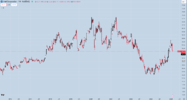

Well they pushed to $180...glad I lowered my other bids. I have a nice position at $180.77 avg. I have a stop of $178.First bid got hit in TSLA at $182.73...low was $182.70. I lowered my other bids. I am wondering if they push to $180.

View attachment 143316