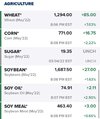

Get on the Fertilizer bandwagon if you missed the oil. I hit the NTR several days ago.

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

“We” sure like buying the dips…?

Retail has been trained by the greatest bull market in the history of our stock market since 2009 to buy up every dip. Eventually, retail is going to get bitten in the ass. ?

“We” have no concept of valuation or fundamentals and just momo everything and anything. Not sure how long this recklessness can last. Money has been practically free for the past couple of years thanks to the Fed.Retail has been trained by the greatest bull market in the history of our stock market since 2009 to buy up every dip. Eventually, retail is going to get bitten in the Tom Brady Sucks. ?

Storm5

Member

Need Monday to be green please . But lots of negative news so far this weekend it's looking red Monday

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

lexxnchloe

Member

The obvious answer to inflation is what i hear Biden is considering. Price controls. Make the price of a gallon og reg unleaded $1.80. Obviously we should make prices low for everything, not just gas, so people can prosper.

Last edited:

Lol that always ends well.The obvious answer to inflation is what i hear Biden is considering. Price controls. Make the price of a gallon og reg unleaded $1.80. Obviously we should make prices low for everything, not just gas, so people can prosper.

lexxnchloe

Member

I was just seeing if anyone would bite, lol. What would end up happening is there would be nothing for anyone to buy. But, i have read Biden is considering it. That would be a disastrous idea.Lol that always ends well.

It is dumbfounding to be sitting on the greatest natural resources on earth (USA) and handcuff ourselves as if we live on a deserted island of concrete.

It is dumbfounding to be sitting on the greatest natural resources on earth (USA) and handcuff ourselves as if we live on a deserted island of concrete.

If you’re referring to US NG and oil production, it is increasing:

1. US NG production rose to a record annual number of 93.6 bcf/day in 2021 and hit a record monthly level of 97.6 in December of 2021 just before the cold January of 2022 caused a moderate drop due largely to freeze-offs mainly in the Permian basin and this has continued through Feb. Even so, it was still at 95.5 in January of 2022, which is a record high for January and is significantly higher than the 92.8 of Jan of 2021. It is projected to rise back starting this month and then reach a record smashing year in 2022 at 96.1 (old record 93.6 in 2021) and then even higher at 2023 at 98.0:

“We estimate dry U.S. natural gas production averaged 95.5 Bcf/d in the United States in January, down 2.1 Bcf/d from December 2021. Production in January was lower due, in some part, to freezing temperatures in certain production regions. We forecast natural gas production to average 95.6 Bcf/d in February and 96.1 Bcf/d for all of 2022, driven by natural gas and crude oil price levels that we expect will be sufficient to support enough drilling to sustain production growth. We expect production to rise to an average of 98.0 Bcf/d in 2023.”

2. . US crude oil production averaged over the last 4 weeks is at 11.6 mbpd, which is 1.2 mbpd higher vs one year ago, when it averaged only 10.375 mbpd for the 4 weeks ending 2/26/21.

Also,

“U.S. crude oil production reached almost 11.8 million b/d in November 2021 (the most recent monthly historical data point), the most in any month since April 2020. We forecast that production will rise to an average of 12.0 million b/d in 2022 and 12.6 million b/d in 2023, which would be record-high production on an annual-average basis. The previous annual average record of 12.3 million b/d was set in 2019.”

Crypto is on the verge of a big dumperooski

Storm5

Member

Crypto is on the verge of a big dumperooski

I sold 8k worth of eth last week on the pop . I need the market to be green tomorrow so I can dump my Amazon and tesla spreads then I'm loading to the downside . The war isn't gonna stop even if they agreed to a peace treaty it won't last and we all know inflation numbers are gonna be crazy high when they are released this week . Fed meeting in two weeks with a hike coming . More blood in the market for sure . IF NATO someone gets pulled into the war the market will dump

Sent from my iPhone using Tapatalk

Anyone know of a fertilizer ETF? Looked but cannot find any. Thinking about cashing out my NG gains, holding wheat for the time being.

Ideally domestic not foreign, thx.

Ideally domestic not foreign, thx.

Storm5

Member

Anyone know of a fertilizer ETF? Looked but cannot find any. Thinking about cashing out my NG gains, holding wheat for the time being.

Ideally domestic not foreign, thx.

