we screwedGains disappearing. Pump and dump confirmed

-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

severestorm

Member

Market's haven't priced in interest rate's for next year. They are assuming a 2.5% cut H2 of next year which isn't happening. #DontFightTheFed

severestorm

Member

Debt Debt Debt

GeorgiaGirl

Member

I doubt the Fed says they're done hiking tomorrow but unless the US2Y starts selling off again, it's saying that the Fed is closer to done than they may think they are right now at their meeting based on previous history.

Maybe one more 25 in February I believe (thought there was a meeting in January, but I think the next one is February).

Now we might very well stay there until 2024 where the bond market priced a bunch of cuts after Powell's Brookings event, buuuuuutttt the market knows that history says that after they pause, cuts typically come 6 months later.

Maybe one more 25 in February I believe (thought there was a meeting in January, but I think the next one is February).

Now we might very well stay there until 2024 where the bond market priced a bunch of cuts after Powell's Brookings event, buuuuuutttt the market knows that history says that after they pause, cuts typically come 6 months later.

severestorm

Member

Debt Debt Debt

Broken024

Member

This is why I stick to KyloG for professional financial advice.

They made a $100m…, I’m just a hair under that. ?This is why I stick to KyloG for professional financial advice.

Broken024

Member

I don't believe youThey made a $100m…, I’m just a hair under that. ?

Nomanslandva

Member

Someone posted a chart about a month ago that showed the S&P bottoming after the Fed pivot every time. If we expect at least a little more WRT rate increases, why should we not expect another decent dip in the S&P that at least tests prior lows? Is there any good reason that we should expect this time to be any different?

No snow for you

Member

- Joined

- Dec 28, 2016

- Messages

- 558

- Reaction score

- 838

Powell is doing 50 bps because inflation is still 7.1% YoY. Yes, inflation is slowing but Powell no longer trust models and he believes if he causes a recession he has the "tools" to quickly address it like he did in March of 2020 (his words). He isn't stopping until he sees inflation under 2%. He does not want to be Arthur Burns but wants to be Paul Volcker. wishcasting is not a solid investment strategy.

