-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

packfan98

Moderator

115k was the projection. There was also a downward revision to the May and June reports of 258,000 jobs.What was the predicted range for the July jobs gain? The 73K gain was a good bit higher than those of the two prior months.

The major indices are down sharply (~1%).

Last edited:

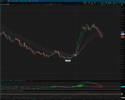

Very bearish candles today...SPY/Qs engulfed several days of gains and closed on the lows. But somehow futures probably pump tonight...I don't think we've seen a down open in weeks. Apple with very solid earnings but muted response....I closed my Apple long when market rolled hard. In fact I closed all my swings...been a crazy few weeks and need a reset.

View attachment 173772View attachment 173773

Glad I closed my swings...I also went more cash in my IRA yesterday...back to 40% cash. Market in complete free fall..

Actually faded Apple off open from $212 and covered at $207. Won't do much else today....

This why I came in the year bearish...tariffs...govt layoffs...feeds into private sector layoffs but this market a clown show and just rips higher all the time. Well...tech earnings have been stellar for AI...without AI we would be in a severe bear market.

broken025

Member

You broke the marketStarted buying into my Roth IRA today.

Started with $1200 worth of VTI and IJH to get the ball rolling.

GeorgiaGirl

Member

This why I came in the year bearish...tariffs...govt layoffs...feeds into private sector layoffs but this market a clown show and just rips higher all the time. Well...tech earnings have been stellar for AI...without AI we would be in a severe bear market.

Yeah, I know folks don't want to see it over at Reddit, hah, but another jobs reports like this with more revisions and I'm sorry to say, but rate cuts are absolutely on the table even with inflation stagnant.

If not the Fed, the treasury bond market will do it for them.

It's kinda strange. Consumption is declining in the US, yet SPX capex is going up, which usually doesn't occur. You can argue that the private sector is helping to juice things, but it's with something that could turn out to be iffy, and that's AI build out.

The Dawn of the AI age has begun.The Next 4 years is gonna see a epic overturn in jobs, careers. Got to be the biggest head scratcher moment HS/College age kids have ever faced. When I was coming up all we heard where computers where coming, even though we never had seen one.

Last edited:

Glad I closed my swings...I also went more cash in my IRA yesterday...back to 40% cash. Market in complete free fall..

Actually faded Apple off open from $212 and covered at $207. Won't do much else today....

View attachment 173790

I faded Apple all day...once it broke 207 and retest failed a few I shorted it again down to $203....also faded a few other things (AMD, SNOW). Probably my best swing day in some time just fading shares. NVDA been holding up well today and it it decides to roll then everythign rolls down more.

ain’t no way Trump fell for a classic Mededev vodka-induced tweet threatening WW3. He LITERALLY does this crap every week.

JHS

Member

All of this is headed somewhere else too, but no one wants to talk about that. AI is nothing but trouble.The Dawn of the AI age has begun. Next 4 years is gonna see epic overturn in jobs, careers. Got to biggest head scratcher moment HS/College age kids have ever faced. O was coming up all we heard where computers where coming, even though we never had seen one.

broken025

Member

We abandoning ship?SPY barely pulled back, relative...it's not even to it's 8wema. I would like to see a 20 week ema tag..

Usually engulfing weekly candles at tops have follow through. Look at last July 2024...

View attachment 173802

Closed my shorts and flipped long AMD at $170.50, OLKO at 71.55 and TQQQ at $72.20

Stops at afternoon lows.....if I get stopped out and then done for the day. Great day today...wasn't planning on fading so many names but all worked.

Stops at afternoon lows.....if I get stopped out and then done for the day. Great day today...wasn't planning on fading so many names but all worked.

GeorgiaGirl

Member

The BLS revisions this time were definitely extra bad, but I have no choice but to believe that the firing here is to fudge the numbers.

Maybe I'm wrong, but I'm certainly not confident.

Maybe I'm wrong, but I'm certainly not confident.

