D

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

Futes mega bullish. Economy great. Pattern loaded.

severestorm

Member

severestorm

Member

Yep. Time to piss on the fire and call in the dogs.

Put some of my taxable into PFIX a week or two ago. Already up over 10%. Guess I should’ve put my Roth in it, too. Instead, it sinks day by day. ?

severestorm

Member

Storm5

Member

Sitting here waiting for the 3k Amazon break since last week . Once she's goes she's going to 2900 . Question is will they hold it up until ER .

Interesting to see how TESLA ER tomorrow impacts big tech

Sent from my iPhone using Tapatalk

Interesting to see how TESLA ER tomorrow impacts big tech

Sent from my iPhone using Tapatalk

Storm5

Member

Holy pump

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

The penny stocks continue lol

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

Market is ripping face AH

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

Epic pump before the bell

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

severestorm

Member

lexxnchloe

Member

If they do that i predict shortages of lumber and livestock feed. I sort of hope Biden forces price controls here. Shelves will be bare and reps might have 310 house seats.

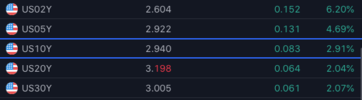

10yr has been in a downward channel for 30+ years....it broke out of the channel in 2018 when the Fed hiked rates to 2.5%...but than was forced to cut rates when the markets melted down. This time the Fed still has rates at 0.25% and inflation at record highs. Some think yields will start rolling over soon but....

D

Deleted member 609

Guest

Hahaha I was watching that last night. Couldn't stop laughing.

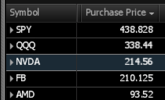

Closed out AMD at $96.80, NVDA at $222.90 and FB at $215. Holding Q's and SPY's. Hopefully we get a pullback today that gets bought.

SPY should get a retest of 441 minimum. Might hit 444.5 first thoughClosed out AMD at $96.80, NVDA at $222.90 and FB at $215. Holding Q's and SPY's. Hopefully we get a pullback today that gets bought.

SPY should get a retest of 441 minimum. Might hit 444.5 first though

I agree...that's my hope. But past couple of weeks I have given away gains holding and now I am just taking trades and taking profits.

Storm5

Member

Picked up qqq 340 puts

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

You're welcomeExpecting a bounce mid next week.

GeorgiaGirl

Member

SPX needs a close above 4450 for possible continuation, and I don’t think it gets it today. Nice day, but it can easily end up just being like Wednesday from last week.

What happened in the after hours yesterday actually has me a little nervous that earnings are still gonna really mess with everything like they have been at times since late last year. If Netflix disappoints again (likely) and it hits other QQQ components fairly hard, I will most likely hit eject on Facebook at a loss after that. I’m not going to get burned twice there.

I’ll willingly take some burn on Google (my cost basis there is pretty low), but I’m not gonna risk Facebook going to $150 with my cost basis at $325. Yeah...that was not a smart move by me.

Saw that someone thinks that Tesla will be below $800 by the end of this week, and all I have to think about that is ha...good luck (they're betting that way). It's not a stock where I'd use logic and reason.

What happened in the after hours yesterday actually has me a little nervous that earnings are still gonna really mess with everything like they have been at times since late last year. If Netflix disappoints again (likely) and it hits other QQQ components fairly hard, I will most likely hit eject on Facebook at a loss after that. I’m not going to get burned twice there.

I’ll willingly take some burn on Google (my cost basis there is pretty low), but I’m not gonna risk Facebook going to $150 with my cost basis at $325. Yeah...that was not a smart move by me.

Saw that someone thinks that Tesla will be below $800 by the end of this week, and all I have to think about that is ha...good luck (they're betting that way). It's not a stock where I'd use logic and reason.

$MSFT has a nice intraday chart building. If it can push through $284...

I have way more than I should in the low $283's.

View attachment 117494

Big if...but MSFT has a chance to fill the gap into earnings next week. I trimmed some here at $285.5.