Fake breakPYPL with an impressive chart. Held the 50dema and now a nice trendline breakout.

View attachment 121309

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

Powell has no pivot in him. The problem this time vs history is the fed waited 13 months too long to address inflation and now they are having to play catchup. They are taking liquidity out of the economy into an economic slowdown. History says that is not a good thing.

severestorm

Member

I think Powell doesn't want to repeat of the 1980's again when they did Pivot and inflation went back up and beyond. I think in the end, Volcker raised interest rates by 20%.Powell has no pivot in him. The problem this time vs history is the fed waited 13 months too long to address inflation and now they are having to play catchup. They are taking liquidity out of the economy into an economic slowdown. History says that is not a good thing.

Powell will pivot after Sept at latest Nov. They will hike .75 in a couple of weeks to get rate to 3-3.25% which will be a 15 year high. They aren’t going to hike to 5%, our economy would crumble. Cuts will come mid next year but they should really keep rate in the 2.5-3% range.I think Powell doesn't want to repeat of the 1980's again when they did Pivot and inflation went back up and beyond. I think in the end, Volcker raised interest rates by 20%.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

The European close has been rough on the US the last 2 weeks

Storm5

Member

Jesus spy was almost at 401 and Down to 396 in ten minutes . Elevator down doesn't do justice

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Now bouncing back up…biglyJesus spy was almost at 401 and Down to 396 in ten minutes . Elevator down doesn't do justice

Sent from my iPhone using Tapatalk

Wants the 401 touch

severestorm

Member

They have to crush demand so fewer dollars chase goods. Powell said this morning they wont stop until the job's done to neutral which is 2-3%. Irving Fisher's equation states interest rates must be above inflation. Volcker understood this and the market's hated him for it, he was not well liked. In the end, he did get inflation down with 20% rates. Brazil with a inflation rate of 10%, has a interest rate of close to 13%, this is dropping their inflation down as less dollars are chasing goods. The US should have interest rate's above 9% now. Powell knows this and won't stop hiking until rates are back to neutral. The FED has made statements that they learned from the 80's to not pause, because as you see below, inflation increased again. I took my money and exited completely out of the market 11 months ago.Powell will pivot after Sept at latest Nov. They will hike .75 in a couple of weeks to get rate to 3-3.25% which will be a 15 year high. They aren’t going to hike to 5%, our economy would crumble. Cuts will come mid next year but they should really keep rate in the 2.5-3% range.

The Fed must do two things to re-establish credibility, Allianz's El-Erian says

The U.S. Federal Reserve needs to do two more things to re-establish its credibility, according to Mohamed El-Erian, chief economic adviser to Allianz.

They have to crush demand so fewer dollars chase goods. Powell said this morning they wont stop until the job's done to neutral which is 2-3%. Irving Fisher's equation states interest rates must be above inflation. Volcker understood this and the market's hated him for it, he was not well liked. In the end, he did get inflation down with 20% rates. Brazil with a inflation rate of 10%, has a interest rate of close to 13%, this is dropping their inflation down as less dollars are chasing goods. The US should have interest rate's above 9% now. Powell knows this and won't stop hiking until rates are back to neutral. The FED has made statements that they learned from the 80's to not pause, because as you see below, inflation increased again. I took my money and exited completely out of the market 11 months ago.

The Fed must do two things to re-establish credibility, Allianz's El-Erian says

The U.S. Federal Reserve needs to do two more things to re-establish its credibility, according to Mohamed El-Erian, chief economic adviser to Allianz.www.cnbc.com

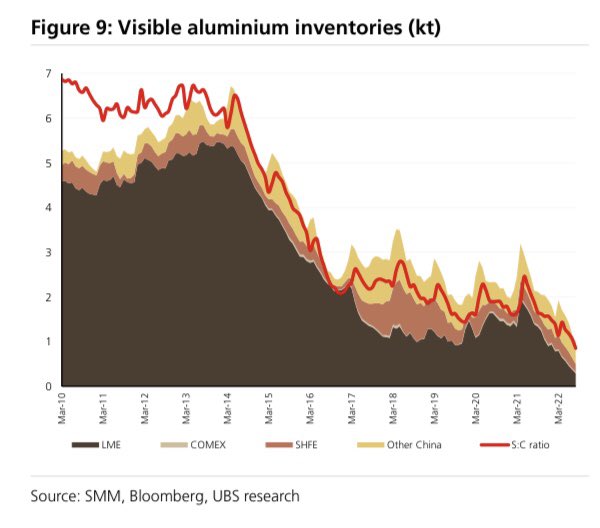

View attachment 121314

View attachment 121313

Multiple Fed govs and Powell has said multiple times he would rather deal with high prices and strong employment rather than high unemployment.

They are going to hike .75 in a couple of weeks to get the Fed Funds rate to a 15 year high...3-3.25. I think they stop there or maybe they do another .5% in Nov and then that's it. They are not hiking rates over 4%.

Edit: I am not betting on a 50% crash in the markets...unless unemployment starts ramping. That's a big if and it could but until I see that I am not betting a 50% crash.

severestorm

Member

FED already expects unemployment to increase to 5%. There's 11 million open positions now, that's not sustainable. The FED fund's rate was 5% when the inflation kicked in before 1980's, Volcker increased it by 15%. By that logic, we could see interest rates be 15%. Nowhere did Powell say he was pivoting and he even questioned why the markets are thinking that. You make financial decisions you thinks best for yourself. I'm just a observer at this point since I got out ahead of the crash as did the FED officials.Multiple Fed govs and Powell has said multiple times he would rather deal with high prices and strong employment rather than high unemployment.

