I’ve been watching apple move lately. It’s all algos. Very predictable price movement. I’ve implemented it into my day trading strategy and it has helped me a lot.Apple with a perfect tag of the trendline, closed position at $152.5 from $147.50 yesterday.

View attachment 123937

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

The Fed is going to slap this market in the mouth again

D

Deleted member 609

Guest

My Disney bags may be lighter tomorrow

www.cnbc.com

www.cnbc.com

Bob Iger returns as Disney CEO, replacing Bob Chapek after a brief, tumultuous tenure

Bob Iger is back as CEO of Disney. Bob Chapek, who replaced Iger in 2020, is out after a brutal earnings report that sowed further doubt about his leadership.

severestorm

Member

Powell's remarks to Warren are interesting...If 7% happens the economy will be crippled, millions will lose there jobs/homes. If it happens they should all be locked for that. Think about....because cereal and rent is higher let's destroy the avg american's life.

GeorgiaGirl

Member

TSLA $150 will likely be a great place to add fresh longs...for other Nasdaq names and the Nasdaq itself.

It's comical how well this stock pushes it around. Apple I understand, Tesla I don't understand.

It had me ticked off the day before CPI earlier this month since it lost a key spot (I was also frustrated about the Bitcoin situation), and it looks like CPI surprising pretty much everyone just temporarily pushed off TSLA leading the Nasdaq down the drain.

$150's likely just a temporary stopping point unfortunately, so I'll get to continue to be mad at TSLA for a while I bet.

It's comical how well this stock pushes it around. Apple I understand, Tesla I don't understand.

It had me ticked off the day before CPI earlier this month since it lost a key spot (I was also frustrated about the Bitcoin situation), and it looks like CPI surprising pretty much everyone just temporarily pushed off TSLA leading the Nasdaq down the drain.

$150's likely just a temporary stopping point unfortunately, so I'll get to continue to be mad at TSLA for a while I bet.

severestorm

Member

GeorgiaGirl

Member

SPY has a nice flag. This market doesn't like to trade sideways for long...I expect $390 to be tested tomorrow or a march towards $400.

I am long $QQQ $383 calls and $NVDA at close. Gap down tomorrow won't feel good.

View attachment 124019

I'd certainly lean towards bull flag as long as SPX is at/above 3900, but man, I just don't feel good at all. I'm leaning towards distribution like that period in June.

Resolution probably comes on Wednesday with the minutes and the thing that I will say there is that some folks are remembering Powell's words over the statement. I can't imagine there's a surprise in those minutes.

But I can imagine that Powell might yell at the market for 8 minutes on the 30th.

Thing that I'd love to see would be for the Fed to double down on jawboning and for core CPI to come in at .2-.3 MoM in a few weeks to jerk everything around again. I'd be deceased from laughter if so...but even if that were the case, my guess is we'd still see 1 more hike and done.

Lol @NoSnowATL

NoSnowATL

Member

Reddit.com/stock/steal/opinion/copy/paste

Elon should buy RedditReddit.com/stock/steal/opinion/copy/paste

NoSnowATL

Member

$7Elon should buy Reddit

SnowMan

Member

Now them 'fighten words...Elon should buy Reddit

D

Deleted member 609

Guest

Buying Reddit might be the only thing worse than buying Twitter.Elon should buy Reddit

@GeorgiaGirl would have the meltdown of all meltdownsBuying Reddit might be the only thing worse than buying Twitter.

severestorm

Member

"Charts suggest the S&P 500 will rally in December" - Jim Cramer ?

I did add some Tesla shares yesterday at $169. Not a fan of Tesla but it's hard to ignore this should be fairly big support. The overhang from Twitter is going to last for some time...Elon has to sell more Tesla shares for the loans he has. Some are saying it won't come until Q1.

I think it gets to $176 soon and if it can get through that than maybe it see $180, which would be gap fill.

I think it gets to $176 soon and if it can get through that than maybe it see $180, which would be gap fill.

META has a nice looking chart, nice bull flag building. Took shares at $110.

It looks quiet, I don't see any +divergence going yet so will be patient.

View attachment 124032

META trying...needs to get through $112.30...

jovialweather

Member

Seems like we still have another drop ahead. I got out of everything right before the midday drop to lock in some gains. Several people I talked to in the industry felt like we were due for a little false bottom, and then one more drop before true recovery starts taking place. Guess we'll see but I didn't want to carry anything into the holiday weekend in my short term accounts.

Lot of dark pool activity in low $394's for SPY earlier. I have a feeling they don't want to pay out $400 calls and $394 is probably the LOD. Today is a huge opex.

SPY $394 dark pool activity last week indicated that was good support. Today, on a very light volume day, several billion in dark pool at $402. Gap fill to $411 would be nice.

severestorm

Member

Yikes!

severestorm

Member

$88 billion in customer deposits have left Credit Suisse this quarter.

Amzn calls working…trimmed a few.SPY looks really good...if it can get into the gap then gap fill to $411.

