SnowNiner

Member

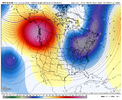

Yes, looks at this 7 day torch to end the 06z gefs/euro ai mean, Awful. January, cancelled. Next!

View attachment 181364

View attachment 181366

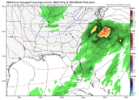

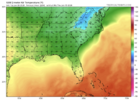

To be fair, verbatim, I don't think that's cold enough for a winter storm in my back yard in the SE. I'm just not a fan of any SE ridging like the ensembles are showing out in time. The temps Kylo showed in his post are not very cold at all sadly. With that said, perhaps the models continue to correct out in time to more western ridge, less SE ridge like they have been. That's still my hope.

0z GEFS though looked really good their for a while. LOL, whiplash overnight discussion.