-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Added some $ADBE at $295...couldn't help myself. 1/3 normal position, $275-$280 could still come so will add down there too.

ADBE low was $292. I started the position at $295...it's earnings were solid, guidance was light, these SAAS names are tough to value though. I think it's best of breed and when the market turns, if it turns, the best of breeds usually outperform.

I would think it retests $292 at some point.

Storm5

Member

That weekly spy candle

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

IMO .75 or 1.00 is irrelevant. It's all about how hawkish Powell is . No clue how he could be dovish at this point but I guess we will see .

Back in with SPX 3800 puts for next Friday . They printed like crazy this week made just under 2k holding them 2 days

Sent from my iPhone using Tapatalk

Back in with SPX 3800 puts for next Friday . They printed like crazy this week made just under 2k holding them 2 days

Sent from my iPhone using Tapatalk

severestorm

Member

severestorm

Member

Companies declared insolvent in England and Wales jumped by 42% in August compared to last year, according to government data — Guardian

severestorm

Member

severestorm

Member

Storm5

Member

The volume gap below on AMD  . Hawkish fed this week im swinging 60 puts

. Hawkish fed this week im swinging 60 puts

Sent from my iPhone using Tapatalk

. Hawkish fed this week im swinging 60 puts

. Hawkish fed this week im swinging 60 puts Sent from my iPhone using Tapatalk

severestorm

Member

severestorm

Member

Storm5

Member

Wow China is gimping and crypto just fell off a cliff . What a sell off

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

How much farther off the cliff we gonna fall this week?

Dixie doing work too. Currently at just over 110. Also, I'm enjoying the reprieve in oil prices in the low 80s. It won't last, but it's nice for now.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

CR let's go Dow O/U +97. be long or be wrong. Turn around Monday

Over!!CR let's go Dow O/U +97. be long or be wrong. Turn around Monday

Storm5

Member

Apple mooning propping up the market . The flush this week is gonna be amazing

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

VIX keeps rejecting 27....that's 2 weeks straight. I imagine Fed is going to hike .75% tomorrow as expected and signal more hikes coming. The question will there be any hints that target rate is 4%...3.5% or 5%...that's they key.

View attachment 121572

Wednesday

Sent from my iPhone using Tapatalk

Pamp ?

Storm5

Member

SPY tapped into the 388-390 supply . Loaded heavy puts ( Friday expiration ) before the bell in SPY and Tesla

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

I don’t know if we are going to be at $410 or $370 on Friday. Lower makes sense with all the bad macro news. ?SPY tapped into the 388-390 supply . Loaded heavy puts ( Friday expiration ) before the bell in SPY and Tesla

Sent from my iPhone using Tapatalk

severestorm

Member

I'm stunned the DOW was positive today. And looks like Layoffs are dramatically less than last month. Are people waiting or scheduling them for next year?

Nomanslandva

Member

Yep, I could see either based solely on the tone of the fed.I don’t know if we are going to be at $410 or $370 on Friday. Lower makes sense with all the bad macro news. ?

