severestorm

Member

I thought about tesla, but with rare earth materials doubling or more, Tesla's will have to dramatically increase in price and price out a significant section of the economy. Their earnings and profits are going to go down.

I thought about tesla, but with rare earth materials doubling or more, Tesla's will have to dramatically increase in price and price out a significant section of the economy. Their earnings and profits are going to go down.

Elon keeps raising prices of his cars. And if Biden gets the $7500 tax credit approved that will go straight into Elons pocket…he will just raise prices of cars again.I thought about tesla, but with rare earth materials doubling or more, Tesla's will have to dramatically increase in price and price out a significant section of the economy. Their earnings and profits are going to go down.

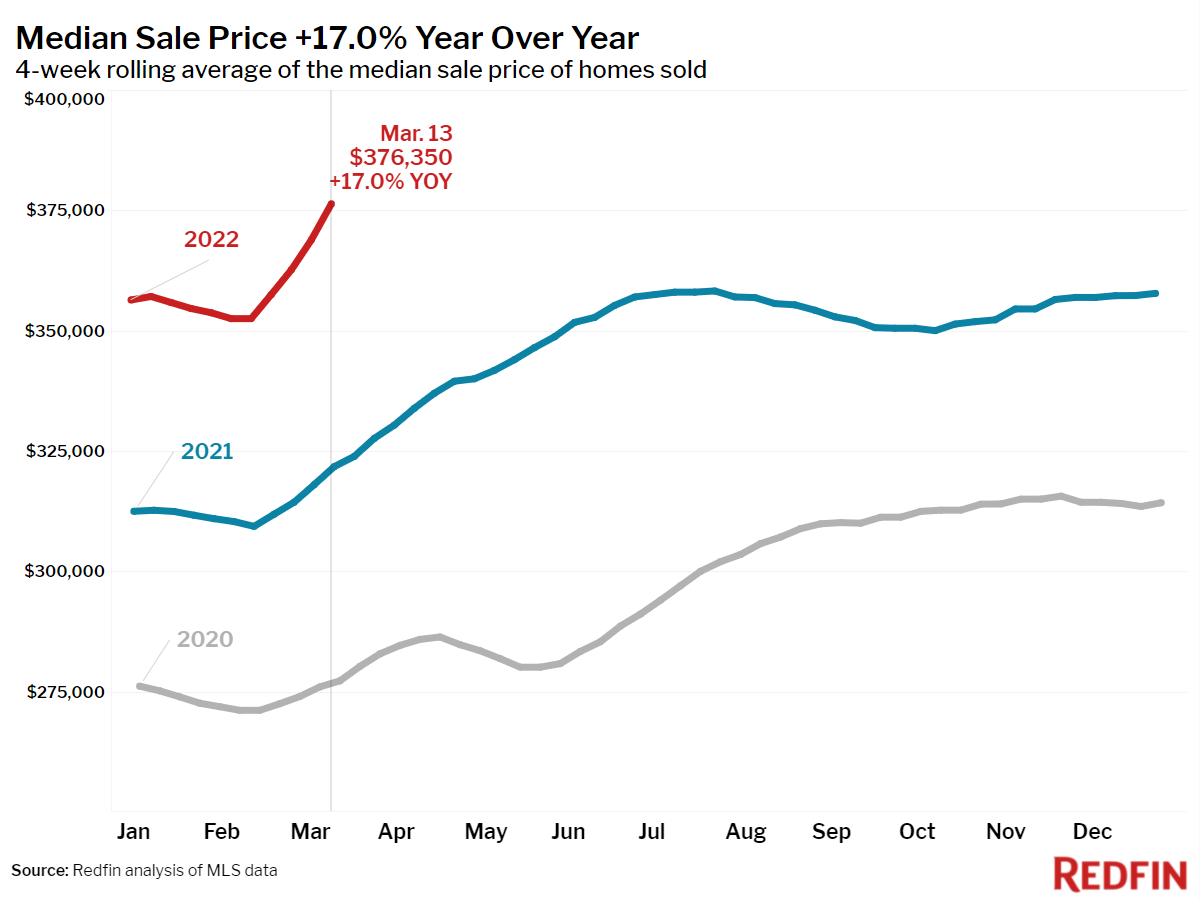

Insane. Freaking Federal Reserve pumping up the value of asset prices and screwing over the younger generation, what else is new. So frustrating…Holy smokes...

