severestorm

Member

It’s going back down to 115 imho

NVDA was asked to not sell to China or Russia, that's the reason for the plunge.This market doesn't respect valuation...if it did NVDA would be sub $100 quickly.

Well and they had a huge earnings miss and guided down to negative double digit growth for this quarter. It's trading at big premium.NVDA was asked to not sell to China or Russia, that's the reason for the plunge.

China makes up 25% of their Revenue I believe.NVDA was asked to not sell to China or Russia, that's the reason for the plunge.

Almost bottom ticked it.Market getting brutalized

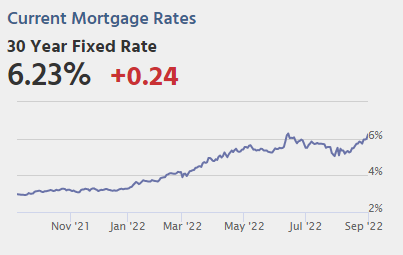

For someone who doesn’t read about this that much, what does this lead to?weekly chart on the 10yr looking for the highest close since 2011

we in big...big trouble

View attachment 121156

For someone who doesn’t read about this that much, what does this lead to?

I have a hard time with these SAAS companies as they all lose money but OKTA is still high rev growth and this seems over done compared to the rest of them.

View attachment 121159

Locked in about $200 profit in 30 minutes. Now if I could do that every 30 minutes for the rest of my life I’d be sitting in high cottonTook some Q’s this afternoon. Make it hurt

Q's - $298.60 is my pivot to abandon ship. Not surprising first hour of the day is lot of profit taking from yesterday's dip buyers. Now see if it push back up, if so, shorts will start covering.

Trimmed a lot of $OKTA into $64's.

View attachment 121190