-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

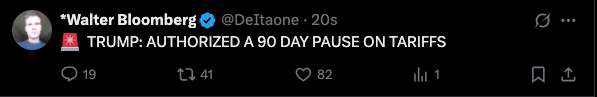

Dang...I trimmed too soon....SPY at $528. But I sold another bunch and sitting at 40%. But dang this made my year.Trump caved...SPY just ripped 5% in 3 mins...I sold 1/3 of what I had on...unreal move.

SPY $515 and bought at 486 today

View attachment 172479View attachment 172480

GeorgiaGirl

Member

You’d get a lot more support for the tariffs and the media wouldn’t be screeching here if it was just a mix of targeted tariffs and being tough on China (but not essentially trade embargo tough). But if that’s the intended message, it doesn’t get through when everybody is getting targeted.

Continue to make it clear this is about fighting China and although the tariffs there are still bad, a lot of the media screeching will be silenced.

Historical move

Man the NASDAQ is cooking now. Up 9%

Oh dang...it excludes China...China raised to 125%. I just went flat all SPY at $534 from $486'ish. I am not giving this away. Let's see how things respond overnight into tomorrow.

What a wild week in the stock market. From going to reciporal tariffs to no reciporal tariffs in one week.

And just like that, after a Trump “Truth” we were green by nearly double digits.  What a

What a  market!

market!

Trade war with China is bullish in comparison to a trade war with the entire world.

QQQ tagged +10%

broken025

Member

Going to laugh if it still closes red

lexxnchloe

Member

China is left holding the tariff bag now. Not good for them.

Shaggy

Member

Is it good for us? For all those amazing this is a negotiating tactic.......Trump just showed a very weak hand.China is left holding the tariff bag now. Not good for them.

lexxnchloe

Member

Its very possible this is a lucky break for Trump. The Tariffs were a bad idea but even if by accident China is now out on a very rotten limbIs it good for us? For all those amazing this is a negotiating tactic.......Trump just showed a very weak hand.

Yeah, but that does he want from China? I don’t know what the endgame is. He wants them to call and beg is my guess and we go back to way things were and he claims a hollow victory.Its very possible this is a lucky break for Trump. The Tariffs were a bad idea but even if by accident China is now out on a very rotten limb

lexxnchloe

Member

Maybe he wants the collapse of the Chinese economy and increased trade with China's neighbors like Viet Nam and India.Yeah, but that does he want from China? I don’t know what the endgame is. He wants them to call and beg is my guess and we go back to way things were and he claims a hollow victory.

Steven_1974

Member

I think the bond market force their hand cause with the way it was going down too that meant people didn't have faith in US treasuries anymore. That's some long term mindset damage right there that's not going to be good for us as long as he's in office.Is it good for us? For all those amazing this is a negotiating tactic.......Trump just showed a very weak hand.

Steven_1974

Member

It might be like last time where they made him a promise to buy x amount of stuff and they actually never did.Yeah, but that does he want from China? I don’t know what the endgame is. He wants them to call and beg is my guess and we go back to way things were and he claims a hollow victory.

lexxnchloe

Member

dsaur

Member

It's blatant stock manipulation. The puppeteer pulls the strings, his buddies buy and sell on fore knowledge, and they all get rich. I bought shares Fri and Mon betting he'd back off. He knew he'd back off, so no bet there, and he and his buddies could load up the wagon knowing what was coming. Drive it down, buy, bring it up sell. Rinse and repeat as the whim strikes him. It was a calculated gamble for me knowing how wishy washy he is, but it could have gone the other way easily without fore knowledge. Power is all about making money, so it was a good bet on my part, but it's still a bet, so I didn't bet the house.

If this holds, today will be the third biggest move in QQQ’s history, and it’s not far off from taking the No. 2 spot.

Just hit me....I imagine their are tens of thousands of people that went to cash this week in retirement accounts and now are looking at the Qs/SPY up 10% and now will have to put there money back in the market missing out on that huge bounce. This is so messed up....beyond criminal.

