StormWatch

Member

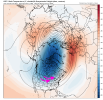

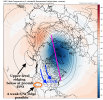

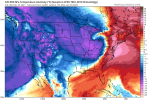

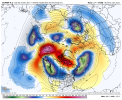

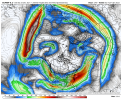

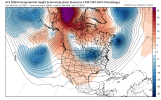

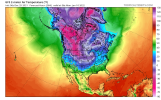

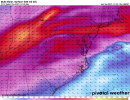

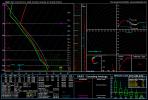

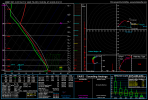

The cold pattern is there, what's holding the cold back from the southeast is the southeastern/eastern ridge. It's just not features in the Pacfic, the upper PV would help out as well with a colder pattern across the southeast.Do think we are finally making some progress towards colder pattern … seems be some shake up in pacific models today