-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Bought it back at $109.20, based nicely there mid day. Rumors are it could be added to SPX after close tomorrow...either APP or HOOD. That alone will keep it perky tomorrow I think. This thing moves so fast so tricky...

Double top looking...but macd starting to curl up and RSI in power zone in the mid 60's.

View attachment 173980

Hood from $103 earlier this week to now $117...made my week.

SPX inclusion possible after close...I probably wont hold all of this but maybe like 30% in case they dont' get included.

Everything working today....HOOD...MRVL...and I've been fading COIN. It had horrendous earnings a week or so ago, they had an offering on Monday I think and then had 2 green days so easy fade. I think this is probably headed to $250 over the coming weeks so will look to fade on pops. Faded from $313 down to $303...just covered and will leave alone for the day.

MRVL has been good...I added in low 70's and added more on Friday at $75. My biggest swing position right now...MRVL on watch for next week...2 red weeks after a big move and that $70-$75 is strong confluence zone.

Weekly chart looks really solid...it pushes through $80 and opens up $120-125. Of course it will take some time to push through $80 but $70 should be nice support.

View attachment 173453

It's valuation is reasonable, trading at only 8x sales...NVDA at 29x sales..AVGO 25x sales and rev growing at over 50%.

Really like when it holds emas like that for several days using it as a launch.

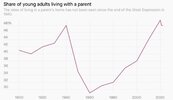

Wow. Those big numbers are probably more cultural. Now, I would say the younger generation has had a hit over there too but historically the US is not a place where younger populations live with their parents very long.

ForsythSnow

Moderator

From my understanding it's not entirely culture. Example being Spain where they're facing housing issues like we are with their case being British companies buying up properties, driving cost up, all while youth unemployment is somewhere around 30% due to the lack of jobs available period, and this is with housing costs way lower than ours too. Greece we all know what happened there with their debt crisis. In terms of economic power if we aren't somewhere near Germany we aren't doing something right, mainly because Germany's GDP and housing pressures would align more with ours, minus the excessive corporatization of housing.Wow. Those big numbers are probably more cultural. Now, I would say the younger generation has had a hit over there too but historically the US is not a place where younger populations live with their parents very long.

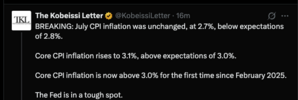

CPI at 8:30am....been consistently long for months as this market just won't give anything back. It closed below it's 20dema a couple of weeks ago and then had a violent 5 day move higher. But the negative divergence is looking ominous and we are entering seasonal weakness. But a close over $639 is on the table today with a soft CPI and looming rate cuts. It's such a tricky time right now.

I have longs on into today but did put on a hedge of the Qs, just 5 of the $570 puts for 80cents yesterday.

NVDA earnings in 2 weeks...market probably won't have any kind of sustained pullback until after that, that stock can single handily keep things afloat.

SPY up 33% from April lows and Qs up 44% from April lows with no real retracement...eventually it will retrace some of that move.

I have longs on into today but did put on a hedge of the Qs, just 5 of the $570 puts for 80cents yesterday.

NVDA earnings in 2 weeks...market probably won't have any kind of sustained pullback until after that, that stock can single handily keep things afloat.

SPY up 33% from April lows and Qs up 44% from April lows with no real retracement...eventually it will retrace some of that move.

CPI at 8:30am....been consistently long for months as this market just won't give anything back. It closed below it's 20dema a couple of weeks ago and then had a violent 5 day move higher. But the negative divergence is looking ominous and we are entering seasonal weakness. But a close over $639 is on the table today with a soft CPI and looming rate cuts. It's such a tricky time right now.

I have longs on into today but did put on a hedge of the Qs, just 5 of the $570 puts for 80cents yesterday.

NVDA earnings in 2 weeks...market probably won't have any kind of sustained pullback until after that, that stock can single handily keep things afloat.

SPY up 33% from April lows and Qs up 44% from April lows with no real retracement...eventually it will retrace some of that move.

View attachment 174158

CPI 2.7% vs 2.8% “expectation”:

Prop looking at a gap and crap this morning

Prop looking at a gap and crap this morning

Dow futures rose 250 on the slightly soft CPI. Nasdaq futures rose 130.

CPI 2.7% vs 2.8% “expectation”:

Core is 3.1%...and futures are pumping hard. Just how high a reading would it take for the market to sell off just a little. This market just don't care...why I am staying long but my hedge is toast. Qs is up 44% from April lows...this is crazy. Going to stop considering stuff like that and just keep making money...they just giving it away in this market if you long.

Nasdaq futures appear to have dropped back ~50% of the post CPI gain on this NVDA news. NVDA is still barely up in before hours trading but I assume it was significantly higher 30 minutes ago.