severestorm

Member

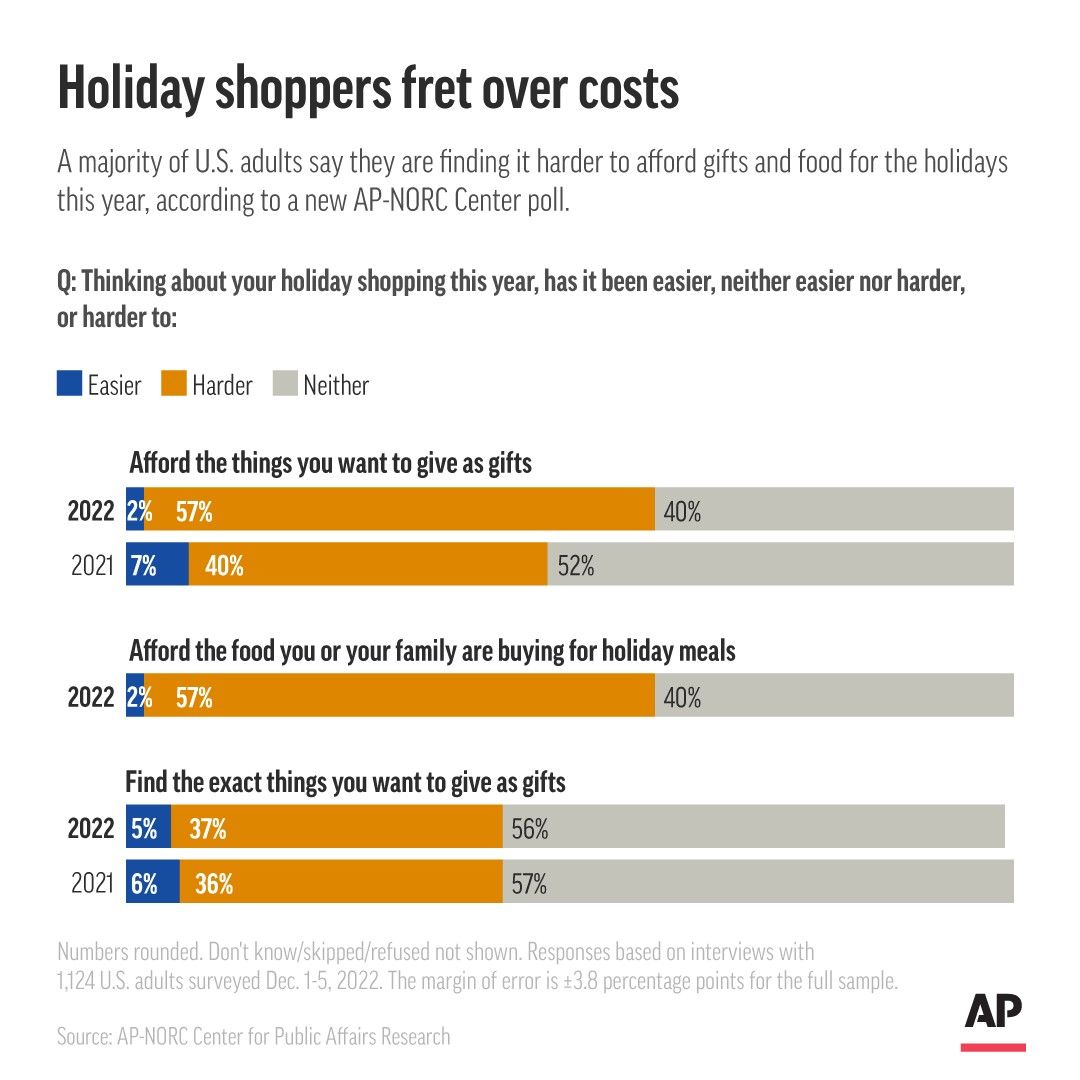

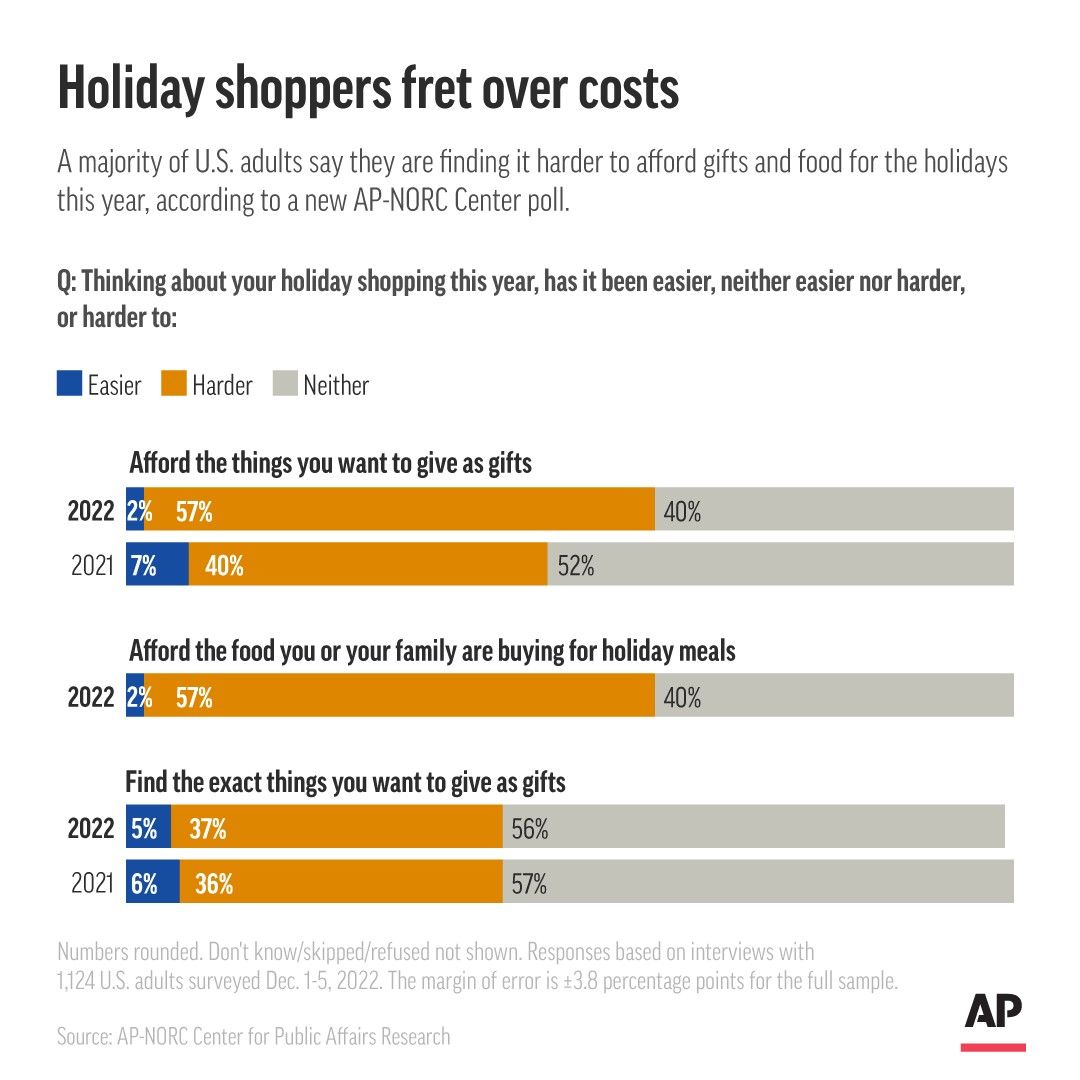

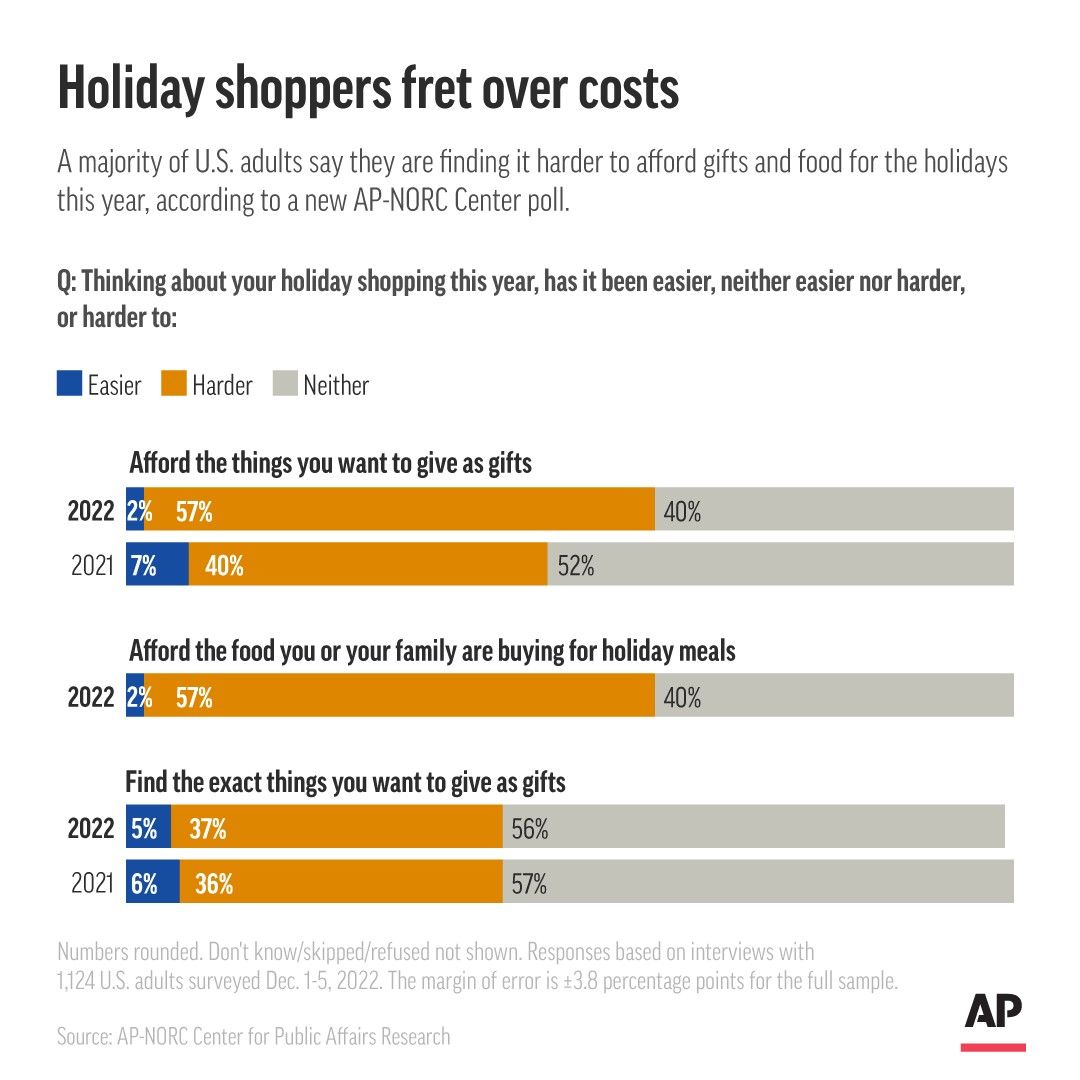

Inflation check

Thor

Member

People in the blue are absolutely lyingInflation check

jovialweather

Member

"Did not understand the question" lolPeople in the blue are absolutely lying

Those are people who think this is a party line vote so they automatically say something that isn’t true in fear that it will make their people look badPeople in the blue are absolutely lying

Poots printing. I figured 50bps would bring it down about like 75 would

Where catalyst now? ?