He's given y'all plenty of timePuts before Biden speech? ?

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

D

Deleted member 609

Guest

?? reporting for dutyPuts before Biden speech? ?

Indeed…I think too risky, though. This market is wild, and who knows what might happen. I would expect the markets to react negatively, though.He's given y'all plenty of time

Storm5

Member

He's given y'all plenty of time

Haha I don't think he's been on time for a scheduled press conference yet

Sent from my iPhone using Tapatalk

D

Deleted member 609

Guest

Up 100%, stop loss moved to 50% gainUp 20%. Set stop loss at break even.

D

Deleted member 609

Guest

Lol just saw dow. ----

pcbjr

Member

Storm5

Member

Joe is loading spy calls

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

He's going to wait till after market close.

So, I need some noob guidance. What's the risk/benefit of holding leveraged etf's from day to day (in noob terms please)? If I believe there is a general sense of market direction over the course of the week, is it wise to buy, say SQQQ, UPRO, UCO, etc, and hold for a few days even if there is some fluctuation day to day? I dropped ECON 201 and took another elective back in school, so I'm challenged and have special needs when it comes to this stuff. Thanks everyone!

D

Deleted member 609

Guest

These ended up at 125% gain, my new stop loss was at 100% which it just dropped to. Not bad for an hour or so. Really wanted to hold through speech, but oh well.Up 100%, stop loss moved to 50% gain

Big green candle

D

Deleted member 609

Guest

Here come the shrek dildos, thank you stop loss.

Storm5

Member

Every pump is sold off

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

What a pump. Up 180 percent on spy 430 calls lol

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Red spinning top daily doji. Indecision

You can tell that the markets didn't believe there was much to the sanctions. Dow rebounded about half its losses and Russian futures up about 7%

EOD dumpathon

Storm5

Member

Haha what a dump

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Shrek dongs after hours ?

buckinbronco

Member

Doesn't seem like the markets gave a rat's a** about Biden's response to Russia/Ukraine situation. Will be interesting to see the Fed rate hikes and Ukraine conflict do the tango.

S&P Futs for end of 2018 v/s now. It was a nice stick save today...is it going to provide support one more time or fail like it did in 2018. Who you got...

View attachment 114236

Long ago, I banned myself from the equities casino

Storm5

Member

S&P Futs for end of 2018 v/s now. It was a nice stick save today...is it going to provide support one more time or fail like it did in 2018. Who you got...

View attachment 114236

Let's just flush it already

Sent from my iPhone using Tapatalk

Nice takeS&P Futs for end of 2018 v/s now. It was a nice stick save today...is it going to provide support one more time or fail like it did in 2018. Who you got...

View attachment 114236

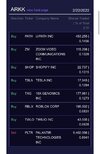

All in? Check back in 2032?Cathy dumped 11m shares of PLTR today. She has now closed out her position which was 25m shares just a week ago. Talk about selling at the bottom…?

View attachment 114260View attachment 114259

She buys such garbage but PLTR has legit tech. They burn cash but so does every other SAAS company.All in? Check back in 2032?View attachment 114261

Storm5

Member

Market fading from its PM highs. Russia still dominating the news

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

If always interesting when fib levels are respected. For NQ it was rejected perfectly at the .618 retracement level last week and then bounced right at the 1.0 extension yesterday. The yellow box is the .5-.618 retracement. Let's see how it respects that in the coming days...and with how fast this market moves it will probably this afternoon or tomorrow.

retracement:

extension

retracement:

extension

Storm5

Member

Bear trap ??

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Storm5

Member

Big tech gonna drag us down today Tesla and Amazon on the struggle bus

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Lol sell off

$UCO going parabolic this morning. ?

Got it yesterday premarket!$UCO going parabolic this morning. ?