I'm sure we could find a few Russian ETFs

Sent from my iPhone using Tapatalk

pcbjr

Member

Larry,If you’re referring to US NG and oil production, it is increasing:

1. US NG production rose to a record annual number of 93.6 bcf/day in 2021 and hit a record monthly level of 97.6 in December of 2021 just before the cold January of 2022 caused a moderate drop due largely to freeze-offs mainly in the Permian basin and this has continued through Feb. Even so, it was still at 95.5 in January of 2022, which is a record high for January and is significantly higher than the 92.8 of Jan of 2021. It is projected to rise back starting this month and then reach a record smashing year in 2022 at 96.1 (old record 93.6 in 2021) and then even higher at 2023 at 98.0:

“We estimate dry U.S. natural gas production averaged 95.5 Bcf/d in the United States in January, down 2.1 Bcf/d from December 2021. Production in January was lower due, in some part, to freezing temperatures in certain production regions. We forecast natural gas production to average 95.6 Bcf/d in February and 96.1 Bcf/d for all of 2022, driven by natural gas and crude oil price levels that we expect will be sufficient to support enough drilling to sustain production growth. We expect production to rise to an average of 98.0 Bcf/d in 2023.”

2. . US crude oil production averaged over the last 4 weeks is at 11.6 mbpd, which is 1.2 mbpd higher vs one year ago, when it averaged only 10.375 mbpd for the 4 weeks ending 2/26/21.

Also,

“U.S. crude oil production reached almost 11.8 million b/d in November 2021 (the most recent monthly historical data point), the most in any month since April 2020. We forecast that production will rise to an average of 12.0 million b/d in 2022 and 12.6 million b/d in 2023, which would be record-high production on an annual-average basis. The previous annual average record of 12.3 million b/d was set in 2019.”

If you know, what is the current average oil consumption in the US on a daily (or weekly or monthly) basis? Ditto for NG?

Then if you know, what is the current average oil import into the US on a daily (or weekly or monthly) basis? Ditto for NG?

What I'm trying to get a ballpark on is how "short" are we on a daily (or weekly ... or heck even a monthly basis if the data is there) on current US consumption vs US current production.

Any numbers at your disposal?

Volatility and commodities have and will be a gold mine, just going back to early January. Wheat prices are at or above Arab Spring levels.

Storm5

Member

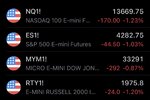

Holy shut bloodbath futures

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Larry,

If you know, what is the current average oil consumption in the US on a daily (or weekly or monthly) basis? Ditto for NG?

Then if you know, what is the current average oil import into the US on a daily (or weekly or monthly) basis? Ditto for NG?

What I'm trying to get a ballpark on is how "short" are we on a daily (or weekly ... or heck even a monthly basis if the data is there) on current US consumption vs US current production.

Any numbers at your disposal?

Phil, I can tell you some NG things now. The US is able to be a net EXPORTER of NG with exports continuing to increase because NG production is near record highs and going higher. Much of those exports is shipped to Europe in the form of LNG. One of those export terminals is here in the SAV area. Many years ago it was an import facility for NG, but that was reversed after the US thanks to major increases in production via fracking resulted in a major increase in production.

Regarding NG consumption, that varies widely from year to year based on wx with hot summers and cold winters (especially in E half of US down to TX) both increasing consumption. Also, consumption varies widely depending on season with highest average consumption per day by far in winter and lowest around late April-early June and much of Sept to mid Oct.

Hope that helps.

Storm5

Member

Keeps going down

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Crude oil (WTI) futures opened up at 122.50 at 6PM EST and then skyrocketed to 130.33 within 2 minutes!!! Since then it has settled back some to 125.50 or so, which is still a whopping +$10 vs the Friday close!!

www.investing.com

www.investing.com

I hope you guys have some investments in oil! Some of todays increase is being fueled by the consideration by the US to stop importing oil from Russia.

Crude Oil Futures Price Today (WTI) - Investing.com

Explore real-time Crude Oil futures price data and key metrics crucial for understanding and navigating the Crude Oil Futures market.

I hope you guys have some investments in oil! Some of todays increase is being fueled by the consideration by the US to stop importing oil from Russia.

On second thought, I am holding NG, looking at publicly traded US fertilizer businesses and defense for a large buy in, holding for ~12 months.

This is not retirement, I want that to be clear. Mid 2021 I started to build a foundation for short and mid term income via investments.

2022 hoping to go pro, understanding of commodities and geopolitical landscape have helped.

I’ve been in the OSINT nest for 5 years, and largely used it as a tool for the nest egg. Roth IRA was setup in 1999 and I first purchased Amazon in 2008, Heather and I used them as a book company in college.

This is not retirement, I want that to be clear. Mid 2021 I started to build a foundation for short and mid term income via investments.