And rates are back to 2019 level but house prices are up 30%. How’s that going to work….Insane. Freaking Federal Reserve pumping up the value of asset prices and screwing over the younger generation, what else is new. So frustrating…

Yes this is why they say "time in the market is better than timing the market." Not that I am following that mantra. I have a good bit of dry powder I am looking to deploy as well. Wanted to see a lower correction before entering that money in, but I am starting to doubt myself. I am just curious to see how rate hikes later in the year effect the market. Although the Fed already advised there will be 6 hikes this year so maybe the market already digested and doesn't give a damn? I feel like its going to take a surprise 100 bps hike in one the announcements to do anything, which I don't think is going to happen.Maybe I should’ve just unloaded my April QQQ puts yesterday at close for a loss. Didn’t expect more green today. Hmm.

Also starting to debate my large cash position after the last couple days. The market doesn’t seem to care about interest rates going up as much as I expected.

And rates are back to 2019 level but house prices are up 30%. How’s that going to work….

And rates are back to 2019 level but house prices are up 30%. How’s that going to work….

Yeah, I generally abide by the time in the market mantra (and indeed my 401k has been very much in the market all along), but I was reshuffling some stuff around in my Roth IRA a while back and decided to wait a bit before buying back in while I decide my long-term allocation since it seemed like we might have continued to drop for a while. Probably will burn me in the end, though. ?Yes this is why they say "time in the market is better than timing the market." Not that I am following that mantra. I have a good bit of dry powder I am looking to deploy as well. Wanted to see a lower correction before entering that money in, but I am starting to doubt myself. I am just curious to see how rate hikes later in the year effect the market. Although the Fed already advised there will be 6 hikes this year so maybe the market already digested and doesn't give a damn? I feel like its going to take a surprise 100 bps hike in one the announcements to do anything, which I don't think is going to happen.

Added 5 more of these at $1 earlier. 10 for tomorrow….come on AMD. Lotto FridayAdded the $AMD $112 calls for tomorrow expiration for $1. Just 5....stop below $.70. I suck so bad at these lotto's.

It seems like we should be red, but I thought that today. I’m clearly an idiot as my April put is going further down the drain. Maybe I should just give up and sell it.Quad witching tomorrow . Thoughts ? 4th Green Day in a row or are they gonna rug us ?

Sent from my iPhone using Tapatalk

Same, 401k comes straight of the paycheck and I never look at it again. I've been holding my 2021 AND 2022 IRA contribution money for a bigger downturn, and same as you it will probably bite me. You don't even want to see my play brokerage account, its closer to WSB investing then passive investing lol.Yeah, I generally abide by the time in the market mantra (and indeed my 401k has been very much in the market all along), but I was reshuffling some stuff around in my Roth IRA a while back and decided to wait a bit before buying back in while I decide my long-term allocation since it seemed like we might have continued to drop for a while. Probably will burn me in the end, though. ?

And my brokerage account is something I trade too much, but it’s a small position that I’m not really adding to at this point. I should probably just buy VTI/VXUS and never touch it again if I knew what was good for me, though, LOL.

I’m in one of those situations where like 80% of my net worth is in retirement assets right now, which is nice, but doesn’t help my short term goals like buying a house! I actually scaled back my 401k contributions to the match this month so I can start building up a larger cash position for a future downpayment.

