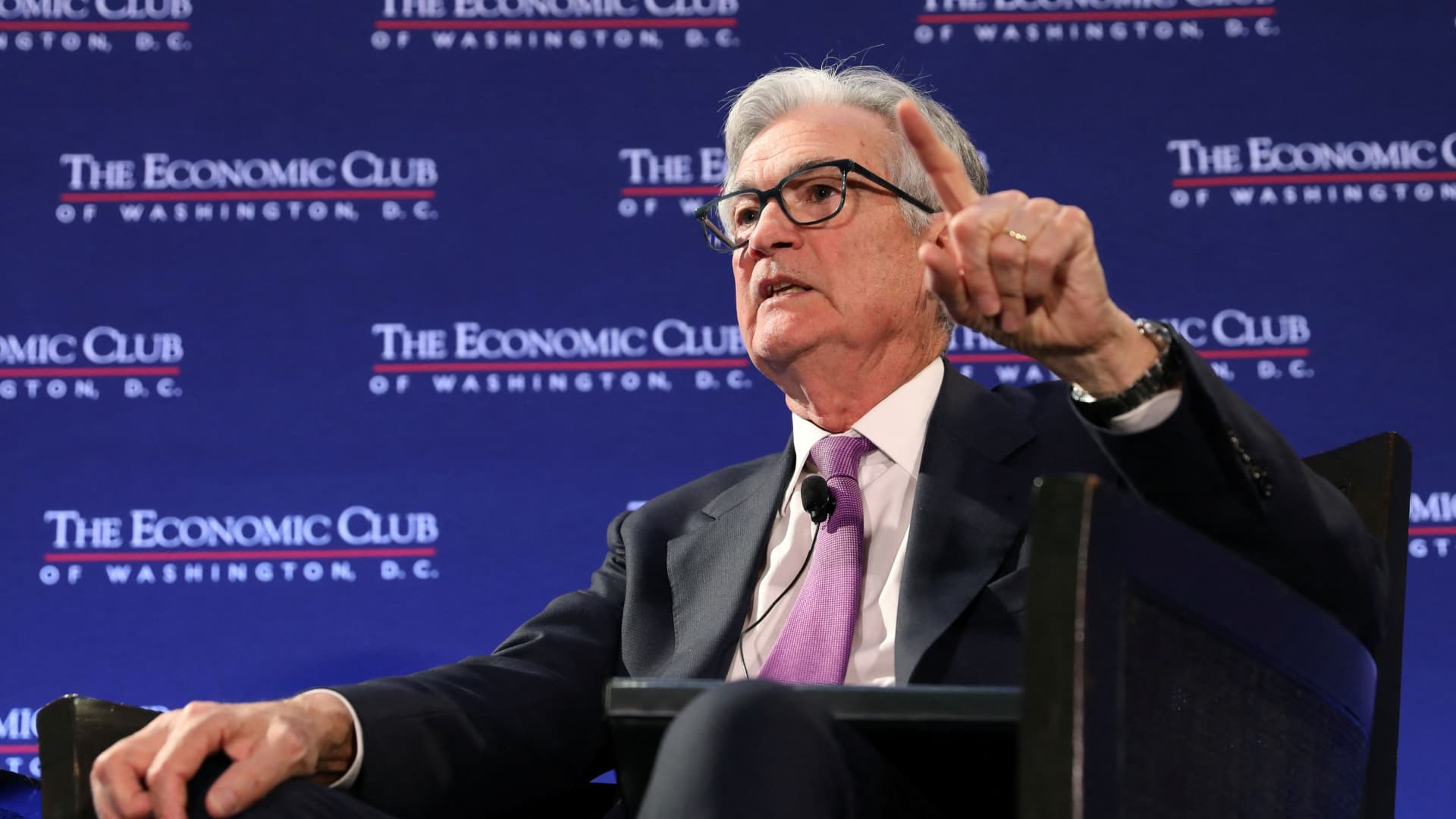

This quote…our Fed wants job losses. They aren’t going to stop until that happens. ?

I just wounder what might happen if banks run into liquidity issues and have to "bail in"(Dodd-frank Act) where banks would take account holders savings. FDIC only has $125.5 billion. There's $17,743 billion in deposits.Powell speaking today. My bet is he will chose the red pill over the green pill.

Also banks have stopped lending. this is when bad things start to happen.

The bail in would be on deposits over the FDIC limit. and they would get shares of stock in return for the bank getting their deposits.I just wounder what might happen if banks run into liquidity issues and have to "bail in"(Dodd-frank Act) where banks would take account holders savings. FDIC only has $125.5 billion. There's $17,743 billion in deposits.

How much would the shares be worth if the bank files for bankruptcy? ?The bail in would be on deposits over the FDIC limit. and they would get shares of stock in return for the bank getting their deposits.

Yes, I heard from a major investor/developer in commercial real estate that they can't get banks to fund some of their projects.I just wounder what might happen if banks run into liquidity issues and have to "bail in"(Dodd-frank Act) where banks would take account holders savings. FDIC only has $125.5 billion. There's $17,743 billion in deposits.

Wow that's scary...Might get some cash out of the ATM. Better safe than sorry.Yes, I heard from a major investor/developer in commercial real estate that they can't get banks to fund some of their projects.

The banks had to pause lending since the fall as the FDIC and the FED have changed the way the banks account for their risk buckets. It has thrown their books crazy.Yes, I heard from a major investor/developer in commercial real estate that they can't get banks to fund some of their projects.

Big oopsie -> Alphabet Stock Loses $100 Billion After New AI Chatbot Gives Wrong Answer In AdGoogle straight up nasty...huge engulfing daily candle yesterday. Super bullish...and now today, down almost 10%. Mm's are sweeping the leg today.

View attachment 132518

Haha...I saw that. Seems a little overdone but momo caught up with Google.Big oopsie -> Alphabet Stock Loses $100 Billion After New AI Chatbot Gives Wrong Answer In Ad

Come on $GOOGL...really dumb it sold off this much.

Typical reversal, took out the morning low to clear stops and then they run it up.

View attachment 132777

What gets me is the market expects the CPI to get to 2% in 6 months which is nuts. CPI is on a concave upward trend.CPI came in largely as expected. Market is looking for direction. SPY/Q's chart look solid, bull flag building...but it's a bull flag until it isn't.

View attachment 133193