packfan98

Moderator

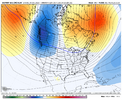

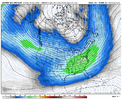

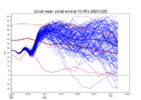

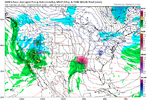

That’s above my pay grade. I’m using it for vibes and trends. Looking at potential outcomes and opportunities.i think I’ve asked this Q already, but again: do we think we can trust these as more of “vibes based” guidance? As in, treated the same as any other ensemble but with perhaps less credence to the actual numbers on there. Lots of members showing snow still indicative of good signal. I am not sure if the oddities it shows with snow way out of place affect these charts significantly enough to inflate them beyond trust