severestorm

Member

Nothing to see here, move along, all is fine......... /s

Nothing to see here, move along, all is fine......... /s

have bought several used cars in the past 2-3 years - there seems to be no inventory for desirable, relatively inexpensive used cars (esp anything hybrid) still in 2023 - for example, an equivalent 2014 toyota camry hybrid sedan (own 3 of these) purchased 3 years ago now costs on average $4K more three years laterLooks like inflation's picking up speed again...

RIP KenyaKenya's President is telling his citizens to get rid of their Dollar's in anticipation for a new system in a few weeks.

Serious question, what is the replacement currency?Kenya's President is telling his citizens to get rid of their Dollar's in anticipation for a new system in a few weeks.

BRICS announced a shifting from Dollar to Chinese Yuan in Asia, Africa, and Latin America. It looks like they are following Egypt in moving away from the Dollar recently.Serious question, what is the replacement currency?

The ironic thing you pick overseas deployed is just how much Americas enemies hate us and what their true intentions are for attacking us. One of if not the main reason is their desire to devalue the dollar. The Chinese and Russians are forging ahead with that goal as we speakBRICS announced a shifting from Dollar to Chinese Yuan in Asia, Africa, and Latin America. It looks like they are following Egypt in moving away from the Dollar recently.

Lets see how that works out for them bc Russia tried it and can't get their money out of China unless they buy goods from China.BRICS announced a shifting from Dollar to Chinese Yuan in Asia, Africa, and Latin America. It looks like they are following Egypt in moving away from the Dollar recently.

They could go through the New Development Bank created by BRICS in 2014. I know Russia and China are making a SWIFT alternative. Maybe it's in it's final stages of development? Kenya was invited to BRICS summit recently too. Maybe they will apply to join when the application process opens back up.Lets see how that works out for them bc Russia tried it and can't get their money out of China unless they buy goods from China.

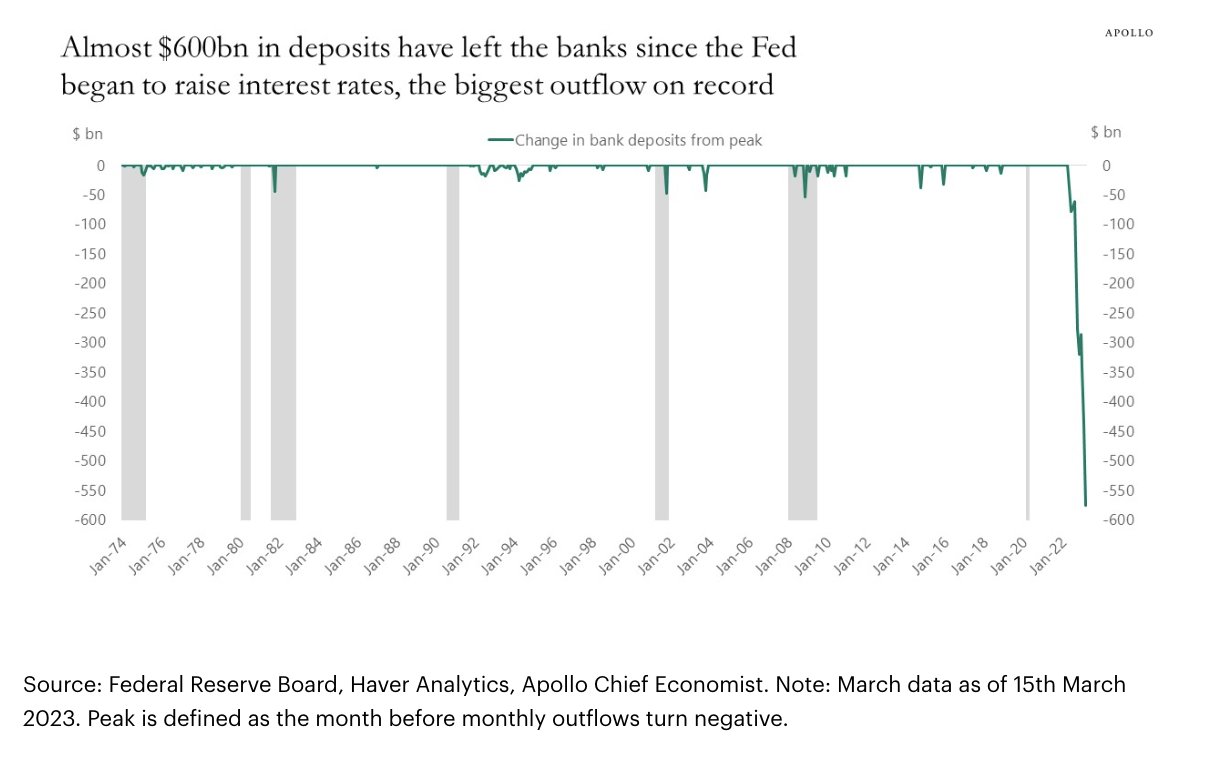

What street?Word on the street is Schwabb might be next bank to belly up.

that would be catastrophic...8th largest bank by assets in the US...$7.38T in client assetsWord on the street is Schwabb might be next bank to belly up.

Vast majority of those assets are investable assets which would not be impacted unless Schwab co mingles the funds (ALA John Corzine). Also that would involve SIPC and FDIC. But I bet a Morgan Stanley or Goldman would love to buy them on the cheap.that would be catastrophic...8th largest bank by assets in the US...$7.38T in client assets

You know, that one street next to that other street.What street?

Main Street News lol.What street?

www.paulcraigroberts.org

www.paulcraigroberts.org

AKA we haven't ------ the people of the US enough so lets pull out all the guns we have.FED’S COLLINS: FED WILL HAVE TO RAISE RATES AGAIN TO HELP LOWER TOO HIGH INFLATION

yup, sounds about right....AKA we haven't ------ the people of the US enough so lets pull out all the guns we have.