severestorm

Member

severestorm

Member

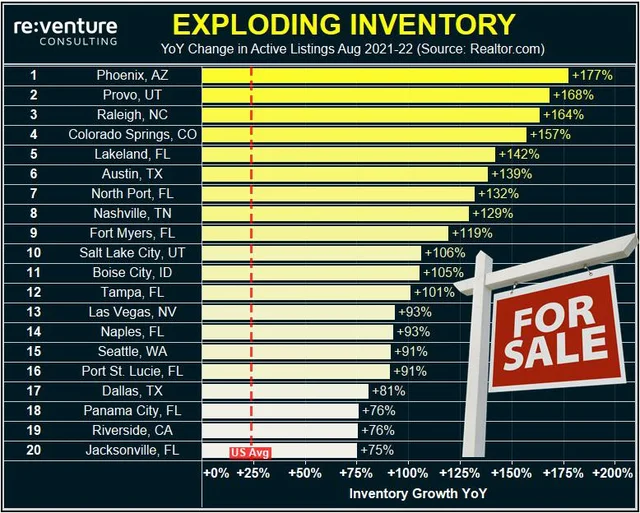

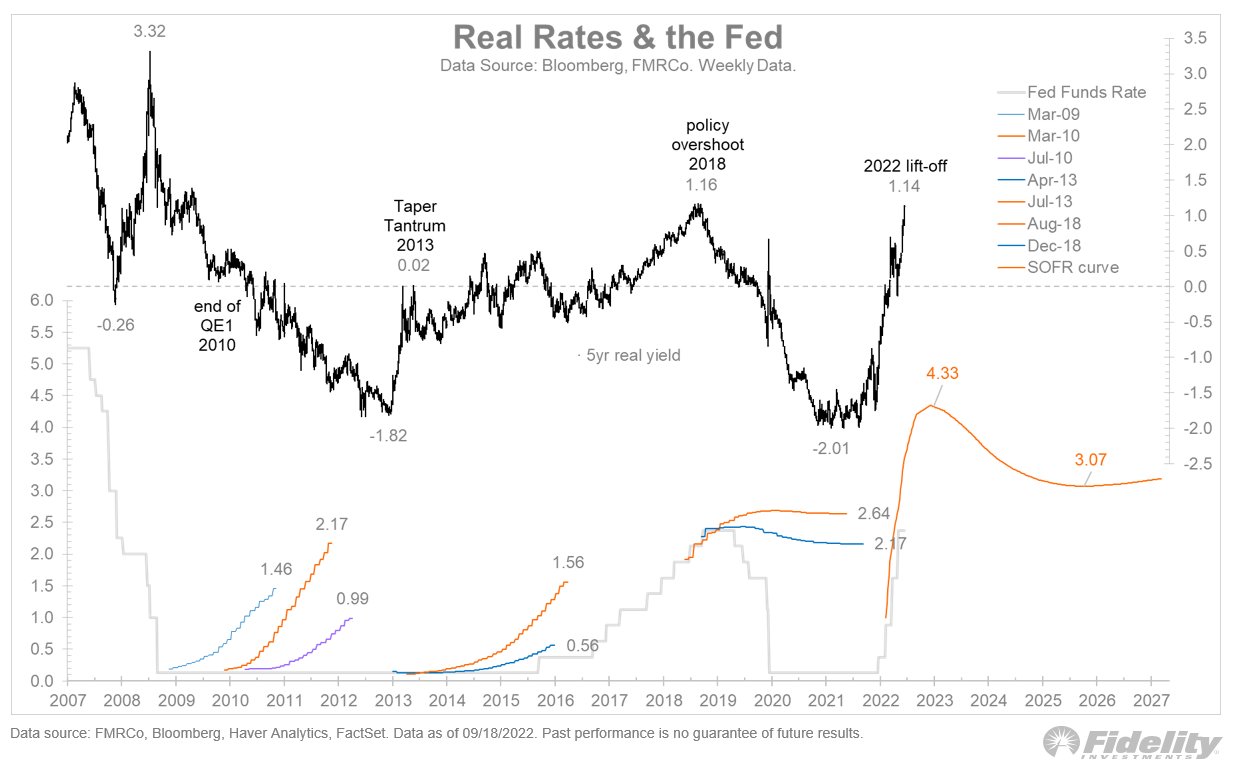

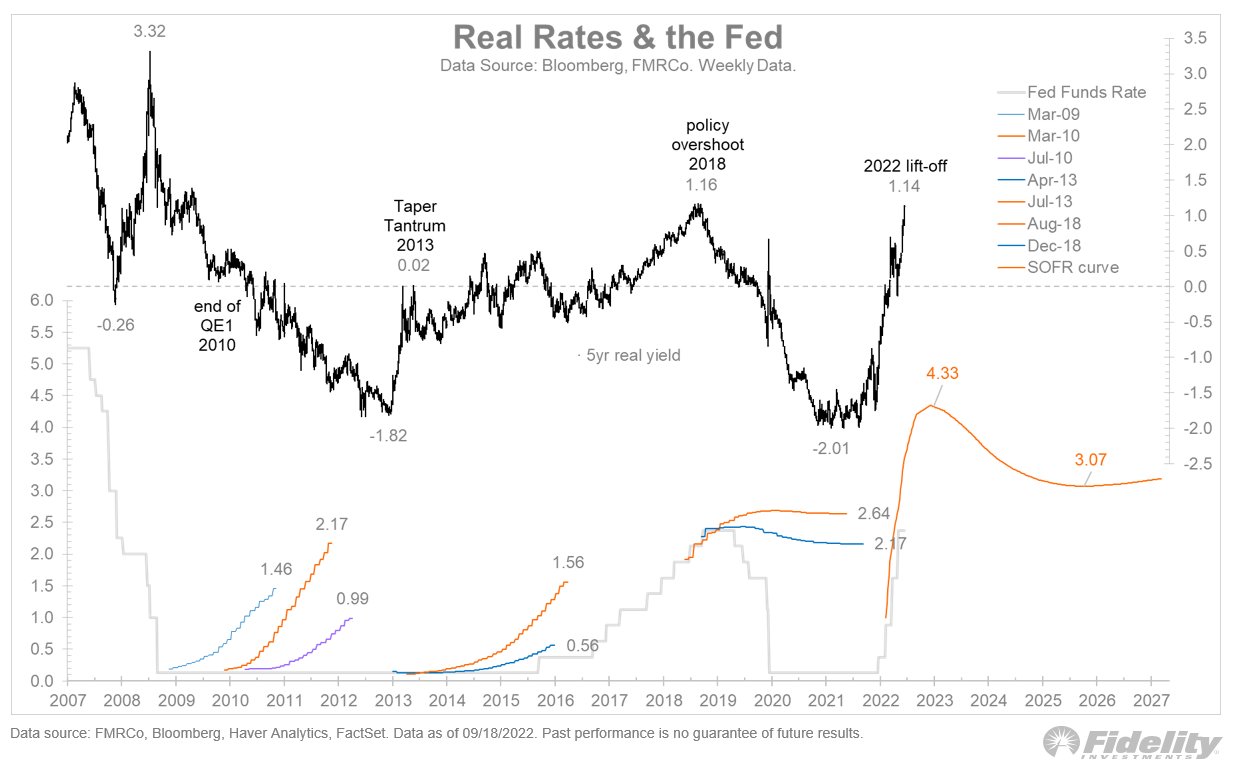

The rate of increase is stunning

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

CR bigly win yesterday. Let's go Dow O/U +124. Be long or be wrong heading into the Fed