I added some $AMZN $95 calls for next week on the morning dip that are up nicely. Plan on holding these for next week in case it wants to wake up.

View attachment 124112

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Now is the time for the DOE to complete the greatest energy trade maybe ever in size. Start buying to refill the SPR at $73 when they sold a good bit closer to $100.

Dark pools at $402 must been resistance. ?SPY $394 dark pool activity last week indicated that was good support. Today, on a very light volume day, several billion in dark pool at $402. Gap fill to $411 would be nice.

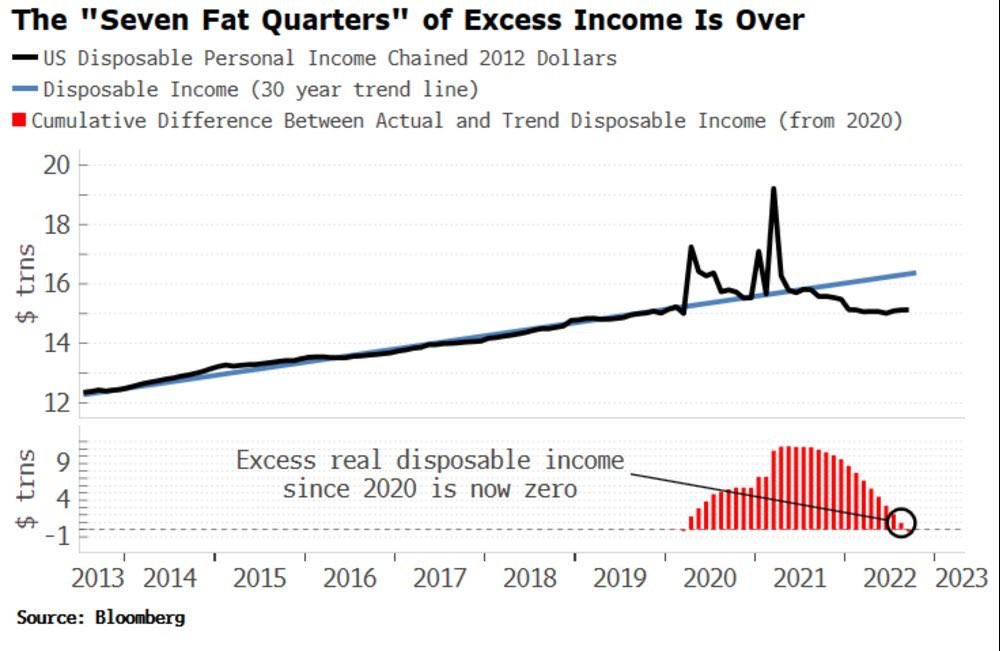

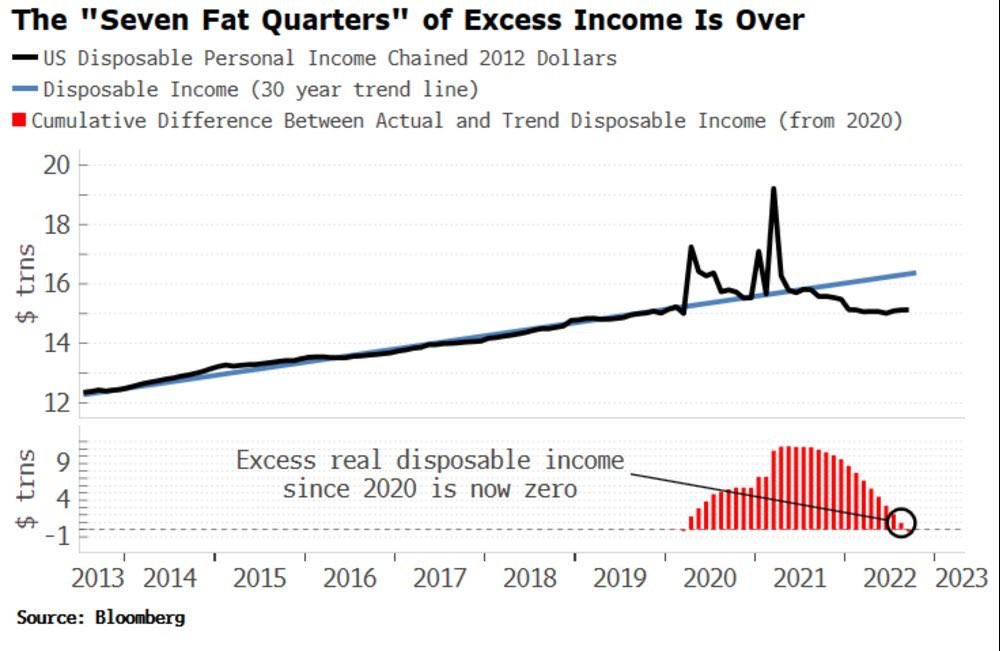

Can you please forward this to the Fed? They seem to not understand what they are doing.Should end wellView attachment 124263