Not me trying to time the perfect bottom to start compounding a 30 year Roth IRAYou broke the market

The trick to the market is you just buy everything when it’s red and keep buying til you get old and only have a few years left to live. Then you dump your lifetime stonk earnings into a nice retirement home @ 7k a month. This should give you about 10-20 years to live comfortably playing bingo and eating meat&3 while your body and brain slowly (or quickly) begin to fail you. That’s the American dream baby.

I try to research,listen,discern what The AI hoopla is all about. How much is hyperbole verse future reality. Its very doom an gloom mostly. But so was Y2K back inthe late 90's.All of this is headed somewhere else too, but no one wants to talk about that. AI is nothing but trouble.

JHS

Member

Fair point. That turned out to be nothing. AI is a lot more dangerous though with the potential to put 50% or more of us out of work in the future among many other things.I try to research,listen,discern what The AI hoopla is all about. How much is hyperbole verse future reality. Its very doom an gloom mostly. But so was Y2K back inthe late 90's.

Huge gap up into the gap from Friday...almost filled. Market loves it's counter trades...

Only 2 swings today...faded AMZN from $217 to $213 and now have a small TQQQ short off 86.90 v/s the high of the day of $87. In and out of trades when volatility creeps up like this...

Nothing really to buy...everything was bid up in pre-market and now it's either chase, which I won't buy strength when market is like this or wait for some sort of gap fill below.

Only 2 swings today...faded AMZN from $217 to $213 and now have a small TQQQ short off 86.90 v/s the high of the day of $87. In and out of trades when volatility creeps up like this...

Nothing really to buy...everything was bid up in pre-market and now it's either chase, which I won't buy strength when market is like this or wait for some sort of gap fill below.

AMZN was an easy fade off $217 but I covered near Friday's low...now I have fomo..should have left half on as it's below Fridays low. Ughh

View attachment 173880

Added AMZN long when it reclaimed Fridays low at $213...it's been relatively weak so will see. It's why I covered short earlier at just over $213...now lets see if it can get back to 215.

Boom…ZETA crushed earnings…at 18.50 in pre market. To be honest, I totally forgot they had earnings yesterday and looked and sawZETA new position...been watching this. One of those trendy/retail AI names...added a bunch at $15.60.

View attachment 173766

View attachment 173765

Some 1/2 my ZETA into $20…from $15.60. Let the rest workBoom…ZETA crushed earnings…at 18.50 in pre market. To be honest, I totally forgot they had earnings yesterday and looked and saw

Apple finally pushing this market higher. SPY with a reclaim of the 20dema Monday, tested yesterday and again today and now pushing higher. This market just won’t rollover.

I don’t have much on for swings….NVDA, SPY and added HOOD at 102.80. Hood has been very erratic today so tight stop.

Correction is coming…just not now it seems.

I don’t have much on for swings….NVDA, SPY and added HOOD at 102.80. Hood has been very erratic today so tight stop.

Correction is coming…just not now it seems.

Sold HOOd into $111. Enough for me. That made my week.Apple finally pushing this market higher. SPY with a reclaim of the 20dema Monday, tested yesterday and again today and now pushing higher. This market just won’t rollover.

I don’t have much on for swings….NVDA, SPY and added HOOD at 102.80. Hood has been very erratic today so tight stop.

Correction is coming…just not now it seems.

View attachment 173939

Wicked fade off the open

Nomanslandva

Member

Yea, I don't like that action.Wicked fade off the open

Sold the rest of my ZETA at $20 when it gapped up over yesterdays high and then gave it up...classis sell signal. Cleaning up some longs too.Some 1/2 my ZETA into $20…from $15.60. Let the rest work

Bought it back at $109.20, based nicely there mid day. Rumors are it could be added to SPX after close tomorrow...either APP or HOOD. That alone will keep it perky tomorrow I think. This thing moves so fast so tricky...

Double top looking...but macd starting to curl up and RSI in power zone in the mid 60's.