-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Bought uvxy $14 puts for next Friday. 0.17 a contract

Storm5

Member

We pumping tomorrow or what ? Thinking about longing the qqqs before the bell

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

You have $17 dollars left?Bought uvxy $14 puts for next Friday. 0.17 a contract

Storm5

Member

You have $17 dollars left?

Had ........

Sent from my iPhone using Tapatalk

The perks of being a panic seller. Your account slowly dwindles as you panic sell every stock you’ve ever owned, but at least you have money to keep playing ? I’m leveraged up to my neck right now. Pray for meYou have $17 dollars left?

D

Deleted member 609

Guest

Feel like going all in on puts here. Seems like free money.

Calls it is. Unloaded into SPXL today. Got my average into the 76’s. No way SPY loses this weekly candle. The Fed will reverse their policies to keep that from happening. Market is throwing a tantrum. I buyFeel like going all in on puts here. Seems like free money.

D

Deleted member 609

Guest

Big pp moveCalls it is. Unloaded into SPXL today. Got my average into the 76’s. No way SPY loses this weekly candle. The Fed will reverse their policies to keep that from happening. Market is throwing a tantrum. I buy

drfranklin

Member

- Joined

- Dec 1, 2016

- Messages

- 507

- Reaction score

- 749

BTC approaching 29K

watch USDT

will miners start to sell as price of BTC moves toward cost of production

watch USDT

will miners start to sell as price of BTC moves toward cost of production

Y’all dare me to buy LUNA? Down 95%. So if I buy here and it goes to -100% I’ll only lose 5% right? Did I do that math correct?..

AAPL is no longer the world’s most valuable company. Saudi Aramco surpasses it in market cap.

Let me just tell you these Friday QQQ 310 calls are not printing ?

What’s everyone’s opinion on the real estate market? Next to go?

For my own sake, I hope so. It’s the only way I can get something good out of this cluster——.What’s everyone’s opinion on the real estate market? Next to go?

Bitcoin crashing right now..

Just bought 200 WLUNA on coinbase. Riding it to $18 or $0 whichever comes first

Might join you, new penny stockJust bought 200 WLUNA on coinbase. Riding it to $18 or $0 whichever comes first

Cad Wedge NC

Member

Yeah, I believe it is a good play. Be ready to jump out if it spikes tomorrow. Think I will drop $1K on it and watch it closely tomorrow.Might join you, new penny stock

Only down 50% on my WLUNA entry from a few hours ago?

D

Deleted member 609

Guest

At least if we keep dropping 1% everyday the amount we lose is less each time.

I fortunately waited until this morning but I'm sure it won't take long, somehow this thing was 6 bucks yesterdayOnly down 50% on my WLUNA entry from a few hours ago?

D

Deleted member 609

Guest

Think I may grab some Dec spy put spreads. $380/$310 for net cost of about $1.7k. Kind of want to wait for the next bounce up though.

??

??

D

Deleted member 609

Guest

Pretty much sums up 2022.

I sold mine lost like 20 bucks, somethings up WLUNA being so much more than LUNA on Coinbase. Seems odd and I think they may drag it down once people stop buying WLUNAI fortunately waited until this morning but I'm sure it won't take long, somehow this thing was 6 bucks yesterday

drfranklin

Member

- Joined

- Dec 1, 2016

- Messages

- 507

- Reaction score

- 749

Tether/USDT as low as 0.98 this morning - watch Tether

LUNA is done for now - algorithmic stable coins are also over - incredibly brilliant team - perhaps a Phoenix will emerge (not for me at this time)

high-risk/"risk on"/speculative assets will be shunned in 2022/23 until inflation is under control

blockchain technology will ultimately transform banking, etc (lots of money to be made) but this will be at the expense of many high-risk, retail investors

LUNA is done for now - algorithmic stable coins are also over - incredibly brilliant team - perhaps a Phoenix will emerge (not for me at this time)

high-risk/"risk on"/speculative assets will be shunned in 2022/23 until inflation is under control

blockchain technology will ultimately transform banking, etc (lots of money to be made) but this will be at the expense of many high-risk, retail investors

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

With liquidity coming out of the market you are seeing who has been swimming naked. What is happening right now (subject to change) is P is coming down (price to earnings) as rates heading higher so you have multiple contraction. Earnings are still growing, but not at the same pace they have been in previous years. Right now credit spreads are pretty well behaved and is not showing a recession is coming. But don't be a hero here as the Fed can't save you as inflation is running at 8.3%, they will actually get more aggressive as inflation hurts everyone, recessions only really hurt the bottom 15% (sorry but true). Also all of this ESG stuff in the words of Obama pastor, the chickens are coming home to roost. The under investment in "dirty" energy for the last 12 years is about to hammer you in your wallet and cause a real problem for the US but a real lives in danger for the rest of the world. Sadly you are about to witness mass starvation in the middle east, Africa, and south Asia like nothing we have ever seen.

Good luck out there and like I said, don't be a hero because you don't have a cape

Good luck out there and like I said, don't be a hero because you don't have a cape

Apparently, they’re “printing” billions of LUNA in order to try to get get UST repegged now, too.

Also, Tether is on the brink of losing its peg. Oh my…

Just walk away and don't look back

I went all cash in long term IRA to end 2021. I had sold Q’s at just under $400 and sold SPY at $458. I started adding back Qs and SPy at $320/$420 respectively and been adding just Qs this week. I probably should wait but feel like I stole something with the move to cash and buying back in 25% less is good enough. I am really unsure on what to do…these both could drop another 20%.

buckinbronco

Member

Yes, you did very well to go cash at the end of 2021. Because of that you are ahead of the game. Your strategy of adding on the downslope is a good one in my opinion. I plan on making weekly purchases in my IRA's; I will continue to contribute to 401k out of every paycheck as well. Gotta buy when blood is in the streets; timing the bottom is an exercise in futility in my opinion.I went all cash in long term IRA to end 2021. I had sold Q’s at just under $400 and sold SPY at $458. I started adding back Qs and SPy at $320/$420 respectively and been adding just Qs this week. I probably should wait but feel like I stole something with the move to cash and buying back in 25% less is good enough. I am really unsure on what to do…these both could drop another 20%.

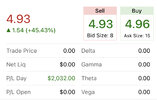

View attachment 118385