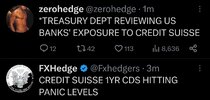

Credit Suisse getting pummeled this morning..

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

She goneCredit Suisse getting pummeled this morning..

It's almost as if they are throwing darts blindfolded and hoping to hit the economic bullseye, in other words, it appears they really don't know what they are doing. Rapid hikes followed by rapid cuts, I don't recall this and doesn't seem prudent but I'm know economist eitherNot sure 100 is enough

Fed swaps are now pricing in 100 basis points of rate CUTS by December

It's almost as if they are throwing darts blindfolded and hoping to hit the economic bullseye, in other words, it appears they really don't know what they are doing. Rapid hikes followed by rapid cuts, I don't recall this and doesn't seem prudent but I'm know economist either

They made the same mistake in 2005-2006...they rapid hiked and the sub prime mortgages imploded. Rapid hiked again and banks were stupid and to exposed to bonds plummeting. They should have started gradual hikes in 2012 to get off of 0% rates.

They either are just stupid or know exactly what they're doing. I tend to think it's the latter, since many regular people have been predicting the outcome of this.It's almost as if they are throwing darts blindfolded and hoping to hit the economic bullseye, in other words, it appears they really don't know what they are doing. Rapid hikes followed by rapid cuts, I don't recall this and doesn't seem prudent but I'm know economist either

Not gonna happenHold on to your butts View attachment 134332

Green finish

CS bouncing back.

Pulled 20% off a $500 call bet. Held for 2-3 minutes

Just wanted to see if I still had it.

Jimmy style

Just wanted to see if I still had it.

Jimmy style

severestorm

Member

On point analysis

You're welcome!Green finish

Rescue operation underway as expected.Tech green...so strong. A close over that trendline the next few days would get things rocking. FOMC next Wednesday.

View attachment 134341

severestorm

Member

more things breaking...

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

SNB bailing out CS

Yep. That's why I don't worry too much when they hype up all these bank failures. Anything that is material to the broader economy is just going to get bailed out, 100% of the time.SNB bailing out CS

Everybody is looking for ripple effects and contagion and dominoes. It all ends with bailouts. That's the formula to fix anything that breaks. And when you think it can't possibly work anymore, it still does. And it always will until they change the rules or change the game and implement the next fix that nobody saw coming.

VegasEagle

Member

severestorm

Member

Building permits spiked to highest since September of last year.

drfranklin

Member

- Joined

- Dec 1, 2016

- Messages

- 507

- Reaction score

- 749

ECB raises rates another 50 basis points

severestorm

Member

severestorm

Member

FRC ripping...all is forgiven is what I am seeing. Can't believe we let these guys do a terrible job at running a bank...cash out millions in stock knowing it's about to crumble and than our govt comes in and rescues them. I should have gone into banking...make a ton of money for doing a terrible job.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

And there are the big banks bailing out the regional guys. Crisis obverted.

Like meteorologist? Lol j/kFRC ripping...all is forgiven is what I am seeing. Can't believe we let these guys do a terrible job at running a bank...cash out millions in stock knowing it's about to crumble and than our govt comes in and rescues them. I should have gone into banking...make a ton of money for doing a terrible job.

View attachment 134357

I can't find another setup like this on the Q's over the past 20 years...3 consecutive weeks of a higher high and lower low on the weekly candles. Incredibly difficult...last week at this time we thought we were heading for multiple bank failures with market heading much lower, shorts piled in...now it looks like Q's is going to march to ATH's by end of 2023.

Very difficult market...next week at this time it could be anywhere.

Very difficult market...next week at this time it could be anywhere.