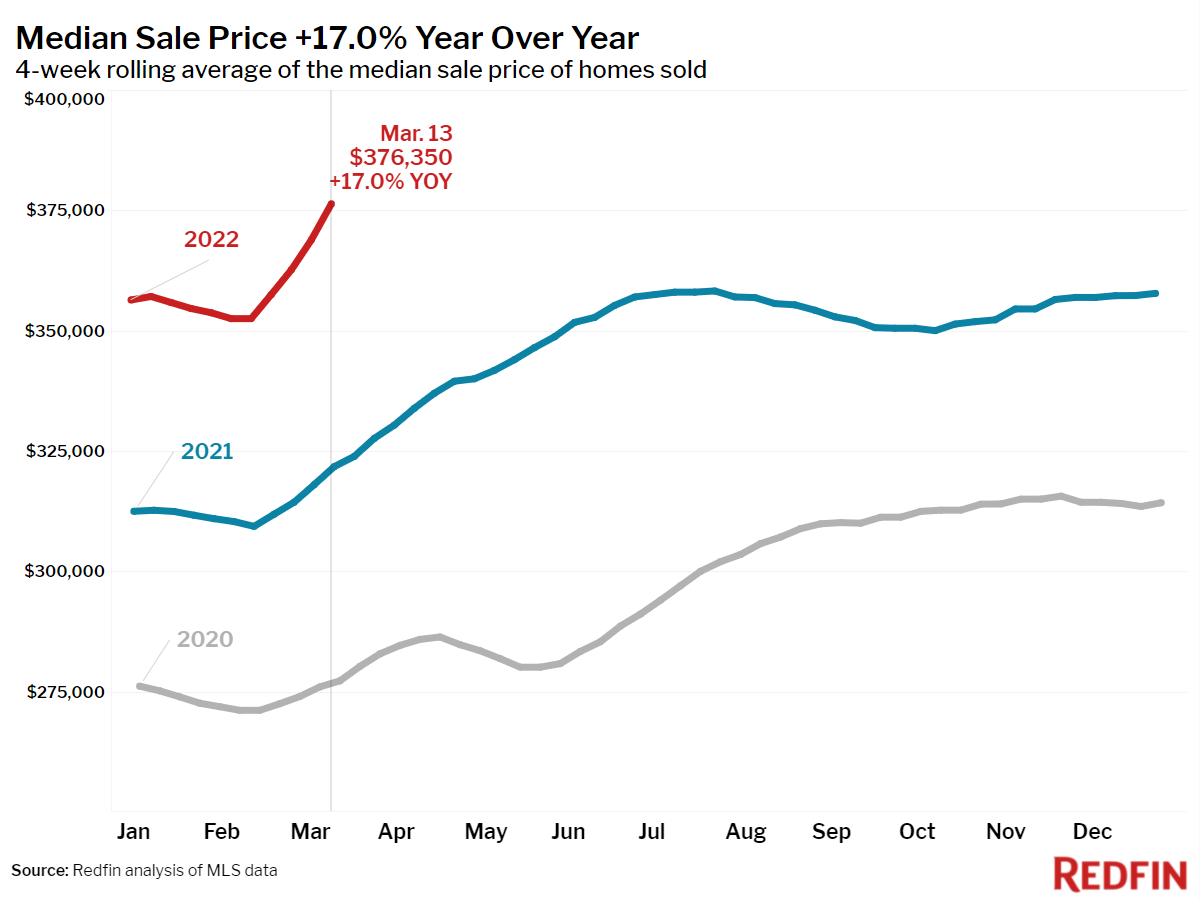

Iron condors it isCan’t imagine SPY closing above $440 nor closing below $435. A pin to $440 seems likely though, but we shall see.

View attachment 115835

Puts and calls they don’t want to pay..Holy S***

Sent from my iPhone using Tapatalk

Added a few more KWEB at $27.50...stop LOD. I should have just did some options but when I start getting heavy in options it ends up being a train wreck for me.

View attachment 115786

Added 5 more of these at $1 earlier. 10 for tomorrow….come on AMD. Lotto Friday