-

Hello, please take a minute to check out our awesome content, contributed by the wonderful members of our community. We hope you'll add your own thoughts and opinions by making a free account!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Misc Stock Market

- Thread starter ForsythSnow

- Start date

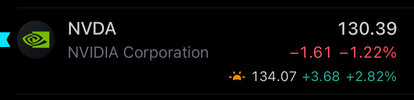

NVDA pissing me off but I am still holding and added a little more at $127.50.

The DOW is down like 10 days in a row....very abnornal to see this and obviously positions are being unwound into end of year. Opex this week too...tricky week...staying mostly out of the way.

View attachment 156117

Sold what I added this morning here at $130.90....maybe finally putting in a hammer reversal. My avg is roughly $128.8 now...

GeorgiaGirl

Member

DIA is on watch for a dip buy...Opex week always volatile....day 9 down in a row...highly unusual. I am usually a day early on these dip buys...like with NVDA yesterday. So maybe tomorrow DIA

Honestly curious what the record is because it will never be green again as long as United Healthcare continues plummeting.

I keep forgetting about UNH. Didn't even occur to me...I do see it's the 2nd largest holding at 7%.Honestly curious what the record is because it will never be green again as long as United Healthcare continues plummeting.

Broken024

Member

You still holding AMD?Sold what I added this morning here at $130.90....maybe finally putting in a hammer reversal. My avg is roughly $128.8 now...

View attachment 156125

Triplephase93

Member

Sold what I added this morning here at $130.90....maybe finally putting in a hammer reversal. My avg is roughly $128.8 now...

View attachment 156125

NVDA typically dips in December and bounces back strong to start the year. It will bounce back Q1.

Yes...I've owned it for years...avg is less than $40/share. But I own it my long term IRA...no plans to sell it or anythingYou still holding AMD?

NVDA $134 in pre marketSold what I added this morning here at $130.90....maybe finally putting in a hammer reversal. My avg is roughly $128.8 now...

View attachment 156125

Going to hold onto these shares for now.

Added some UDOW at open..101.90....just a little for a swing. I like these little leveraged ETFs for quick swings...preserves cash and catch quick/big moves, I hope.DIA is on watch for a dip buy...Opex week always volatile....day 9 down in a row...highly unusual. I am usually a day early on these dip buys...like with NVDA yesterday. So maybe tomorrow DIA

View attachment 156128

Sold what I added this morning here at $130.90....maybe finally putting in a hammer reversal. My avg is roughly $128.8 now...

View attachment 156125

NVDA ripping with Qs/SPY down...$135. My best swing in some time...I really have done much the past 2-3 weeks. And I am ready for the year to be over for the stock market. Will keep things relatively quiet until January.

UDOW 103...give me 105 and I'm out for a quick trade. Maybe tomorrow into FOMC meeting...Added some UDOW at open..101.90....just a little for a swing. I like these little leveraged ETFs for quick swings...preserves cash and catch quick/big moves, I hope.

View attachment 156198

Triplephase93

Member

SoundHound AI and Bigbear AI running.

Triplephase93

Member

Market did not like that .25 rate cut.

packfan98

Moderator

It wasn’t the cut, but the trimming back their projected cuts next year. Only two, down from four.Market did not like that .25 rate cut.

Triplephase93

Member

NVDA ripping with Qs/SPY down...$135. My best swing in some time...I really have done much the past 2-3 weeks. And I am ready for the year to be over for the stock market. Will keep things relatively quiet until January.

View attachment 156199

Good call!