-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

GeorgiaGirl

Member

So, Chicago PMI is in severe contraction based on what we got this morning, yet I'm supposed to believe the Fed is being 100% truthful when Powell comes out to look to set the tone before the blackout period. ? ? ?

They are a few more soft economic data prints and another softer CPI away from possibly being ignored.

They are a few more soft economic data prints and another softer CPI away from possibly being ignored.

severestorm

Member

Only 127K jobs added per ADP. Low quits. Fewer openings. Record tech layoffs. Will probably cascade to other sectors in January. Fed 75bps hike likely after GDP numbers.

GeorgiaGirl

Member

Only 127K jobs added per ADP. Low quits. Fewer openings. Record tech layoffs. Will probably cascade to other sectors in January. Fed 75bps hike likely after GDP numbers.

Might have a very different opinion shortly after Powell speaks, but for now at least...no.

My concern is that this event is like Jackson Hole though to look to jack financial condition tightness up and if so then, I'm not so sure.

severestorm

Member

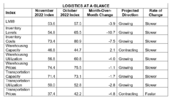

Yup. I just don't understand why companies don't increase inventories to pre-pandemic levels. This is a major part of the inflation issue. It's not because too many people have jobs. Sounds like the blame is placed on the workers and not the current system.Might have a very different opinion shortly after Powell speaks, but for now at least...no.

My concern is that this event is like Jackson Hole though to look to jack financial condition tightness up and if so then, I'm not so sure.

GeorgiaGirl

Member

Yup. I just don't understand why companies don't increase inventories to pre-pandemic levels. This is a major part of the inflation issue. It's not because too many people have jobs. Sounds like the blame is placed on the workers and not the current system.

The -100k manufacturing jobs in the ADP report says it all. Only thing the Fed's done this year is stifle investment that can help with the issue and yet plenty of folks still have laser focus on inflation.

I'd slightly favor the discussion of 2023 being a nasty recession instead of inflation, in which, we'll be at 2% core PCE or below because of it. Then my hope afterwards is that the focus will be on building up supply chains so we can avoid having to rely on China so much.

Inflation likely remains at least slightly elevated for a lot of this decade. A large block of retirees, energy issues because of bad policy, and the need to reshore are why.

Reason why I'm at only slight instead of great is the optimist in me wants to think a reckoning is coming in the next few months. Don't think cuts are coming too soon, but maybe the data winds up leading us to 1 more and done.

severestorm

Member

The thing is, how many people have to loose their livelihood in order to bring inflation down? I think this comes down to more supply needed. The more supply the less dollars chasing a particular product. Forcing people out of work will be a bandaid on a bigger systemic issue. Inflation will skyrocket again. Companies that thought they could raise prices to compensate for lack of sales with already overvalued merchandise are about to have a reckoning. Things are not built for the lower middle class or poor anymore.The -100k manufacturing jobs in the ADP report says it all. Only thing the Fed's done this year is stifle investment that can help with the issue and yet plenty of folks still have laser focus on inflation.

I'd slightly favor the discussion of 2023 being a nasty recession instead of inflation, in which, we'll be at 2% core PCE or below because of it. Then my hope afterwards is that the focus will be on building up supply chains so we can avoid having to rely on China so much.

Inflation likely remains at least slightly elevated for a lot of this decade. A large block of retirees, energy issues because of bad policy, and the need to reshore are why.

Reason why I'm at only slight instead of great is the optimist in me wants to think a reckoning is coming in the next few months. Don't think cuts are coming too soon, but maybe the data winds up leading us to 1 more and done.

Last edited:

Not sure if JP is on drugs but he completely went from ultra hawkish to uber dovish...

FED'S POWELL: THE FED HAS BEEN PRETTY AGGRESSIVE, BUT IT DOES NOT FEEL IT APPROPRIATE TO CRASH THE ECONOMY AND CLEAN UP AFTERWARDS.

FED'S POWELL: THE FED HAS BEEN PRETTY AGGRESSIVE, BUT IT DOES NOT FEEL IT APPROPRIATE TO CRASH THE ECONOMY AND CLEAN UP AFTERWARDS.

I tried puts after the initial pump and got rekt

Midterms are over. Time to bring the market back up.Not sure if JP is on drugs but he completely went from ultra hawkish to uber dovish...

FED'S POWELL: THE FED HAS BEEN PRETTY AGGRESSIVE, BUT IT DOES NOT FEEL IT APPROPRIATE TO CRASH THE ECONOMY AND CLEAN UP AFTERWARDS.

severestorm

Member

@GeorgiaGirl talked with Powell before ? But I think Elizabeth Warren's comments made a difference here. Congress is also about to force a end to the Rail strike too. Hopefully they are going to get the supply chain back up and running to Pre-Pandemic levels.Not sure if JP is on drugs but he completely went from ultra hawkish to uber dovish...