Qs is just under 3% from where it closed on that Wednesday of Trump's tariff announcement.

Qs is just under 3% from where it closed on that Wednesday of Trump's tariff announcement.

This is why people shouldn’t sell in a panic (not that there isn’t market manipulation going on).Just hit me....I imagine their are tens of thousands of people that went to cash this week in retirement accounts and now are looking at the Qs/SPY up 10% and now will have to put there money back in the market missing out on that huge bounce. This is so messed up....beyond criminal.

Qs is just under 3% from where it closed on that Wednesday of Trump's tariff announcement.

View attachment 172482

broken025

Member

I considered it but knew this was one tweet away from reversing. I also won’t need it for 25 years.Just hit me....I imagine their are tens of thousands of people that went to cash this week in retirement accounts and now are looking at the Qs/SPY up 10% and now will have to put there money back in the market missing out on that huge bounce. This is so messed up....beyond criminal.

Qs is just under 3% from where it closed on that Wednesday of Trump's tariff announcement.

View attachment 172482

I rem when the world was ending yesterday

Just hit me....I imagine their are tens of thousands of people that went to cash this week in retirement accounts and now are looking at the Qs/SPY up 10% and now will have to put there money back in the market missing out on that huge bounce. This is so messed up....beyond criminal.

Qs is just under 3% from where it closed on that Wednesday of Trump's tariff announcement.

View attachment 172482

I'm no stock guy and never will be, but this just sounds ridiculous to me.

Yeah...the time to sell was when SPY hit $600, which I did. I added back 20% at $560 and 30% yesterday (thank god) at SPY close of $496. I am still 50% cash in 401k and 4% in my IRA. I was down 8-9% I think at lows and now I am up 2% on the year.I considered it but knew this was one tweet away from reversing. I also won’t need it for 25 years.

My swing account I was down over 10% and I just erased all that today and now up 4% on the year.

But still this was brutal price action I imagine millions are super pissed as they had about 20 mins to buy before missing out. Total casino right now.

This was totally ridiculous...you had our president of the united states manipulating our stock market and economy like it was a parlor trick. Trillions were lost and I imagine many of the middle class got wrecked and imagine their were people that knew what was going to happen before it happened today. And once buying started today it was non-stop, shorts got no reprieve.I'm no stock guy and never will be, but this just sounds ridiculous to me.

The more screwed up was the price action at announcement....they announced it at roughly 1:15pm and the algos ripped it lower from $503 to $497 clearing out any trailing stops and then they ramped it up as hard as they good. I guarantee a bunch of folks got stopped out...you see that all the time which is why I use trailing stops rarely.

-Dow +7.9% 19th largest gain ever and largest since 3/13/2020

-S&P +9.5% 9th largest gain ever and largest since 10/28/2008

-Nasdaq +12.2% 2nd largest gain ever and largest since 1/3/2001! (keep in mind Nasdaq goes back only to 1971)

-Regardless of today’s huge rise, I’ll remain wary about a possible resumption of big drops at least until overall volatility falls to near normal and the overall tariffs situation is clearer. If so, those could be further careful buying opportunities.

-S&P +9.5% 9th largest gain ever and largest since 10/28/2008

-Nasdaq +12.2% 2nd largest gain ever and largest since 1/3/2001! (keep in mind Nasdaq goes back only to 1971)

-Regardless of today’s huge rise, I’ll remain wary about a possible resumption of big drops at least until overall volatility falls to near normal and the overall tariffs situation is clearer. If so, those could be further careful buying opportunities.

It depends on what one man decides to say, but you knew that.

But regarding the stats, here are the 3 cases with 8%+ Dow drops first two days combined followed by further drops days 3 and 4:

-9/18-22/1931 Fri-Tue; Wed was +6.0%

-7/19-22/1933 Wed-Sat; Mon was +6.6%

-10/6-9/2008 Mon-Thu; Fri was -1.5%

The positive cases for each of days 3 and 4, which have been in an ~2/3 majority, have not been coming through although today early on looked promising obviously before Trump said China would have 104% total tariffs. So, day 5 also had 2 of 3 closing in the green with the two greens having very strong days. But the tiny sample size of 3 means credibility is nil. And again it depends on Trump’s words, regardless.

