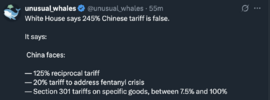

Per Lutnick, the tech tariffs exception will last a month.

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

GeorgiaGirl

Member

What a sh--show.

My guess is that there's still truth behind yesterday, but Trump was mad that it looked like what he did in 2017 still worked here in 2025.

My guess is that there's still truth behind yesterday, but Trump was mad that it looked like what he did in 2017 still worked here in 2025.

dsaur

Member

It will be interesting to correlate the various ups and downs that are coming. If one one could guess on the traits of personality in one individual as related to decisions to be made in coming situations...but have good data as to what occurs when he decides on his actions, one could have a solid gamble. I mean, one could guess that he'd back down on the world wide taxes after his fragile coalition was quaking, so figure for an up day..but need to predict when he'll fold. One could then figure he'd double down on China since he has a real case of the ass with them, and it's how the system is manipulated.... to knee jerk in both directions, sometimes twice in a day. If you can write a program to predict his decisions based on sensor data, or, i.e., intuitions, and when he's likely to do it, ie. back down...but double down on China, the old one two punch. One could even predict what the markets would do with a one two punch. Jump around with hair on fire.. But it's tomorrow when your program makes us money. What we need is a Cray, or a bank of them. With your abacus and Crays, with my nonsense, we'll make a fortune, lol. Knowing the markets are now in a straight jacket with him, and dance to his tune, and freak out when he twitches, then we need a program to predict what the markets will do tomorrow by predicting twiches and responses by the markets. Which way will the lurch propel the markets? It seems to me a obsolete version of Goofy, Using news reports from lots of news sources, adding in stocko for climo, and factor for the cold bias, would serve. We need a wider sample, but your abacus will fill in for that. Ohh, ohh, get data on what the baro pressure was doing during these lurches. And the moon. I never really had thought of the tide being a continuous, constant wave. Is like breathing. Maybe the stock market is attuned to his breathing? Put that in the program. Man, we are going to be so set for life. Sorry, if I'm loopy, but I watched the Masters today, and I'm used up. Nothing left in the tank, and I was just sitting there.What did day 6, which would correspond to tomorrow, do for the two remaining cases (excluding the current one)? These are the only two cases other than the current one that had an 8%+ drop for days 1-2 combined, further drops days 3 and 4, and a gain on day 5:

-9/18-22/1931 Fri-Wed (days 1-5): day 6 (9/23 Thu) had a 7.1% drop to new low!

-7/19-24/1933 Wed-Mon (days 1-5): day 6 (7/25 Tue) had a 1.5% drop; but days 7-8 rose a combined 3.4% to a short term high

Regardless, there being only two cases and both from way back during the Great Depression means virtually no statistical credibility, of course, and the outcome will be largely influenced by what Trump says/does tomorrow as we know.

JeezWeBull went public View attachment 172536

Haven't really done much the past 3 days...$548-550 was previous support and been rejected. Right into the emas...typical rejection too in bearish sequences. This closes over $550 that would suck to not have anything on...but I like $520 area better down the road but still believe it makes lower lows in Q3.

Avalanche

Member

Yes, it’s going to rain

rambleon

Member

Been a scalpers paradise. Even in the chop of today.

4% for cash is the play...this market blows and I think it's headed much much lower

Powell just dropped the hammer...slower growth higher inflation...exactly what a teetering market wants to hear.

View attachment 172551

I think you agree this is a bear market with high volatility, uncertainty, and instability largely due to the tariffs/economy. I maintain what I said last week right after the huge up day: that’s just a big relief bounce and there will be more bad days. The problem leading to this hasn’t gone away and stocks were expensive to begin with. I’m a longterm buy and hold investor only seeking to add a little each time on dips like I did on March 11th and again on April 9th. I don’t daytrade.

I’m similar with my long term accounts…those are still 50% cash. Added at SPY $560 and $496.I think you agree this is a bear market with high volatility, uncertainty, and instability largely due to the tariffs/economy. I maintain what I said last week right after the huge up day: that’s just a big relief bounce and there will be more bad days. The problem leading to this hasn’t gone away and stocks were expensive to begin with. I’m a longterm buy and hold investor only seeking to add a little each time on dips like I did on March 11th and again on April 9th. I don’t daytrade.

dsaur

Member

Yeah, that's just what we need for a sound economy and society...flood the unemployment roles with tons of over qualified people for the jobs available. Oh, and keep poking China until they decide to call in our markers, and start mass selling bonds. They'd endure some real hurt, but weaken the dollar such that the yen could take over as the world standard, which they want. Real genius at work here, for sure, lol.Impact to the private sector of federal job cuts, spending cuts, tariffs is just starting

View attachment 172552

Haven't done anything today...really haven't done anything since last weeks huge up day. $520 on the SPY looks like key level but it keeps rejecting the emas...typical bearish sequence. I don't know what could trigger this to push through those emas....i guess China/US deal but that doesn't look close. And economy has other huge problems to do deal with.