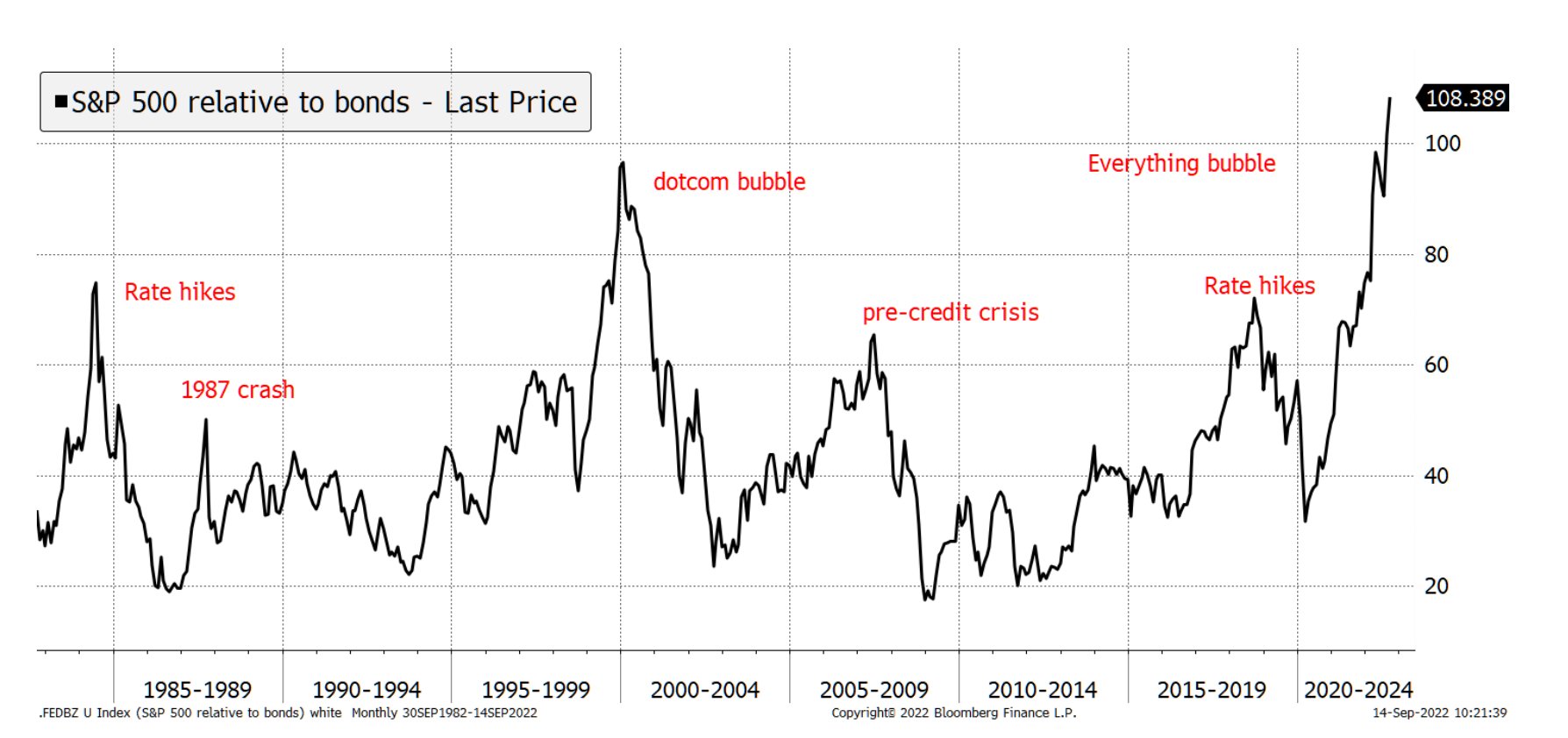

Deja vu....Fed hiking rates quickly, banks complaining about capital requirements. It's never good when the CEO of a big financial institution complains about being required to have strong capital.

Under today. Expecting choppy conditions with a mildly positive finish.CR bigly win yesterday. Let's go Dow O/U +124. Be long or be wrong heading into the Fed

Storm5

Member

Market dumping and apple isn't . What Bs I hope Powell slaughters the market tomorrow

My Tesla puts are ripping this am

Sent from my iPhone using Tapatalk

My Tesla puts are ripping this am

Sent from my iPhone using Tapatalk