-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Luckily I caught some yesterday at $522.70 when it took out the prior day high. I sold it all into SPY 544 as that should be major resistance. So will see. Just taking small trades and getting in and out...but $22 on SPY trade in 24 hours is crazy. This market is nuts and after 2 big back to back gap ups I'm not going to chase anything overnight tonight.Well…maybe the bulls had enough. I did swing SPY long when it took out $522….yesterday high.

Sick about AMD...I was staring at it yesterday at $85/share and thinking, this is really cheap....so dumb. But I do feel like the market will take out the lows and this will go lower...I think.I had held AMD for years and finally exited a few months back at $110. I am going to start adding it back though...it's growing at 25%, trading at only 4x sales. The China/US trade war is such a weigh on anyone with exposure to China right now but I might add back slowly. Currently at $85/share. I really feel like the market lows aren't in so this will go lower...

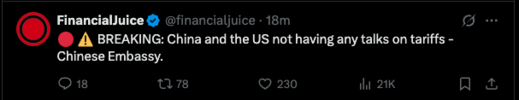

Now to what just happened with the Trump crypto coin, $TRUMP. This Trump coin was $8-9 for 2.5 weeks through just before noon. Then due to a pump, it skyrocketed from $9.30 at 11:55 AM to way up at $14.70 at 12:35 PM, a 58% increase in just 40 minutes!!

“JUST IN: $TRUMP

Call it hype, call it alpha... or call it what it is: memetic market manipulation at its finest token pumps 75% after Announcing a private dinner with President Trump for the top 220 holders!”

coinmarketcap.com

coinmarketcap.com

“JUST IN: $TRUMP

Call it hype, call it alpha... or call it what it is: memetic market manipulation at its finest token pumps 75% after Announcing a private dinner with President Trump for the top 220 holders!”

Crypto Patel Posts on CoinMarketCap

Read this crypto post from Crypto Patel posted on 2025/04/23 on CoinMarketCap’s Community message board. See user comments and interaction, plus replies from Crypto Patel as they discuss up-to-date cryptocurrency topics.

Last edited:

NoSnowATL

Member

Bla bla. They pay a tax and we pay a tax. Some of all need to go back to school.

Added back some SPY after open at $537...sold yesterday into $544.Luckily I caught some yesterday at $522.70 when it took out the prior day high. I sold it all into SPY 544 as that should be major resistance. So will see. Just taking small trades and getting in and out...but $22 on SPY trade in 24 hours is crazy. This market is nuts and after 2 big back to back gap ups I'm not going to chase anything overnight tonight.

View attachment 172592

It's held the 8/20 dema.

Going to leave this swing on from $537 on SPY...I also added a little URTY (Small caps) at $28.50. Seems like SPY wants to push through mega resistance.

View attachment 172598

I still have SPY long on from $537..and just holding for now. Haven't really done much other than that...I still think a recession is coming and we will test lows, at the least.

But it's reclaimed the 8/20dema and now onto the 50dema. You don't see a lot of relief rallies hold the 8/20dema for several days like this. Maybe bull market back on...I don't know...it's a confusing time.

JHS

Member

The market will probably be down tomorrow. Trump is going after Powell again.

GeorgiaGirl

Member

I'd say it's more likely we're red due to two things here, one being a nice reminder that the Nasdaq has another reason that has turned into a sideshow on its decline (SMCI preliminary report hit everything AI in the AH yesterday) and two being...well, all the data we just saw.

Well...maybe I'm wrong for being so bearish. Definitely getting a recession, probably severe, couple with sticky inflation (stagflation) and dip buyers are non stop.What a mess...this is why I've been so bearish. Closed out my SPY on those readings. Flat any swings and still 50% cash in my retirement.

Stagflation...couple that with severe tariffs...we are headed for an economic catastrophe.

View attachment 172639

Closed out my SPY in pre-market at $551 and now I am ticked I didn't buy the dip.

Well...maybe I'm wrong for being so bearish. Definitely getting a recession, probably severe, couple with sticky inflation (stagflation) and dip buyers are non stop.

Closed out my SPY in pre-market at $551 and now I am ticked I didn't buy the dip.

View attachment 172640

Well its clear I've been wrong about the market testing lows...right about recession coming, sticky inflation but for the market, none of that matters. I went long SPY at $549.20 and Qs at $470.33. Fairly heavy long...you don't see this non stop 10 min green candles and lean bearish.

Going to get back to being aggressive buying and not just SPY/Qs. Well add some stocks, mega caps today.

Cut/ abolish payroll tax at $200,000 and under with the big Beautiful Bill this summer. And it's Boom Time. Saddle Up!

broken025

Member

Payroll tax funds social security and Medicare. Kind of important.Cut/ abolish payroll tax at $200,000 and under with the big Beautiful Bill this summer. And it's Boom Time. Saddle Up!

Well its clear I've been wrong about the market testing lows...right about recession coming, sticky inflation but for the market, none of that matters. I went long SPY at $549.20 and Qs at $470.33. Fairly heavy long...you don't see this non stop 10 min green candles and lean bearish.

Going to get back to being aggressive buying and not just SPY/Qs. Well add some stocks, mega caps today.

View attachment 172641

Added some more Qs/SPY on those little dips intraday (469.30 and 548.11) and probably as long as I've been in weeks. Added a little MSFT to my IRA. I had a very small position on for a couple of months and now just added more. Its starting to look more clear that bear market done and bull market back in the face of a recession, inflation and tariffs.

