-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

broken025

Member

So do we buy the UNH dip?

Anybody else seeing home inventory going up sharply where they live?

not at all...houses in my hood go fastAnybody else seeing home inventory going up sharply where they live?

It’s probably nothing but less than a year ago there was 1 page of listings in my town on Zillow now there’s 8not at all...houses in my hood go fast

Also it’s the fastest growing town in the county

We’ve got a 1400 sq ft modular home that’s paid in full and my wife is set on upgrading and I’m dreading it. Talk me off the ledge Kylo

I fell you…I got a 3% mortgage…we ain’t ever moving.It’s probably nothing but less than a year ago there was 1 page of listings in my town on Zillow now there’s 8

Also it’s the fastest growing town in the county

We’ve got a 1400 sq ft modular home that’s paid in full and my wife is set on upgrading and I’m dreading it. Talk me off the ledge Kylo

Moodys downgraded US credit after hours…first time ever. Market rolling over. I sold 80% of my longs. That hurt.

I can’t believe they would do that after hours on a Friday into a rising parabolic market. Almost like this market rigged

I can’t believe they would do that after hours on a Friday into a rising parabolic market. Almost like this market rigged

Nomanslandva

Member

We clearly have a problem, I get it. I saw this chart a while back and it really crazy to see not only how much we spent during the pandemic, but also how we changed the post pandemic spending trend line. I added the second line BTW.Moodys downgraded US credit after hours…first time ever. Market rolling over. I sold 80% of my longs. That hurt.

I can’t believe they would do that after hours on a Friday into a rising parabolic market. Almost like this market rigged

I am curious, why now? I am also curious how this may impact spending/tax bill negotiations. You would think it would give the spending hawks a bit more leverage.

We got 2 big down opens this week and bought both and been selling SPY/Qs into strength. I've been buying Apple too but it's down 6 days in a row now...I could have literally bought any other tech stock and be up nicely. So dumb...I rarely swing Apple and now I remember why.

I did add some AVGO via AVL at $26.90 on Monday and still holding that too. So that's been a good one.

I did add some AVGO via AVL at $26.90 on Monday and still holding that too. So that's been a good one.

Tariff news:

Trump is threatening to tariff Apple if they don’t build the iPhone in the US.

Trump is announcing a straight 50% tariff (I don’t know what straight tariff even means)on EU will go effect on June 1st.

Trump is threatening to tariff Apple if they don’t build the iPhone in the US.

Trump is announcing a straight 50% tariff (I don’t know what straight tariff even means)on EU will go effect on June 1st.

Tariff news:

Trump is threatening to tariff Apple if they don’t build the iPhone in the US.

Trump is announcing a straight 50% tariff (I don’t know what straight tariff even means)on EU will go effect on June 1st.

Dow futures dropped to -600 on these 2 items!

Apple Stock Falls After Trump Threatens Tariffs on Foreign-Made iPhones

“Wedbush analyst Daniel Ives has estimated that making an iPhone in the U.S. would probably lead to a retail price of around $3,500 compared with around $1,000 currently, and it would take years to build the necessary production capacity.”

“Wedbush analyst Daniel Ives has estimated that making an iPhone in the U.S. would probably lead to a retail price of around $3,500 compared with around $1,000 currently, and it would take years to build the necessary production capacity.”

broken025

Member

More Trump tariff tweets that toppled futures...I had lightened up with longs after the Moodys downgrade and end of May being seasonally weak but still, the longs I have hurt with SPY/Qs down 1.5-2%. I guess I will see how morning goes and then just exit and suck up the losses...I don't know what to do here. I am tired of trading around tariff tweets...we had gotten a few weeks repreive...

The safer thing to do is wait until Oct/Nov to buy...feels like a summer of chop with another test of lows in Sept/Oct. With the credit issues, tariffs...the market you would think would perceive that as bearish.

The safer thing to do is wait until Oct/Nov to buy...feels like a summer of chop with another test of lows in Sept/Oct. With the credit issues, tariffs...the market you would think would perceive that as bearish.

More Trump tariff tweets that toppled futures...I had lightened up with longs after the Moodys downgrade and end of May being seasonally weak but still, the longs I have hurt with SPY/Qs down 1.5-2%. I guess I will see how morning goes and then just exit and suck up the losses...I don't know what to do here. I am tired of trading around tariff tweets...we had gotten a few weeks repreive...

The safer thing to do is wait until Oct/Nov to buy...feels like a summer of chop with another test of lows in Sept/Oct. With the credit issues, tariffs...the market you would think would perceive that as bearish.

I did buy some SPY in pre-market and added to my AVGO position which has helped mitigate most of my losses on the day. Tricky stuff...but SPX right at it's 200/20d moving avgs...so a bounce/support makes sense if it's going to stay special.

Last edited:

ForsythSnow

Moderator

At this point, market manipulation. 50% tariff for an American based but Chinese manufactured phone but 25% for the same conditions but a S Korean based company makes little sense.

At this point, market manipulation. 50% tariff for an American based but Chinese manufactured phone but 25% for the same conditions but a S Korean based company makes little sense.

The threat to Apple is also a 25% tariff. The 50% threat is to the EU in general. But still it doesn’t make sense. Apple would have to sell IPhones at a whopping $3,500 if they were made in the US. And it would take years to get it up and running.

Last edited:

EU tariffs postponed to July 9.

EU tariffs postponed to July 9.

As a result, Dow futures are +304. NAS is +213.

Trump just announced that steel tariffs are headed to 50%.

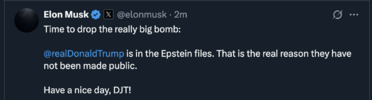

Tesla shares are down 10% today.Public divorce unfolding between Elon/Trump...get your popcorn ready. We handed the keys to our government to Elon, gave him access to any/everything. And now this...is this really happening.

View attachment 173015

Trump just threatened to stop all contracts with Elon's companies! I was wondering what Trump would say after Elon's crash-out earlier today.

Last edited:

From bromance last week to straight up fighting.

Nomanslandva

Member

Just ridiculous. -15% nowTrump just threatened to stop all contracts with Elon's companies! I was wondering what Trump would say after Elon's crash-out earlier today.

This is literally insane.

broken025

Member

GeorgiaGirl

Member

No harm, no foul for me ultimately, so that Elon meltdown was funny.

Wow.

He also called for Trump to be impeached.

He also called for Trump to be impeached.