-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

D

Deleted member 609

Guest

This is stupid

buckinbronco

Member

I mean if Powell thinks the economy is so strong and that recession is unlikely, then why not raise rates higher to get further ahead of inflation? The "strong" economy can handle it right? I think we know the answer...

Storm5

Member

Omgd my lottos are printing

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Couldn’t resist. Bought UVXY 17.5 Friday calls at the bell

Im out of the market...No sense in playing a game that's designed to make you lose. This is a serious question. I have a small Roth IRA...a little less than $4500 (started it and didn't mess with it for years). Does anyone know a place to put it into gold/silver/precious metals as an IRA? Everywhere I've looked says you need at least $5K or so

D

Deleted member 609

Guest

Up 0.38% on a 2-3% market day ?

You only lose if you sit in cash or try to short. The market is the symbol of economic health. Nothing else matters. At all. They will let it correct a little, but they will always rapidly bring it back. I wouldn't be surprised to see the S&P a thousand points higher by the end of the year.Im out of the market...No sense in playing a game that's designed to make you lose. This is a serious question. I have a small Roth IRA...a little less than $4500 (started it and didn't mess with it for years). Does anyone know a place to put it into gold/silver/precious metals as an IRA? Everywhere I've looked says you need at least $5K or so

GeorgiaGirl

Member

Up close to 1.5% in the account I protest-bought SARK today because of my long term holds.

Will be just sitting on it at least for now, because sadly, based off recent history since December, I kind of expect a -2% Nasdaq day tomorrow and for ARKK to get blasted to kingdom come. General deal has been that it does great on a day where Powell speaks, and then that day goes away almost immediately.

Edit: I don't expect an up day tomorrow, but I would kind of say it needs to happen, because I felt the Dow needed a 34k+ close+follow through for us to possibly move to at least maybe 35k on this index, 4500 on the S&P, and 14200ish on the Nasdaq.

Will be just sitting on it at least for now, because sadly, based off recent history since December, I kind of expect a -2% Nasdaq day tomorrow and for ARKK to get blasted to kingdom come. General deal has been that it does great on a day where Powell speaks, and then that day goes away almost immediately.

Edit: I don't expect an up day tomorrow, but I would kind of say it needs to happen, because I felt the Dow needed a 34k+ close+follow through for us to possibly move to at least maybe 35k on this index, 4500 on the S&P, and 14200ish on the Nasdaq.

Im out of the market...No sense in playing a game that's designed to make you lose. This is a serious question. I have a small Roth IRA...a little less than $4500 (started it and didn't mess with it for years). Does anyone know a place to put it into gold/silver/precious metals as an IRA? Everywhere I've looked says you need at least $5K or so

You only lose if you sit in cash or try to short. The market is the symbol of economic health. Nothing else matters. At all. They will let it correct a little, but they will always rapidly bring it back. I wouldn't be surprised to see the S&P a thousand points higher by the end of the year.

I would leave it in a S&P 500 ETF/fund and forget about it. Assuming you have 15-20 years time horizon.

Storm5

Member

I bought YANG calls before the bell

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Time for UPRO/TQQQ, eh? ?You only lose if you sit in cash or try to short. The market is the symbol of economic health. Nothing else matters. At all. They will let it correct a little, but they will always rapidly bring it back. I wouldn't be surprised to see the S&P a thousand points higher by the end of the year.

Storm5

Member

Haha yep , murdered today lol

Sent from my iPhone using Tapatalk

Seems like a good move with todays unreal move to the positive. There’s gotta be a snapback, right? Then again, I’m afraid to touch Chinese stocks. $BABA, a company with a market cap in the hundreds of billions, went up 36% today. Like how does that even happen??? In ONE day???I bought YANG calls before the bell

Sent from my iPhone using Tapatalk

Seems like a good move with todays unreal move to the positive. There’s gotta be a snapback, right? Then again, I’m afraid to touch Chinese stocks. $BABA, a company with a market cap in the hundreds of billions, went up 36% today. Like how does that even happen??? In ONE day???

KWEB a cool 40% up day...

D

Deleted member 609

Guest

My Roth is at all time high and I haven't put money in yet this way. Not sure how I managed that.

Storm5

Member

Big tech still

Pushing

Sent from my iPhone using Tapatalk

Pushing

Sent from my iPhone using Tapatalk

pcbjr

Member

Whatever old school conventional wisdom says, it seems like in these days and times, go just the opposite direction ...Still pushing after hours...Fed hiked rates today and said they were going to hike 6 or 7 more times. Who knew that's what the market wanted to hear...?

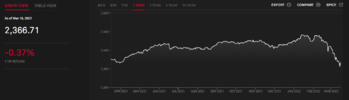

View attachment 115740

Should be a fun backtest when it comes

D

Deleted member 609

Guest

Down $900 on the $3,200 spy put I bought Monday (September expiration). I'm going to diamond hand that ----- though. No way this ---- doesn't drop significantly again.

BABA up a cool 37% today ?

D

Deleted member 609

Guest

Up 37% after dropping 75% from ATH ?BABA up a cool 37% today ?

buckinbronco

Member

Yeah I'm just about at the point where I'm gonna dump my 2022 IRA contributions in VOO and take my ball home. It seems obvious we should correct further, but I am ready to concede I'm not smart enough to find the bottom. Boring long term investing just is so vanilla and leaves you wanting more though lol.I would leave it in a S&P 500 ETF/fund and forget about it. Assuming you have 15-20 years time horizon.

D

Deleted member 609

Guest

Just double down every loss until you win or lose everything.Yeah I'm just about at the point where I'm gonna dump my 2022 IRA contributions in VOO and take my ball home. It seems obvious we should correct further, but I am ready to concede I'm not smart enough to find the bottom. Boring long term investing just is so vanilla and leaves you wanting more though lol.

buckinbronco

Member

This seems reasonable, I’m back in. Thanks for the pep talk.Just double down every loss until you win or lose everything.

VegasEagle

Member

D

Deleted member 609

Guest

That's what I'm here for. Just remember, first bankruptcy is free - Jimmy covers it.This seems reasonable, I’m back in. Thanks for the pep talk.

severestorm

Member

severestorm

Member

Never thought I would see this

Never thought I would see this

Going to see a lot more of stuff like this as the financial system collapses.

Yes, but the real driving force behind this is the election clock ticking closer to go time.Going to see a lot more of stuff like this as the financial system collapses.

There are much larger forces at play in the market than the "put it in an index fund and let it ride" days. I acknowledge that the market slopes in a positive direction when you zoom out....but this is not a "normal" circumstance. The private central banks are failing (thankfully), and our current financial system will fail. As it should. It's so corrupt, it needs to. We will have a new system once the dust settles. I'm going to precious metals during this transition. Silver should be over 50x what it is now (at least). Gold is suppressed too. This is going to change. I'm just trying to have a 30000 foot view of the reality of our financial system. When you do that, it looks like it's dying....and deservedly so.

Perfect example of what I'm referring to in my post above in the thread in the link. They make the rules as they go so they are protected when it sucks and get rich when it doesn't.