-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Storm5

Member

Roe V Wade decision coming Monday . Market is gonna take if violence breaks out

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Fidelity says you can buy physical metals....anyone familiar with this on there?

A $5 Trillion ‘Wealth Shock’ Is Cracking Americans’ Nest Eggs

(Bloomberg) -- The world’s richest nation is waking up to an unpleasant and unfamiliar sensation: It’s getting poorer.Most Read from BloombergWalmart’s Troubles Should Have Everyone on High AlertA $5 Trillion ‘Wealth Shock’ Is Cracking Americans’ Nest EggsHow an Energy Expert Triggered Vladimir...

I bought $10 worth. If it jumps back to where it was I'll be rich. But, I figure I'll probably lose it. I also figure the odds of me becoming rich are better than a lottery ticket, so why not.Such fomo on Luna...was looking at this yesterday morning and was going to try it again but chickened out.

Really don't have any fomo on missing a big crypto rip as a whole but Luna is moving so fast.

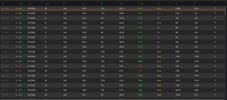

View attachment 118675

Futures are up nicely but semi's (AMD/NVDA/AVGO) are all down 1-2% and so is Tesla. Going to be tough for the market unless those reverse. Something isn't right...

Storm5

Member

Amazon wrecked

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

I might grab a few of these if it drops below 2kAmazon wrecked

Sent from my iPhone using Tapatalk

Storm5

Member

Rookie question for the experts ..... what happens to my spreads after a stock split ? Should dump them prior ?

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Rookie question for the experts ..... what happens to my spreads after a stock split ? Should dump them prior ?

Sent from my iPhone using Tapatalk

They will adjust them. You don't have to dump unless you want.

Storm5

Member

Shrek candles everywhere

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

So blood bath tomorrow ? Turnaround Tuesdays haven't been paying off lately

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

My offical forecast- Open +1.5%. Drop to negative 3.5% by lunch. Back to +2% by 2pm. Drill down to negative 1.9% by close.So blood bath tomorrow ? Turnaround Tuesdays haven't been paying off lately

Sent from my iPhone using Tapatalk

Storm5

Member

Shut your mouth lol

Sent from my iPhone using Tapatalk

Storm5

Member

Well there is the gap down AH . F'ing snap

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Cascades to FB and Google. ?Well there is the gap down AH . F'ing snap

Sent from my iPhone using Tapatalk

SNAP ?

At what point does economics 101 say times up? Is this the leverage to get us to the digi dollar and off the/ away with the US dollar.?

America's stunning $30.4 trillion national debt now exceeds the size of the entire U.S. economy and is expected to total 102% of the US gross domestic product by the end of this fiscal year.

America's stunning $30.4 trillion national debt now exceeds the size of the entire U.S. economy and is expected to total 102% of the US gross domestic product by the end of this fiscal year.

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 583

- Reaction score

- 890

So much for that strong consumer. Recession dead ahead.

Tech smoked this morning

Storm5

Member

Here comes daddy Powell to send us on a face melting 3 day rally

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

weatherboyy

Member

We Are In A Recession?️

Nice cup and handle....should have another green day.

Storm5

Member

Nice cup and handle....should have another green day.

What year ?

Sent from my iPhone using Tapatalk