Followup regarding day 5:

Here are the 4 cases with 8%+ Dow drops first two days combined followed by further drops days 3 and 4:

-9/18-22/1931 Fri-Tue; Wed (day 5) was +6.0%

-7/19-22/1933 Wed-Sat; Mon (day 5) was +6.6%

-10/6-9/2008 Mon-Thu; Fri (day 5) was -1.5%

-10/3-8/2025 Th-Tue; Wed (day 5) was +7.9%

@broken025

@KyloG

Last edited:

And for 10/6-9 2008 the day 5 that Monday the SPY ripped 15% and then tested the 10/6 lows a couple of days later.Followup:

Here are the 4 cases with 8%+ Dow drops first two days combined followed by further drops days 3 and 4:

-9/18-22/1931 Fri-Tue; Wed was +6.0%

-7/19-22/1933 Wed-Sat; Mon was +6.6%

-10/6-9/2008 Mon-Thu; Fri was -1.5%

-10/3-8/2025 Th-Tue; Wed was +7.9%

@broken025

@KyloG

Yeah, one thing you’ll notice about these days with massive gains is that they almost never happen in “healthy” market situations. It’s a list of dates that correspond with the Great Recession, the Covid Crash, the Tech Bubble popping, Black Monday, the Great Depression, etc…-Dow +7.9% 19th largest gain ever and largest since 3/13/2020

-S&P +9.5% 9th largest gain ever and largest since 10/28/2008

-Nasdaq +12.2% 2nd largest gain ever and largest since 1/3/2001! (keep in mind Nasdaq goes back only to 1971)

-Regardless of today’s huge rise, I’ll remain wary about a possible resumption of big drops at least until overall volatility falls to near normal and the overall tariffs situation is clearer. If so, those could be further careful buying opportunities.

dsaur

Member

Trillions in the toilet...and "investors got yippy." Of all the bs things to say, as you flush.Just hit me....I imagine their are tens of thousands of people that went to cash this week in retirement accounts and now are looking at the Qs/SPY up 10% and now will have to put there money back in the market missing out on that huge bounce. This is so messed up....beyond criminal.

Qs is just under 3% from where it closed on that Wednesday of Trump's tariff announcement.

View attachment 172482

Followup regarding day 5:

Here are the 4 cases with 8%+ Dow drops first two days combined followed by further drops days 3 and 4:

-9/18-22/1931 Fri-Tue; Wed (day 5) was +6.0%

-7/19-22/1933 Wed-Sat; Mon (day 5) was +6.6%

-10/6-9/2008 Mon-Thu; Fri (day 5) was -1.5%

-10/3-8/2025 Th-Tue; Wed (day 5) was +7.9%

@broken025

@KyloG

What did day 6, which would correspond to tomorrow, do for the two remaining cases (excluding the current one)? These are the only two cases other than the current one that had an 8%+ drop for days 1-2 combined, further drops days 3 and 4, and a gain on day 5:

-9/18-22/1931 Fri-Wed (days 1-5): day 6 (9/23 Thu) had a 7.1% drop to new low!

-7/19-24/1933 Wed-Mon (days 1-5): day 6 (7/25 Tue) had a 1.5% drop; but days 7-8 rose a combined 3.4% to a short term high

Regardless, there being only two cases and both from way back during the Great Depression means virtually no statistical credibility, of course, and the outcome will be largely influenced by what Trump says/does tomorrow as we know.

Last edited:

Sometimes patience is the name of the gameI don't think anyone denies if they remain for extended time there could be long term pain but seems to be a freak out about speculative scenarios. Maybe let it play out and see what happens. We should've never allowed other countries take our work force, our factories, our technology and kick our butt's for so long. The path we were on wasn't sustainable so time to put us first and attempt to bring it back