severestorm

Member

Wow I'm glad I didn't buy a home yet! Next year's budget proposal will eliminate the 1031 exchange.

Wow!

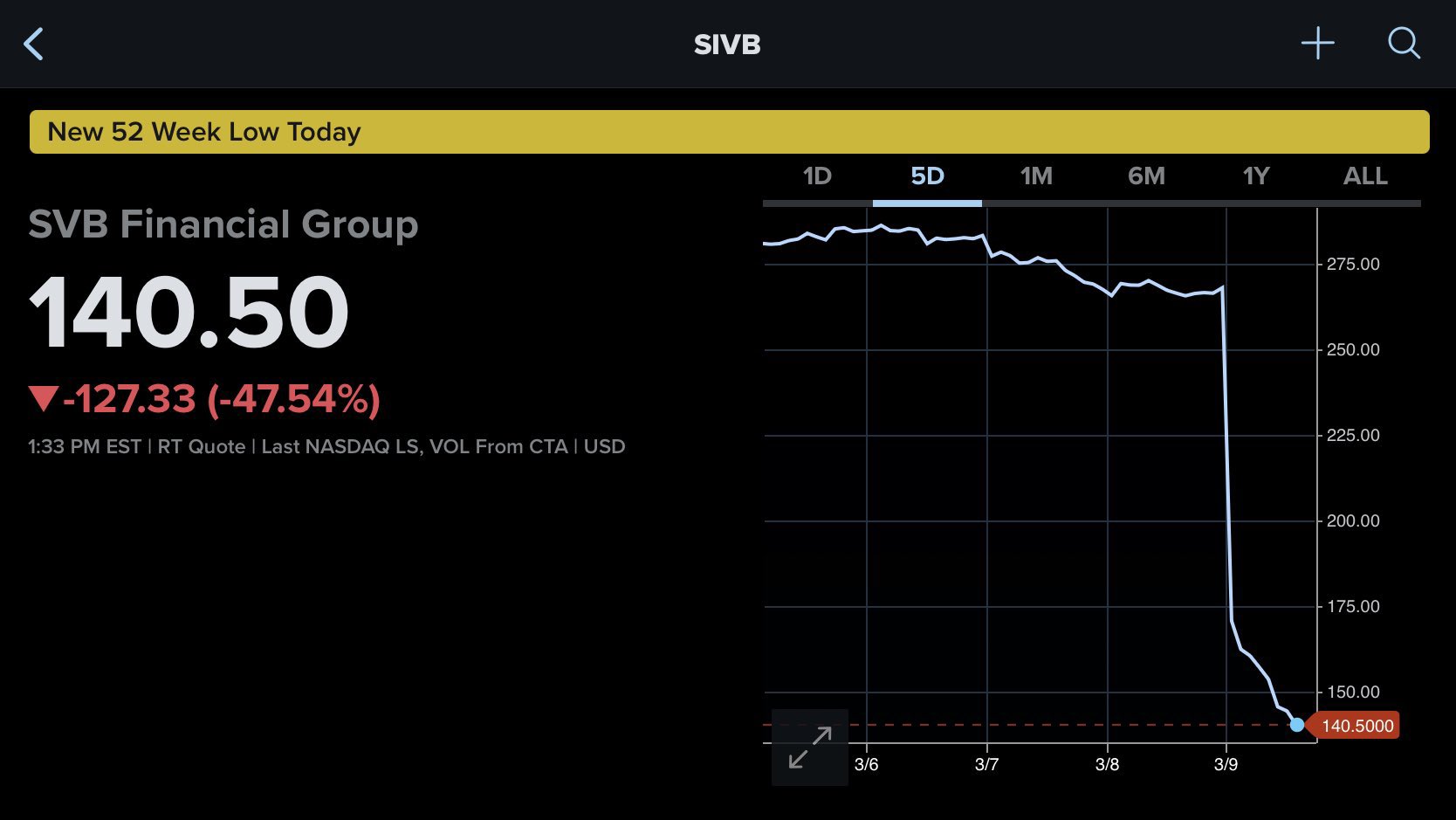