Close below $520 it gets ugly.

Close below $520 it gets ugly.

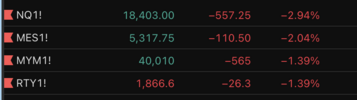

Oof

Market waterfalling again...we have tariff problems but that's just the start. We have so many big problems that the Fed can't rescue us from.

View attachment 172577

Today’s steep drop is no surprise whatsoever. I expect more to come but hard for anyone to predict when as that’s the nature of the markets. Reasons given for today’s drop are the threat of Powell being fired (though Powell said he won’t leave before his term is up in 2026) and continued tariffs related uncertainty.

Last edited:

packfan98

Moderator

I would think that once trade deals start getting announced with various countries that the market would try to rally. However, with so much uncertainty and the speculative nature of the markets, any perceived negative could offset any potential positives.Today’s steep drop is no surprise whatsoever. I expect more to come but hard for anyone to predict when as that’s the nature of the markets. Reasons given for today’s drop are the threat of Powell being fired (though Powell said he won’t leave before his term is up in 2026) and continued tariffs related uncertainty.

Last edited:

Today’s steep drop is no surprise whatsoever. I expect more to come but hard for anyone to predict when as that’s the nature of the markets. Reasons given for today’s drop are the threat of Powell being fired (though Powell said he won’t leave before his term is up in 2026) and continued tariffs related uncertainty.

Any tariff agreement will be a short lived rally. There will be some sort of tariff that won’t be healthy for our economy. I don’t know how we get out of this.I would think that once trade deals start getting announced with various countries that the market would try to rally. However, with so much uncertainty and the speculative nature of the markets, any perceived negative could offset and potential positives.

Steven_1974

Member

Even if they claim a deal of any kind was made, I wouldn't believe them unless the other party actually says so.I would think that once trade deals start getting announced with various countries that the market would try to rally. However, with so much uncertainty and the speculative nature of the markets, any perceived negative could offset and potential positives.

IAU up 42% past 12 months. Up 30% since new year rolled In. Giddy Up

lol damn

I am usually a degenerate dip buyer...but this is just starting to waterfall again. I think in the past 7 trading days I had 2 swings on, one I got stopped out very quickly and the other made a few pennies. Just a mess and no desire to try and swing anything in this.

View attachment 172578View attachment 172579

I’ve bought very modest amounts (as % of whole portfolio) on dips twice: March 11th and April 8th. I’ll be looking for a possible third modest buy at some point within the next month or so.

Maybe my bull bias but kind of getting a feeling that in the next week or two we see a multi-week retracement higher. Tech has been so washed out it's probably ready for a 2-3 week move higher, especially in the Qs. Maybe a 8-10% move, grind higher, back to $480.

I've done such little swing trading for what seems likes months it just feel like something is coming. I don't like today with a big gap up after a big red day, we don't see reversals off big gap ups.

I've done such little swing trading for what seems likes months it just feel like something is coming. I don't like today with a big gap up after a big red day, we don't see reversals off big gap ups.

I really don't know why AMD is getting beaten up so bad...trading at 6x sales...PEG of .4. It's getting it's butt kicked by NVDA/AVGO but it's growing nicely.

I had owned this for years but finally got fed up when $110 broke last week. If it hits $80 I will add it all back.

View attachment 171347

I had held AMD for years and finally exited a few months back at $110. I am going to start adding it back though...it's growing at 25%, trading at only 4x sales. The China/US trade war is such a weigh on anyone with exposure to China right now but I might add back slowly. Currently at $85/share. I really feel like the market lows aren't in so this will go lower...

Pretty nice trading range set here on tech

Brutal price action...they gapped it up and erased the entire intraday candle from yesterday. This market is so predatory right now...they probably flushed out many folks yesterday and then violent short cover into close and then another big gap up. Typical bear market price action.

Would be shocked if it doesn't fill this gap today or tomorrow. Shorts are trapped right now and they aren't giving a reprieve...just like yesterday when longs were trapped and got no bounce to get out. This is why i am trading so little right, it's all a guessing game...pain trade. I want SPY down at 510-515 area.

Would be shocked if it doesn't fill this gap today or tomorrow. Shorts are trapped right now and they aren't giving a reprieve...just like yesterday when longs were trapped and got no bounce to get out. This is why i am trading so little right, it's all a guessing game...pain trade. I want SPY down at 510-515 area.

Well…maybe the bulls had enough. I did swing SPY long when it took out $522….yesterday high.Maybe my bull bias but kind of getting a feeling that in the next week or two we see a multi-week retracement higher. Tech has been so washed out it's probably ready for a 2-3 week move higher, especially in the Qs. Maybe a 8-10% move, grind higher, back to $480.

I've done such little swing trading for what seems likes months it just feel like something is coming. I don't like today with a big gap up after a big red day, we don't see reversals off big gap ups.

View attachment 172583