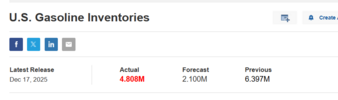

Well dang...covered my short at $675 when I saw this. Small win...will take it.

Maybe we do get a Santa rally...huge gap up. NQ up 1.5% in pre-market after closing down almost 2% yesterday at the dead lows. Talk about counter trade...the market loves that. I still think we go much much lower in January...but we shall see.

Maybe we do get a Santa rally...huge gap up. NQ up 1.5% in pre-market after closing down almost 2% yesterday at the dead lows. Talk about counter trade...the market loves that. I still think we go much much lower in January...but we shall see.