severestorm

Member

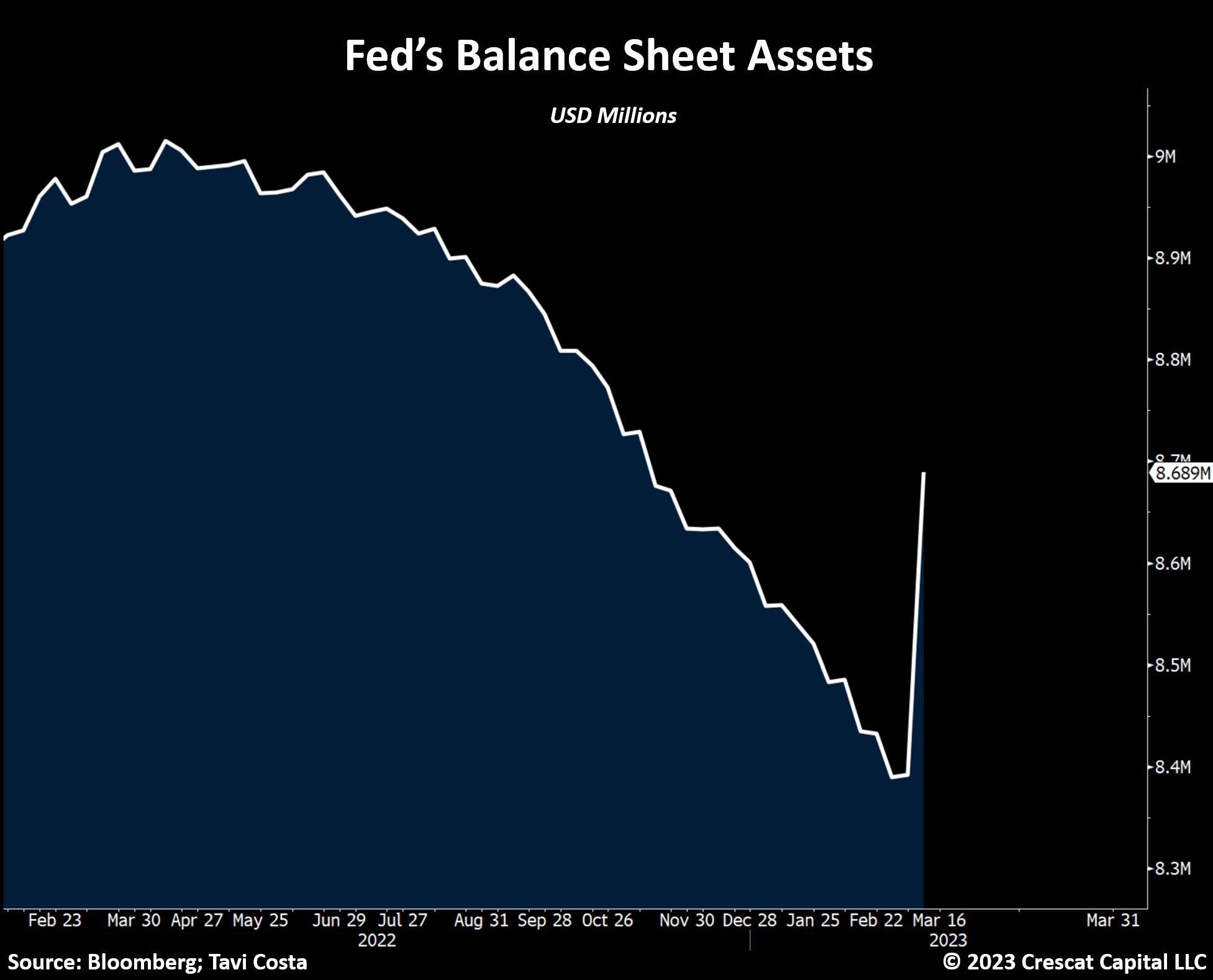

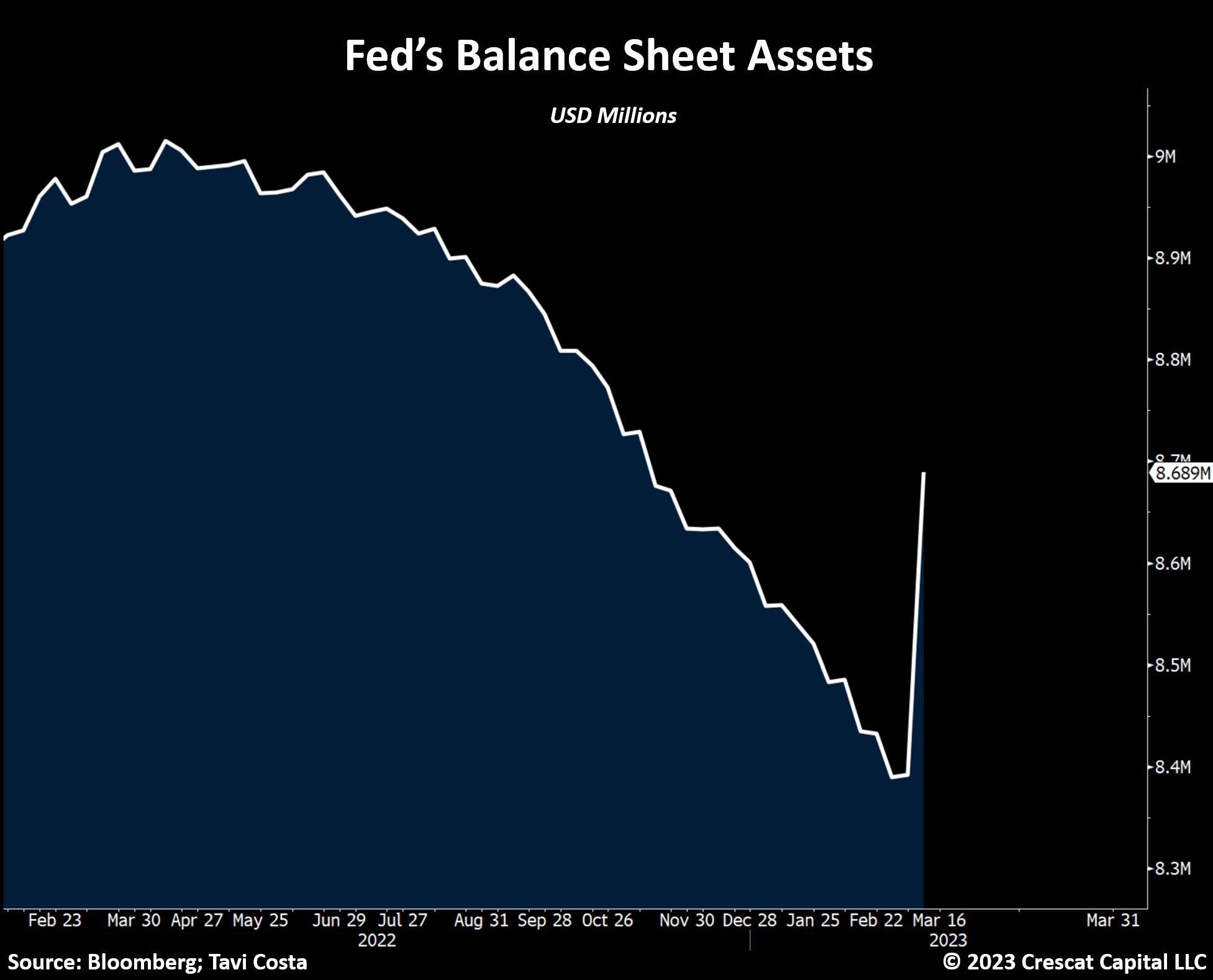

QT is over. Inflation's here to stay.Fed ATM open up for all...