They are going to hike .75 in a couple of weeks to get the Fed Funds rate to a 15 year high...3-3.25. I think they stop there or maybe they do another .5% in Nov and then that's it. They are not hiking rates over 4%.

Edit: I am not betting on a 50% crash in the markets...unless unemployment starts ramping. That's a big if and it could but until I see that I am not betting a 50% crash.

View attachment 121319

Storm5

Member

Euro futures selling . Wonder if Europe sells off tomorrow so to queens death

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Here we go...White House and always commented on the previous CPI reports on them being very elevated. Now we getting the opposite...if CPI comes in light next Tuesday it's going to be chaos.

D

Deleted member 609

Guest

Here we go...White House and always commented on the previous CPI reports on them being very elevated. Now we getting the opposite...if CPI comes in light next Tuesday it's going to be chaos.

Calls for next week?

If CPI comes in really light but it’s so tricky as Fed meeting is following week. They have been so hawkish. I am biased bull so I think we rally higher closer to mid terms.Calls for next week?

GeorgiaGirl

Member

Take:

If 75 bps is not paired with upped dot plots for 2023 (I think most of the plots may have been around 4% in June as it is), I’m dubious going that way is going to send the message that it seems like the Fed wants to send by going that way, even though the data isn’t really supporting doing 75 again.

It honestly sounds like it won’t be if you listen to Mester to boot as well. If it’s not, I’d say it’s slightly better than 50/50 the Fed winds up with a June repeat here with another top in tightness in financial conditions around the September meeting.

If 75 bps is not paired with upped dot plots for 2023 (I think most of the plots may have been around 4% in June as it is), I’m dubious going that way is going to send the message that it seems like the Fed wants to send by going that way, even though the data isn’t really supporting doing 75 again.

It honestly sounds like it won’t be if you listen to Mester to boot as well. If it’s not, I’d say it’s slightly better than 50/50 the Fed winds up with a June repeat here with another top in tightness in financial conditions around the September meeting.

Yep, monster bounce off of support. When bitcoin is weak, that usually translates over.BTC is the easiest way to see if risk is back on...and for today, it is. That's a big candle.

View attachment 121326

severestorm

Member

Belgium PM: the energy crisis may bring EU the economy to a full stop.

Storm5

Member

Buying two week out puts today on spy for the gap fill .

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

I wonder when they will begin to realize that people are not falling for this extreme rhetoric like they used to?Belgium PM: the energy crisis may bring EU the economy to a full stop.

If Apple gets through $156.6 it's going to be nuts this afternoon. I took some Apple at $155...past 3 days has been a good a stretch as any this year.

I got lucky yesterday, I didn't move my stops up from the morning so when the big sell off happened mid day I didn't get stopped out. In fact I hit several bids on holdings. Good thing I was lazy yesterday.

I got lucky yesterday, I didn't move my stops up from the morning so when the big sell off happened mid day I didn't get stopped out. In fact I hit several bids on holdings. Good thing I was lazy yesterday.

This guy is a perma bear but this is funny. ?

Indexes sliced through two major resistances this morning like butter. No backtest or anything ?

Indexes sliced through two major resistances this morning like butter. No backtest or anything ?

The market is clearly front running the CPI print on Tuesday. Yellen comments yesterday that it could come in light was all the market needed.

I trimmed a lot of longs today...50% of all my swings. And if things go crazy againi today I will trim 1/2 of what I have left.

severestorm

Member

US household net worth falls over $6 trillion in Q2.

severestorm

Member

Storm5

Member

Gonna add AMD this week for the first time lol.

SPY -I still think we drop below 390 before the elections . Pump into the elections then a huge dump post

Sent from my iPhone using Tapatalk

SPY -I still think we drop below 390 before the elections . Pump into the elections then a huge dump post

Sent from my iPhone using Tapatalk

I sold half into 85.40 but will be adding back this week on any dip. It’s also my biggest stock holding in my long term IRA.Gonna add AMD this week for the first time lol.

SPY -I still think we drop below 390 before the elections . Pump into the elections then a huge dump post

Sent from my iPhone using Tapatalk

That’s assuming CPI comes in light as expected.

Rail strike sept 16. Cooling off period ends. Anyone got an inside scoop, besides msm media reposting sane story?

severestorm

Member

Storm5

Member

AMD

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

From what I understand the big sticking point is the current Union people are trying to protect future hires. The rail companies at this time have said no just no but heck no. It will take an act of congress to stop a strike from happening.Rail strike sept 16. Cooling off period ends. Anyone got an inside scoop, besides msm media reposting sane story?

Also you have a future strike at the ports in California bc the long shoremen don't want to automate and the ports need to.

You are seeing the swing from capital to labor, which we have not seen since 1982

drfranklin

Member

- Joined

- Dec 1, 2016

- Messages

- 507

- Reaction score

- 749

...wait for August CPI report tomorrow and ETH merge in 2+ days...I do like US Debt approaching $31T for BTC LOL......BTC seen bottom? Descending triangles aren't typically bullish but if it breaks up and out of the trendline then pattern broken...