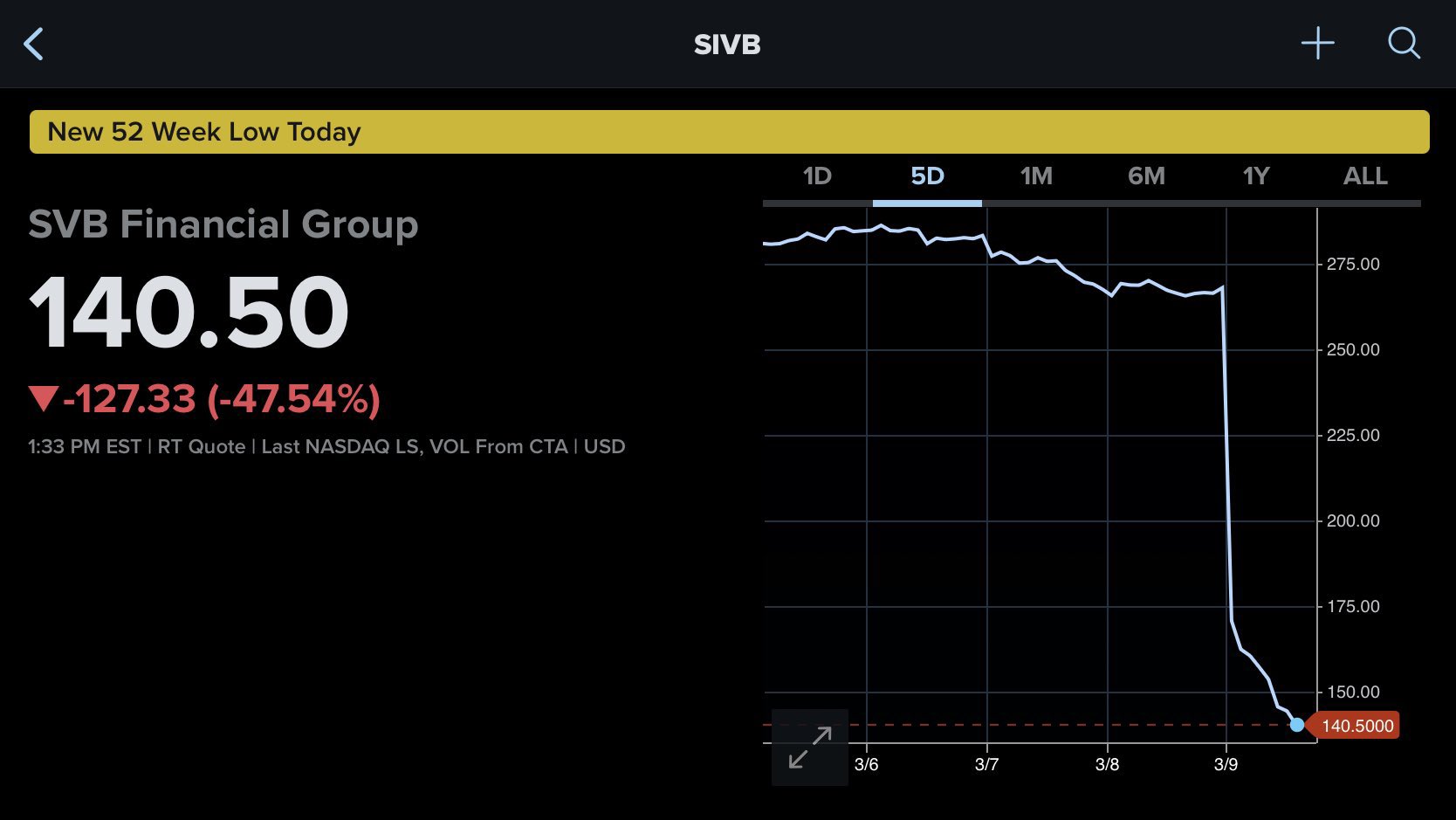

Silicon Valley Bank, $SIVB, CEO has said to investors: "stay calm and don’t panic"Wow!

lower nowThe more I read about the more concerned I am getting. ?