The play for weeks has been gap up....crazy buying at open and then fade from 10am. I've been selling into that for weeks and then buying late day for the eventual gap up. The SPY has gapped up 19 out of the past 20 trading days...a solid month of gapping up everyday.Nasdaq futures appear to have dropped back ~50% of the post CPI gain on this NVDA news. NVDA is still barely up in before hours trading but I assume it was significantly higher 30 minutes ago.

Yesterday they changed things up...they faded at 10am...but then ripped it up above the 10am high only to vomit it back down.

I have no confidence in shorting or buying any dips mid morning.

What a rip off the gap fill on the Qs....SPY never really blinked which was the tell. Now seeing if SPY can clear $640...I added AMZN/AMD at 219/170.The play for weeks has been gap up....crazy buying at open and then fade from 10am. I've been selling into that for weeks and then buying late day for the eventual gap up. The SPY has gapped up 19 out of the past 20 trading days...a solid month of gapping up everyday.

Yesterday they changed things up...they faded at 10am...but then ripped it up above the 10am high only to vomit it back down.

I have no confidence in shorting or buying any dips mid morning.

GeorgiaGirl

Member

Yeah, I'm late here, but I think the US stocks action today tells you your answer...at least the way the market feels, tho I doubt Powell pushes back at Jackson Hole at this point, on a September cut or no.

MRVL has been good...I added in low 70's and added more on Friday at $75. My biggest swing position right now...

It's valuation is reasonable, trading at only 8x sales...NVDA at 29x sales..AVGO 25x sales and rev growing at over 50%.

Really like when it holds emas like that for several days using it as a launch.

View attachment 174121

Marvel hasn't been easy...put in a nasty bearish hammer yesterday and now putting in a bullish one. I bought the dip this morning on that at around $75 low but just sold that at $77.60 to lower cost average.

AMD/AMZN and MRVL were all great today with Qs flat.What a rip off the gap fill on the Qs....SPY never really blinked which was the tell. Now seeing if SPY can clear $640...I added AMZN/AMD at 219/170.

Amazon looks really good. I sold 1/2 of my AMD into $185. I probably shouldn’t have but been a big move from $170.

Yea was gonna say something about PPI. Been hearing it for a few weeks coming through port of Charleston. Expect another big jump for August. Any slack that was left is gone now and the full brunt of tariffs is here.

Yea was gonna say something about PPI. Been hearing it for a few weeks coming through port of Charleston. Expect another big jump for August. Any slack that was left is gone now and the full brunt of tariffs is here.

Considering all of this, I’m surprised the major indices are only slightly down this morning. Maybe it’s because of an increased anticipation of a Sept Fed rate cut?

Last edited:

And the Qs is green…nothing taking this market down. Amazon been great, and NVDA buy off $180 worked too. Closed that at $182 for a quick swing. Just watching now. If this market can’t close red today…Oh wow...PPI came in super hot...not sure how the market doesn't close hard red today but we shall see. AMZN held up well still up 1%...

View attachment 174236

Went flat all my swings earlier. This market getting really dumb….well dumber. That PPI was so bad…been a good few months really and just going to wait for things to calm down.And the Qs is green…nothing taking this market down. Amazon been great, and NVDA buy off $180 worked too. Closed that at $182 for a quick swing. Just watching now. If this market can’t close red today…

Hates to sell Amazon as it’s so strong but been long since $220 and $230 a good spot

And this too....

ForsythSnow

Moderator

Won't even make half.Look at this house for sale in my town that was just listed ROTFL listed at 1.3mil this morning. we’re all gonna die View attachment 174282

Just at a glance, BTC should be under 100k by first week of November

drfranklin

Member

- Joined

- Dec 1, 2016

- Messages

- 494

- Reaction score

- 712

why? mirror 2021 cycle? I am looking to add position.Just at a glance, BTC should be under 100k by first week of November

Considering all of this, I’m surprised the major indices are only slightly down this morning. Maybe it’s because of an increased anticipation of a Sept Fed rate cut?

The market will be fine until it's not. The overall economy was going down the tubes ~15 months before the 2008 crash as an example.

Didn’t do anything on Friday. No swings on.Went flat all my swings earlier. This market getting really dumb….well dumber. That PPI was so bad…been a good few months really and just going to wait for things to calm down.

Hates to sell Amazon as it’s so strong but been long since $220 and $230 a good spot

SPY with glaring negative divergences with both RSI/MFI. Doesn’t mean market can’t push higher…this can go on. With market pricing in rate cuts for mid Sept it will probably chop around or maybe push buyer.

I will look for very short swings long/short.

Went flat my swings last week and glad I did. Things look terrible…tech been sold hardWent flat all my swings earlier. This market getting really dumb….well dumber. That PPI was so bad…been a good few months really and just going to wait for things to calm down.

Hates to sell Amazon as it’s so strong but been long since $220 and $230 a good spot

Short SPY from $643 earlier. Will let that sit and see if market really rolls over.