GeorgiaGirl

Member

GeorgiaGirl

Member

In all seriousness, unless it's a hedge, I saw an interesting put buy that suggests that you're not going to see Main Street take off in a 2027 IWM put, while they're continuing to buy long term tech calls.

It suggests that the show from I'd say 2019 will continue to go on involving the Nasdaq, but full resumption won't be until late in the year/early next probably.

It suggests that the show from I'd say 2019 will continue to go on involving the Nasdaq, but full resumption won't be until late in the year/early next probably.

Heavy long today worked. My bearish bias is done…we are back to buy every dip and headed back to ATH’s. I’m still 50% cash in 401k but added another chunk back in IRA today. Recession/inflation/tariffs don’t matter. Neither do earnings.Added some more Qs/SPY on those little dips intraday (469.30 and 548.11) and probably as long as I've been in weeks. Added a little MSFT to my IRA. I had a very small position on for a couple of months and now just added more. Its starting to look more clear that bear market done and bull market back in the face of a recession, inflation and tariffs.

View attachment 172642

packfan98

Moderator

I would imagine the mag7 earnings reports are going to drag things back down until there’s any hint of something positive. Seems like the markets just want to rip at the smallest bit of perceived positive news.Heavy long today worked. My bearish bias is done…we are back to buy every dip and headed back to ATH’s. I’m still 50% cash in 401k but added another chunk back in IRA today. Recession/inflation/tariffs don’t matter. Neither do earnings.

MSFT long working...bought at $388'ish and now it's $420. Bull market back in full force.

SPY up 7 days in a row so yeah...but why not another 7 days in a row.

SPY up 7 days in a row so yeah...but why not another 7 days in a row.

META/MSFT crushed earnings just now...bear market over and bull market back.I would imagine the mag7 earnings reports are going to drag things back down until there’s any hint of something positive. Seems like the markets just want to rip at the smallest bit of perceived positive news.

packfan98

Moderator

Wow! I didn’t see that coming.META/MSFT crushed earnings just now...bear market over and bull market back.

On April 21st, Microsoft stock was trading way down at 359. It closed yesterday at 395. In early trading this morning, it is trading way up at 429 after the much better than expected earnings report released yesterday after the close! We’ll see whether or not that will hold in the regular session after 9:30AM.

All major stock indices’ futures are currently up although Apple is down $3. Meta is way up due to its strong earnings report.

Edit: MSFT is 435, which is +40!!

All major stock indices’ futures are currently up although Apple is down $3. Meta is way up due to its strong earnings report.

Edit: MSFT is 435, which is +40!!

Last edited:

Oh wow. Just a note: China buys a crapton of oil from Iran.

Its deducted separately. Talking just pure fed tax withheld. Look at columns on your stubPayroll tax funds social security and Medicare. Kind of important.

broken025

Member

Oh ok. You said payroll tax. All for cutting income tax below $200k. We increasing rates on incomes above $200k to offset it?Its deducted separately. Talking just pure fed tax withheld. Look at columns on your stub

Cad Wedge NC

Member

No, it will be "tariff" funded.Oh ok. You said payroll tax. All for cutting income tax below $200k. We increasing rates on incomes above $200k to offset it?

No need to. Cut the astronomical waste ( work in progress) and tariffs, that will do the trick.Oh ok. You said payroll tax. All for cutting income tax below $200k. We increasing rates on incomes above $200k to offset it?

And to put icing on the cake, If the Fed would start zero line budgeting every year and act responsible ( i.e congress/both parties/ all of them). Problem would be solved. We all have been played like a fiddle and it needs to stop.

Gas is $1.98 Gallon today, Mortgage Rates heading down. Inflation going down. Interest rates will have to follow here soon, unless there's nefarious shenanigans.

It's a bold move by administration. And some don't like, some ( myself) are for. I can see the argument for both sides of the coin. We will know 12 months from now how well this has played out or not played out. I'm more focused on main street and not wall street. I root for both, and think both will benefit greatly down the road here next couple of years. Lets see where it ends up and then we can score it.

ForsythSnow

Moderator

Gas is barely below $3 here, nationwide but has been headed down the last 3 years graduallyNo need to. Cut the astronomical waste ( work in progress) and tariffs, that will do the trick.

And to put icing on the cake, If the Fed would start zero line budgeting every year and act responsible ( i.e congress/both parties/ all of them). Problem would be solved. We all have been played like a fiddle and it needs to stop.

Gas is $1.98 Gallon today, Mortgage Rates heading down. Inflation going down. Interest rates will have to follow here soon, unless there's nefarious shenanigans.

It's a bold move by administration. And some don't like, some ( myself) are for. I can see the argument for both sides of the coin. We will know 12 months from now how well this has played out or not played out. I'm more focused on main street and not wall street. I root for both, and think both will benefit greatly down the road here next couple of years. Lets see where it ends up and then we can score it.

Housing is an overpriced disaster overall that's causing lower priced houses to not get built, driving prices up further for low and middle income families and individuals with it only generally stabilizing, but not decreasing.

The dollar remains weaker also the past several months but still better than during COVID. Comparing the Euro as economically it's likely the best comparison of two economies.

Another factor, income tax, just income tax, not counting any of the other parts of deductions, covers HALF of all US Govt funding.

Fiscal Data Explains Federal Revenue

Check out @FiscalService Fiscal Data’s new federal revenue page! #FederalRevenue

I would like to see the breakdown on bracket funding, but I guarantee that eliminating that would not offset the 160B cut so far and would increase govt spending.