2022 hoping to go pro, understanding of commodities and geopolitical landscape have helped.

I’ve been in the OSINT nest for 5 years, and largely used it as a tool for the nest egg. Roth IRA was setup in 1999 and I first purchased Amazon in 2008, Heather and I used them as a book company in college.

On second thought, I am holding NG, looking at publicly traded US fertilizer businesses and defense for a large buy in, holding for ~12 months.

This is not retirement, I want that to be clear. Mid 2021 I started to build a foundation for short and mid term income via investments.

2022 hoping to go pro, understanding of commodities and geopolitical landscape have helped.

I’ve been in the OSINT nest for 5 years, and largely used it as a tool for the nest egg. Roth IRA was setup in 1999 and I first purchased Amazon in 2008, Heather and I used them as a book company in college.

NG up a much more modest 3% because US NG is more immune to the Ukraine situation than oil largely because we’re not importing any Russian NG and are a net exporter of NG. However, crude oil rise is causing NG to go up some with it and also the war means the possibility of higher demand for US LNG from Europe. The warmer wx forecast change over the weekend for late week 2 is actually net bearish for NG. But the geopolitical situation and especially crude being up so sharply is negating the bearish wx.

Crude now up to 127.50!

Last edited:

bingcrosbyb

Member

Crude oil @ $130.20 per barrel.

NG up a much more modest 3% because US NG is more immune to the Ukraine situation than oil largely because we’re not importing any Russian NG and are a net exporter of NG. However, crude oil rise is causing NG to go up some with it and also the war means the possibility of higher demand for US LNG from Europe. The warmer wx forecast change over the weekend for late week 2 is actually net bearish for NG. But the geopolitical situation and especially crude being up so sharply is negating the bearish wx.

Crude now up to 127.50!

Holding my LNG inputs till Nov 2022 at a minimum.

I’m just glad we’re energy independent here in the US..wait

Crude oil @ $130.20 per barrel.

WTI crude actually has fallen back to “only” $125.

I’m just glad we’re energy independent here in the US..wait

We’re NG independent, but not oil independent, with record high NG production. Crude oil imports from Russia have increased every year 2019-21 unfortunately. However, US CO monthly production just increased to its highest level since April of 2020 and it is projected to rise to new record high in 2023.

Oil prices are largely internationally set unlike NG.

Investing a portion of portfolios in commodities as a whole is a good idea for diversification and inflation protection purposes. Of course, first getting in now means more downside risk. Thus, only dollar cost averaging into commodities would probably be wise if one is going to first invest in a commodities basket.

Last edited:

Fertz and food just saying, heavy position in 2022 in commodities. Retirement is out of market at this point and parked, January 10th effective date. Otherwise it pegs the SPI.

Yeah just saw this and was coming here to post about it, holy crap.Crude oil @ $130.20 per barrel.

lexxnchloe

Member

If i were the rest of Opec i would start cutting back on exports. Just ball park figures, guesses, but 10 million barrels a day selling at $110 a barrel will make you alot more money than increasing production to 12 million a day that causes the price to fall to $80 a barrel.

GeorgiaGirl

Member

Considering that Europe is this currently:

I kinda didn't think the market was going to open higher tomorrow anyway.

I would not be surprised if the same pattern from January and February is starting to play out, and my personal hope if so, is for quad-witching to mark a low and pattern change.

Probably comes from 3960 or so if it does.

I kinda didn't think the market was going to open higher tomorrow anyway.

I would not be surprised if the same pattern from January and February is starting to play out, and my personal hope if so, is for quad-witching to mark a low and pattern change.

Probably comes from 3960 or so if it does.

Larry,

If you know, what is the current average oil consumption in the US on a daily (or weekly or monthly) basis? Ditto for NG?

Then if you know, what is the current average oil import into the US on a daily (or weekly or monthly) basis? Ditto for NG?

What I'm trying to get a ballpark on is how "short" are we on a daily (or weekly ... or heck even a monthly basis if the data is there) on current US consumption vs US current production.

Any numbers at your disposal?

Investing in a bicycle might be a good idea now.

lexxnchloe

Member

"Experts" really dont know all that much. Kudlow had an expert on (jim diorio)? last monday who was predicting oil would get to 110 a barrel who changed his mind last monday saying oil would peak below 100. I personally think it will fall soon just because high prices will cause demand to drop.

pcbjr

Member

My IT band will love it ... and the rest of me will as well ... especially at 2:30 PM on a Wednesday afternoon in July ... ?️Investing in a bicycle might be a good idea now.