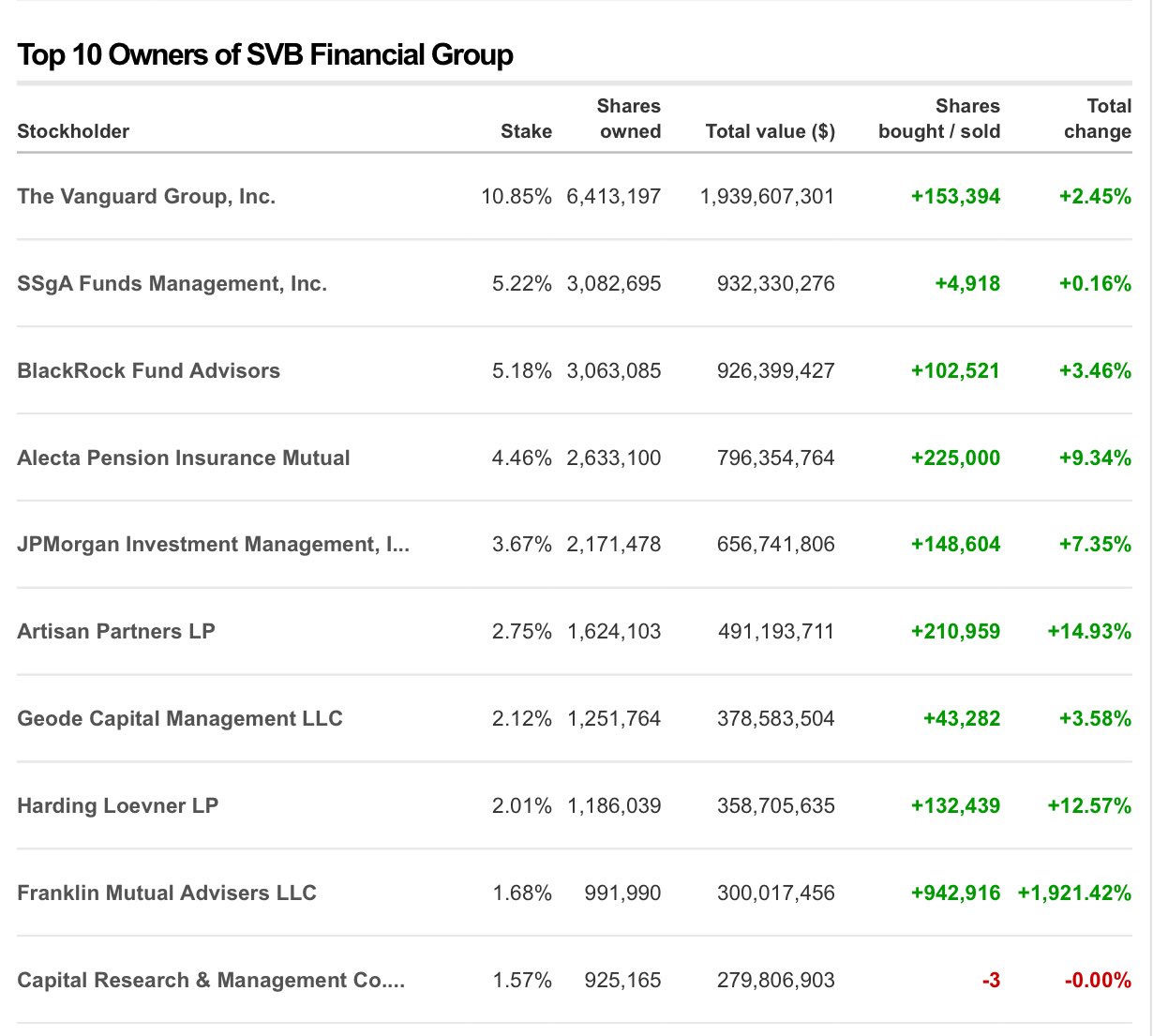

This is/was a solid bank. Just how vulnerable are the others. Stuff like this tends to get drag on the big dogs too.

View attachment 134139

Have mercy

Pre market below 40 now, pretty insane collapse of the price in the last 48 hours total being 265 to 39.

Maybe we can all gather a couple dollars each and buy a bank.Pre market below 40 now, pretty insane collapse of the price in the last 48 hours total being 265 to 39.

Sold them 30 seconds later for $200 profit. Jimmy style.Just bought 20 XLF $32 puts for .16 expiring today. Probably pissing away money but whatever.

LFG! ?Sold them 30 seconds later for $200 profit. Jimmy style.

SVB had $150b+ deposits in excess of FDIC insurance limit as of end of 2022. Going to be a while for those depositors to get that money back (and it won't be 100%). Probably most companies vs individuals. Not sure how that process will work.The banks have been warned now. They better increase deposit rates quickly or they will have liquidity problems. a 5% T-Bill is just too much for people to pass up. Regional's down are having massive funding issues.

J Powell got his credit crisis. FYI keep an eye on FRC

Lastly realize if you have over the FDIC protection in the bank, you are an unsecured general creditor. Good luck to you

Congress is going to have to pass legislation if the contagion spreads. FDIC only has $119.4 billion in reserves.The banks have been warned now. They better increase deposit rates quickly or they will have liquidity problems. a 5% T-Bill is just too much for people to pass up. Regional's down are having massive funding issues.

J Powell got his credit crisis. FYI keep an eye on FRC

Lastly realize if you have over the FDIC protection in the bank, you are an unsecured general creditor. Good luck to you

I'm starting to withdraw my deposits today. Not taking any chances.

Deposits from where?I'm starting to withdraw my deposits today. Not taking any chances.

It's insured. But whatever.I'm starting to withdraw my deposits today. Not taking any chances.

FDIC has a line of credit with the treasury.Congress is going to have to pass legislation if the contagion spreads. FDIC only has $119.4 billion in reserves.

The Fed enters their blackout period tonight at midnight until March 22. No more speeches. only leaksAlright...someone wake up JayP. We got panic settling in.

Agree...but it appears the bottom may be dropping out fast.Massive liquidity swipe. Good on the Fed for letting this boil over. Surprised it took this long.