FED: WE STAND READY TO PROVIDE LIQUIDITY TO ELIGIBILE INSTITUTIONS.

QT is over. Inflation's here to stay.Fed ATM open up for all...

FED: WE STAND READY TO PROVIDE LIQUIDITY TO ELIGIBILE INSTITUTIONS.

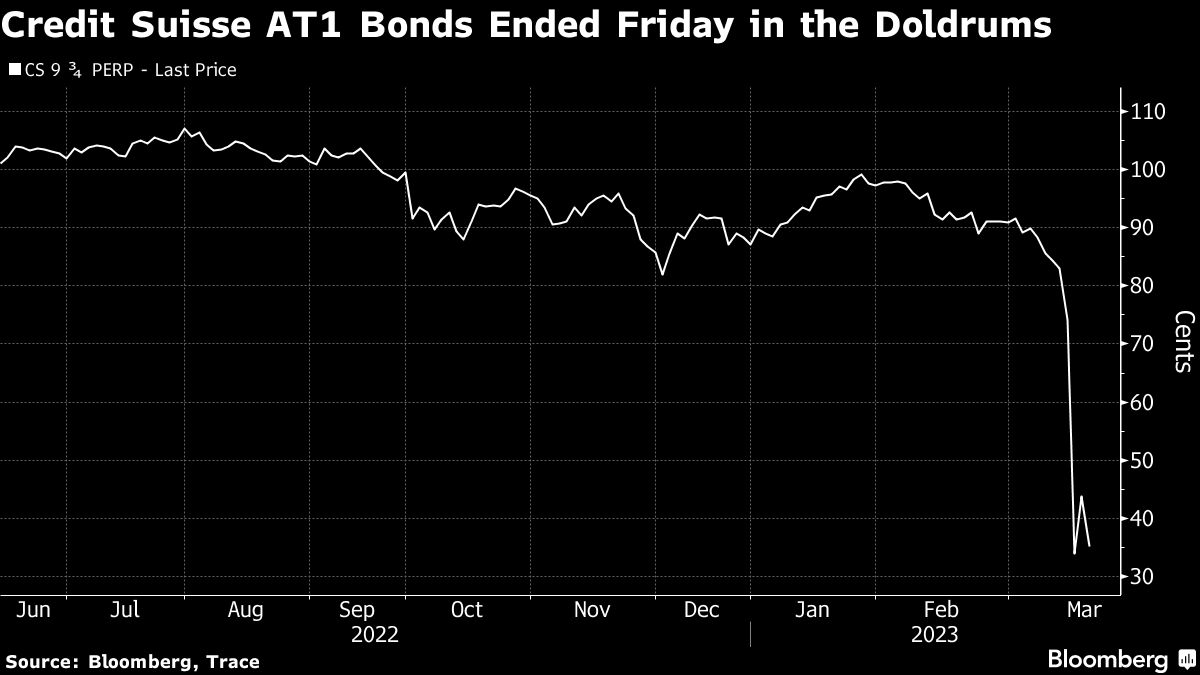

Maybe. I still think the worst is ahead.And there are the big banks bailing out the regional guys. Crisis obverted.

Just buy calls and have a nice trip! ?Ok guys and gals the Fed is printing again and tech is responding. It is hooked on Fed liquidity. So I’d appreciate it if y’all can hold this together tomorrow and next week as I take the Fam to St. John for 9 days. Tia

Midsize banks are reportedly requesting the FDIC to insure all deposits for two years per Bloomberg

This could have something to do with it...

It's going to turn soon.S&P futs with a nice breakout...ema's tightened up.

With some banks literally failing and we have our markets ripping. Go figure...

View attachment 134461

When you figure it out please tell me. I will blindly follow you to glory.SPY rejected hard into that trendling resistance...I have no clue what market is going to do. Just sitting and watching...

View attachment 134474

Would think $380 coming…I got out of the way at lunch and no fomo short or long

Ugly daily.

View attachment 134478