FED'S POWELL: THE FED HAS BEEN PRETTY AGGRESSIVE, BUT IT DOES NOT FEEL IT APPROPRIATE TO CRASH THE ECONOMY AND CLEAN UP AFTERWARDS.

jovialweather

Member

Got stopped out of my QQQs in the volatility but rode Google up nicely.

GeorgiaGirl

Member

Not sure if JP is on drugs but he completely went from ultra hawkish to uber dovish...

FED'S POWELL: THE FED HAS BEEN PRETTY AGGRESSIVE, BUT IT DOES NOT FEEL IT APPROPRIATE TO CRASH THE ECONOMY AND CLEAN UP AFTERWARDS.

lol...Powell killed a narrative that I'm sure many were wondering about (that the hawks in the Fed would like a nasty recession)...including myself with the commentary from Bullard we've recently heard. I was definitely wrong about today...maybe I need to continue to lean pessimistic.

I just have to wonder if he's axing the nasty recession narrative too late because that Chicago PMI this morning...aye yi yi.

Seems like we're in a manufacturing recession (similar to late 2018)...more evidence to it would be if the ISM manufacturing number tomorrow comes in below 50.

severestorm

Member

yup, recession already herelol...Powell killed a narrative that I'm sure many were wondering about (that the hawks in the Fed would like a nasty recession)...including myself with the commentary from Bullard we've recently heard. I was definitely wrong about today...maybe I need to continue to lean pessimistic.

I just have to wonder if he's axing the nasty recession narrative too late because that Chicago PMI this morning...aye yi yi.

Seems like we're in a manufacturing recession (similar to late 2018)...more evidence to it would be if the ISM manufacturing number tomorrow comes in below 50.

severestorm

Member

severestorm

Member

100k+ dropped out out of the workforce. Length of unemployment is increasing. Number of discouraged workers are increasing. FED's mission of destroying livelihoods is succeeding.

severestorm

Member

Get ready for 5000 on the s&p

severestorm

Member

severestorm

Member

Storm5

Member

400 break or 410 break on spy next ???

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

410 for sure400 break or 410 break on spy next ???

Sent from my iPhone using Tapatalk

severestorm

Member

ISM today....

What did you do to it?

Opened a trillion dollar leveraged short position. Honestly, I’m scared to do anything. FOMC next TuesdayWhat did you do to it?

severestorm

Member

This sucks this is happening around Christmas, hard to get in the spirit when it's inevitable what's coming after.

Storm5

Member

Spy puts ripped today . Was up 400 percent and got greedy. Closed out up 301 percent

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

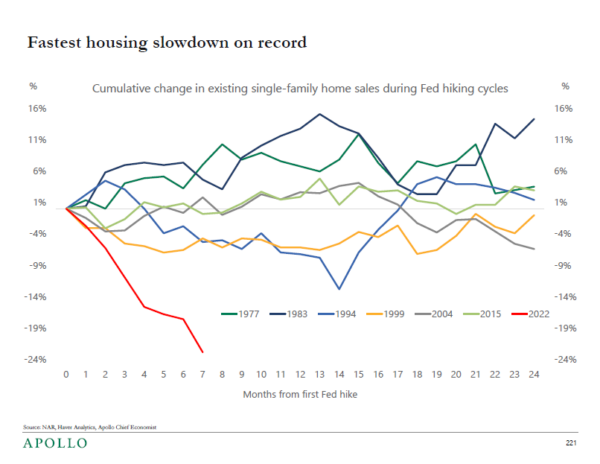

Tough market...day 4 down on SPY, PPI on Friday, CPI next Tuesday. Market gave back the gains from JPowells conf last week where he said hikes would be slowing and he wouldn't destroy the economy with rate hikes. Now, if market gives up the CPI gains from Nov then market is in big big trouble. That would say market knows inflation isn't the problem that we are headed for recession and in deep trouble.

Swinging some leveraged bull ETF’s into FOMC

D

Deleted member 609

Guest

Going all in in that $5k you made?Swinging some leveraged bull ETF’s into FOMC

severestorm

Member

JPMORGAN'S LAKE: A 5% UNEMPLOYMENT RATE WOULD NOT BE A BAD OUTCOME. ?

severestorm

Member

D

Deleted member 609

Guest

That's below long run average so yea.. not a bad outcome.JPMORGAN'S LAKE: A 5% UNEMPLOYMENT RATE WOULD NOT BE A BAD OUTCOME. ?

severestorm

Member

lol okayThat's below long run average so yea.. not a bad outcome.

Welp. Got out on the breakdown earlier. Only lost $200. What’s next?Going all in in that $5k you made?

severestorm

Member

73 month car loan?!